Why International Stocks Are Surging--And What U.S. Investors Should Know

Forbes

Forbes

Why International Stocks Are Surging and What U.S. Investors Should Know

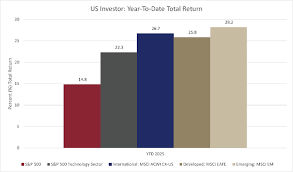

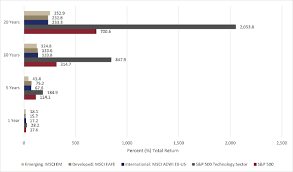

Over the past months, global equities have outpaced their domestic counterpart, sending international indexes higher while U.S. stocks lag behind. Bill Stone’s recent Forbes analysis attributes this surge to a confluence of macro‑economic shifts, policy changes, and evolving investor sentiment. Here’s a comprehensive overview of the factors driving the rally, the markets most affected, and practical guidance for U.S. investors seeking to capture upside while mitigating risk.

1. Divergent Economic Trajectories

a. U.S. Lagging Growth and Rising Rates

The U.S. economy has been grappling with higher inflation expectations and an aggressive tightening stance by the Federal Reserve. Rate hikes have squeezed borrowing costs, curbed discretionary spending, and put pressure on valuation multiples. In contrast, many emerging markets have enjoyed robust growth, underpinned by stronger domestic demand and, in some cases, lower debt burdens.

b. Accelerated Recovery in Asia

China’s recent rebound—marked by a surge in retail sales and a revival of manufacturing activity—has lifted many of its local stocks. India’s economic growth, propelled by consumer spending and fiscal stimulus, has similarly outpaced expectations. Meanwhile, Japan’s cautious recovery is being bolstered by a stable monetary policy that keeps rates low and encourages capital inflows.

c. European Resilience Amid Debt Concerns

European markets have managed to avoid a hard landing thanks to the European Central Bank’s accommodative policy stance and gradual easing of the debt crisis narrative. Several Eurozone countries are benefiting from strong export demand, especially in industrial and technology sectors.

2. Policy Dynamics and Currency Movements

a. Monetary Policy Divergence

The Fed’s hawkish path has led to a strengthening U.S. dollar, which dampens earnings of dollar‑denominated companies with significant overseas revenue. Conversely, weaker currencies in Europe, Asia, and Latin America have boosted the net present value of foreign earnings, enhancing profit margins for multinational firms headquartered there.

b. Fiscal Stimulus Variations

While the U.S. has shifted focus away from direct fiscal stimulus toward targeted infrastructure spending, many emerging economies are employing expansive fiscal policies to support growth. This differential spending environment is another catalyst for international outperformance.

c. Geopolitical Influences

Ongoing trade negotiations, sanctions regimes, and regional conflicts have created a patchwork of opportunities. For instance, the easing of tensions in the Middle East has lifted commodity prices, benefitting energy‑heavy markets in the region. Conversely, supply‑chain disruptions remain a headwind for certain Western industrial sectors.

3. Market‑Specific Highlights

| Region | Key Drivers | Top Sectors | Representative ETFs |

|---|---|---|---|

| Asia Pacific | Strong domestic demand, tech boom | Technology, consumer discretionary | iShares MSCI ACWI ex U.S. ETF |

| Emerging Markets | High growth rates, low debt | Finance, materials | Vanguard FTSE Emerging Markets ETF |

| Europe | Accommodative ECB policy, export strength | Industrials, technology | iShares MSCI Europe ETF |

| Latin America | Commodity price rally, fiscal stimulus | Energy, mining | SPDR S&P Latin America Select Industry ETF |

4. Investor Takeaways

a. Diversification Still Matters

International exposure can offset the volatility of U.S. markets. Even if U.S. stocks have lower yields at the moment, adding foreign equities can reduce portfolio variance and increase expected returns over the long run.

b. Currency Risk Management

While the U.S. dollar’s strength can erode returns on foreign holdings, many international ETFs employ hedging strategies to mitigate currency exposure. Investors should weigh the cost of hedging against the potential benefits.

c. Tax Considerations

Foreign dividends may be subject to withholding tax, and U.S. investors must report foreign income on their tax returns. Utilizing tax‑advantaged accounts (IRA, 401(k)) or selecting ETFs that distribute tax‑efficiently can help minimize tax drag.

d. Watch the Policy Cycle

Rate hikes by the Fed or ECB can rapidly shift investor sentiment. Monitoring central‑bank minutes, inflation data, and economic growth indicators is essential to adjust allocation in a timely manner.

e. Quality over Quantity

In a volatile global environment, high‑quality companies with strong balance sheets, consistent cash flows, and robust growth prospects are more likely to weather downturns. A focus on value and profitability metrics—such as ROE, free‑cash‑flow yield, and debt‑to‑equity ratios—can guide selection.

5. Practical Steps for U.S. Investors

Assess Current Allocation

Compare your portfolio’s exposure to international versus domestic stocks. A common rule of thumb is a 20–30% allocation to global markets, though this varies with risk tolerance and time horizon.Choose the Right Vehicles

ETFs offer liquidity and diversification. Consider broad market ETFs for general exposure, or sector‑specific funds if you target a particular growth story.Monitor Key Indicators

Keep an eye on GDP growth rates, inflation expectations, and central‑bank policy statements. Use economic calendars and reliable news sources (e.g., Bloomberg, Reuters) to stay informed.Tax‑Efficient Planning

Use tax‑advantaged accounts for foreign investments. If you hold direct shares, consider foreign tax credits to offset withholding tax.Rebalance Regularly

Periodically review your asset allocation to ensure it remains aligned with your investment goals and risk profile.

6. Conclusion

The surge in international equities reflects a broader shift in global economic momentum. While the U.S. continues to grapple with higher rates and a weaker dollar, markets in Asia, Europe, and emerging economies are capturing growth, benefiting from accommodative policy, and capitalizing on structural tailwinds. For U.S. investors, the key lies in disciplined diversification, careful management of currency and tax risks, and a focus on quality assets. By staying informed and strategically allocating, investors can position themselves to benefit from the continued upward trajectory of international stocks.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/bill_stone/2025/10/11/why-international-stocks-are-surging-and-what-us-investors-should-know/ ]