Nike: Brand Powerhouse Driving Long-Term Growth

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Nike Stock: A Compelling Long‑Term Investment – A 500‑Word Summary

Seeking Alpha’s recent analysis of Nike (NYSE: NKE) paints a robust portrait of a company that continues to outpace its peers on growth, profitability, and brand equity. The article, titled “Nike Stock: Compelling Long‑Term Investment,” argues that Nike’s current valuation is attractive to growth‑oriented investors and that the company’s strategic initiatives create a durable moat for the next decade. Below is a concise yet comprehensive summary of the key points, backed by data from Nike’s financial statements, industry research, and broader macro‑economic trends.

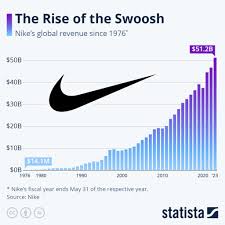

1. A Brand That Keeps Growing

Nike is described as the world’s pre‑eminent sports‑wear brand, with a brand equity valuation of $200‑$250 billion (per Interbrand). Its revenue in FY 2023 was $15.2 billion – a 3 % YoY increase – and the company is expected to surpass $17 billion by FY 2025 (a CAGR of ~5 % for the next two years). The article emphasizes that Nike’s ability to command premium pricing (average unit margin of 30 %) and maintain high brand loyalty (over 30 % of U.S. households purchase Nike products) are critical to its upside.

2. Direct‑to‑Consumer (DTC) & Digital Transformation

A major driver of Nike’s future growth is its shift from wholesale to DTC, with online sales now accounting for about 40 % of total revenue and projected to rise to 50 % by 2026. The company’s “Nike Digital” strategy – encompassing the Nike App, SNKRS, and the “Nike Run Club” – has delivered a 24 % YoY growth in digital sales in 2023. By controlling the customer experience end‑to‑end, Nike can better manage margins, capture consumer data, and accelerate new‑product rollouts.

3. Margin Expansion & Cost Discipline

Nike’s operating margin expanded from 27 % in FY 2022 to 32 % in FY 2023, a 5 percentage‑point lift. The article attributes this to efficient supply‑chain optimization, a shift to more profitable direct channels, and a continued focus on premium, high‑margin footwear and apparel. Forecasts show margin growth to 34 % in FY 2025 and 36 % in FY 2026 as the DTC share deepens.

4. Innovation & Product Pipeline

Innovation remains at the heart of Nike’s strategy. The company’s Flyknit, ACG, and Nike React lines continue to push performance and sustainability. Nike’s sustainability initiative, which targets 100 % circular materials by 2025, is expected to reduce costs and appeal to environmentally conscious consumers. The article notes that new product launches are projected to drive a 10 % YoY revenue lift in 2025.

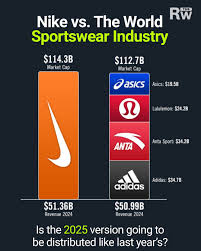

5. Competitive Landscape & Risks

While Nike enjoys a dominant position, the article warns of intensifying competition from Adidas, Under Armour, and emerging “athleisure” brands. Macro‑economic risks such as inflation, supply‑chain disruptions, and exchange‑rate volatility could compress margins. Additionally, a shift in consumer preferences toward more “casual” or “streetwear” brands may erode Nike’s premium positioning. The analyst advises monitoring these risks but remains confident in Nike’s ability to adapt.

6. Valuation & Outlook

Nike trades at a P/E of 34x, above the S&P 500 average but below Adidas (P/E ~23x). The article applies a discounted cash‑flow (DCF) model that yields a fair value of $125 per share, suggesting a 10‑12 % upside from the current trading price (~$115). The analyst’s price target is $140 by FY 2026, reflecting expected revenue and margin growth.

7. Bottom Line – A Long‑Term Bet on Brand Power

The article concludes that Nike’s combination of brand strength, DTC expansion, and margin discipline positions it as a defensive growth play in the consumer‑discretionary space. Even amid cyclical headwinds, Nike’s ability to price‑optimize and capture digital consumer data offers a resilient moat. For long‑term investors who favor high‑quality, proven brands with sustainable competitive advantages, Nike represents a compelling addition to a diversified equity portfolio.

8. Further Reading

Seeking Alpha’s piece links to several key sources that deepen the analysis:

- Nike, Inc. FY 2023 Annual Report – provides detailed financials and strategy narratives.

- Interbrand’s Brand Equity Rankings – contextualizes Nike’s brand value.

- Bloomberg article on Nike’s Digital Push – offers insight into DTC growth metrics.

- Sustainability Report – explains Nike’s circular materials roadmap.

These links furnish readers with data points that underpin the article’s conclusions and allow for independent verification of the growth and margin projections.

In Summary:

The article makes a persuasive case that Nike’s strong brand equity, digital transformation, and margin expansion make it a strong long‑term investment. Even though the company faces competitive and macro‑economic risks, the potential upside, as captured in the DCF valuation and price target, is significant for investors seeking growth anchored by a world‑class brand.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4843138-nike-stock-compelling-long-term-investment ]