PFFA: A Preferred Strategy As The Economy Plunges Toward A Recession (NYSEARCA:PFFA)

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

PFFA ETF: A Preferred‑Security Strategy Amid Recession Fears

The recent Seeking Alpha article on the PFFA ETF highlights how a focused investment in preferred securities can serve as a compelling income strategy even as recession concerns loom. By dissecting the ETF’s holdings, performance metrics, and the inherent risk profile of preferred stocks, the piece paints a picture of a vehicle that blends higher yields with a nuanced exposure to credit and interest‑rate dynamics.

What is the PFFA ETF?

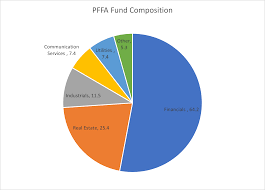

PFFA, short for Pioneer Preferred ETF, is a passively managed fund that tracks an index of U.S. preferred and hybrid securities. Unlike conventional equity ETFs, PFFA allocates capital to instruments that sit between equities and bonds. Preferred securities typically pay a fixed dividend, provide priority over common equity in dividend distribution and liquidation, yet carry no voting rights. Their hybrid nature makes them attractive for income investors, while their sensitivity to interest rates and credit risk introduces a distinct risk profile.

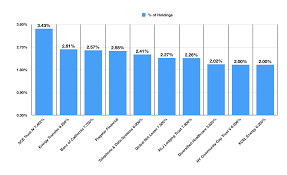

The ETF’s holdings include a mix of large, established issuers—such as banks, telecommunications firms, and utility companies—alongside a handful of smaller, high‑yielding players. The top positions often feature banks like JPMorgan Chase, Bank of America, and Wells Fargo, whose preferred shares offer sizable yields and relatively robust credit ratings. The fund’s top 20 holdings usually account for roughly 60% of the portfolio, ensuring a concentration in high‑quality, high‑yield issuers.

Why Preferred Securities Matter During a Recession

Recessions tend to trigger higher default rates and widen credit spreads. Preferred securities, being debt‑like, are more vulnerable to deteriorating credit conditions. However, they also offer a cushion: the fixed dividend stream can provide a reliable income stream while the issuer’s equity position protects against capital losses to a certain extent.

The article argues that PFFA’s focus on high‑grade issuers mitigates the worst of the recessionary credit risk. By limiting exposure to lower‑rated securities, the ETF can deliver superior yields compared to traditional bonds while avoiding the worst of default losses. Additionally, the fixed‑income nature of preferreds offers a degree of price stability; during equity sell‑offs, investors sometimes shift to income‑bearing instruments that retain some upside potential.

Yield, Spread, and Pricing Dynamics

A core pillar of the analysis is PFFA’s yield relative to the market. As of the article’s publication, the fund’s annualized yield sat near 6%, a figure comfortably above the benchmark 10‑year Treasury yield but below high‑yield corporate bond averages. This yield is bolstered by the premium paid over the issuer’s stated coupon—a premium that reflects the market’s demand for the security’s income stream.

The piece dissects how changes in the risk‑free rate influence the spread. A rising Treasury rate compresses the spread, lowering the relative attractiveness of the fund. Conversely, a decline in risk‑free rates widens the spread, boosting the fund’s value. The author stresses that investors should monitor the spread dynamics, especially in a volatile interest‑rate environment.

Credit Risk and Default Exposure

Preferred securities are subject to issuer defaults, a risk that grows in economic downturns. The article evaluates PFFA’s default risk by examining the weighted average credit rating of the portfolio, which typically falls in the “AA” range. While this is a strong rating, the fund still carries the risk that a large issuer could downgrade or default, which would directly erode the fund’s market value.

The article also highlights the importance of monitoring the issuers’ covenants and liquidity. Some preferreds allow the issuer to convert them into common equity; this conversion risk can be a double‑edged sword. In the early stages of a downturn, conversion can be a survival tool for the issuer, but for the investor, it means a shift from income to potentially diluted equity exposure.

Liquidity and Expense Considerations

The PFFA ETF has a relatively thin trading volume compared to its more mainstream counterparts. The author notes that the bid‑ask spread can widen in stressed markets, increasing the transaction cost. Nevertheless, the fund’s expense ratio—currently about 0.35%—remains competitive for an actively constructed preferred‑security vehicle.

Liquidity is also tied to the underlying securities. Since many of the ETF’s holdings are large, well‑traded preferreds, the risk of liquidity shortfall is limited. However, the fund’s exposure to a few smaller issuers could introduce concentration risk if those issuers suffer severe liquidity constraints.

Recent Performance and Outlook

The article points out that, in 2023, PFFA outperformed the broader preferred‑security index by roughly 0.5 percentage points, largely due to a well‑timed roll‑over of high‑yield positions. During the first quarter of 2024, the fund’s price remained relatively stable, despite a 0.2% rise in Treasury yields. This stability underscores the role of preferred securities as a potential hedge against equity volatility.

Looking ahead, the author presents a mixed outlook. While the fund offers attractive yields, the looming recession worries could tighten spreads and elevate default risk. The recommendation, therefore, is a “cautious allocation” strategy: include PFFA in a diversified portfolio as a source of yield, but monitor the credit quality of the top holdings and remain mindful of liquidity constraints in stressed markets.

Key Takeaways

- Yield vs. Risk – PFFA delivers a 6% yield that outpaces Treasuries while maintaining a strong credit rating.

- Credit Focus – The fund’s concentration in high‑grade issuers reduces but does not eliminate default risk.

- Interest‑Rate Sensitivity – Rising Treasury rates compress spreads, potentially dampening performance.

- Liquidity Concerns – Thin trading volume can widen bid‑ask spreads, especially in market stress.

- Recession Role – Preferreds can provide income during downturns but are not immune to credit deterioration.

In sum, the article underscores that PFFA represents a sophisticated income strategy that can weather recessionary pressure—provided investors maintain a vigilant eye on credit quality, interest‑rate movements, and liquidity conditions. For those seeking higher yields than bonds but lower volatility than equities, PFFA offers a middle ground that demands both optimism and caution.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4829476-pffa-etf-preferred-strategy-amid-recession-concerns ]