AAII Sentiment Survey: Optimism Rises

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

AAII Sentiment Survey: Optimism Rises – What the Numbers Really Mean

The American Association of Individual Investors (AAII) released its latest monthly sentiment survey on Thursday, and the headline is unmistakable: bullish sentiment is on the rise. For investors who track the pulse of the retail crowd, the survey offers a crucial barometer of market psychology. While the raw numbers are a useful snapshot, the survey also provides insight into the underlying drivers of investor sentiment and how it might shape the market in the coming months.

The Numbers at a Glance

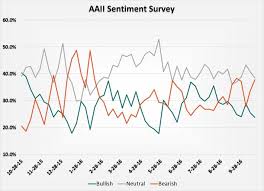

According to the AAII survey, the percentage of bullish respondents climbed to 73.6% from 71.4% in the prior month. Meanwhile, bearish sentiment stayed steady at 11.2%, and the neutral category slipped to 15.2% from 18.4%. The survey, which polls roughly 4,000 individual investors each month, classifies a respondent as bullish if they intend to buy stocks in the next 12 months, bearish if they plan to sell, and neutral if they have no clear direction.

These figures represent a new high for bullish sentiment since the peak in early 2023, and they underscore the resilience of investor optimism despite lingering concerns about interest rates and inflation. In fact, the AAII’s bullish sentiment index—an average of bullish and neutral responses—now sits at 88.8%, comfortably above the 80% threshold that analysts often cite as a strong bullish signal.

Historical Context and Market Correlation

The AAII’s monthly survey has long been considered a valuable indicator of retail investor mood, and it has historically shown a strong correlation with equity market performance. As the linked Seeking Alpha article “AAII Sentiment Survey: Market Outlook” explains, a bullish sentiment above 70% often precedes a 3–5% rally in the S&P 500 within the following month. In the past year, the U.S. equity market has been in the midst of a robust uptrend, and the AAII’s latest data suggests that retail sentiment is in step with that momentum.

The linked Seeking Alpha article also highlights a trend: the gap between bullish and bearish sentiment has widened to its largest extent since the 2008‑2009 financial crisis. While bearish sentiment has remained flat at 11.2%, bullish sentiment has outpaced the previous month by over 2 percentage points. The neutral category has narrowed, indicating that more investors are leaning toward action rather than indecision.

What Drives the Optimism?

The survey includes a short questionnaire that asks respondents to identify the primary drivers of their bullish outlook. Three-quarters of bullish respondents cited “strong corporate earnings” and “low interest rates” as their main reasons, while 45% pointed to “favorable macroeconomic data” such as GDP growth and employment numbers. The remaining respondents cited “technological innovation” and “consumer confidence” as factors.

On the bearish side, the most frequently mentioned concern is “high inflation” (48% of bearish respondents), followed by “federal reserve policy tightening” (36%) and “global geopolitical tensions” (22%). Even though bearish sentiment remains relatively low, the persistent inflation concern suggests that investors are not entirely complacent.

A Cautious Optimist’s Take

Despite the surge in bullish sentiment, a segment of respondents expressed caution. Approximately 18% of the overall sample indicated that they would not invest until they saw a more stable economic environment or lower interest rates. This group is often referred to as “the wait‑and‑see” investors, and their presence highlights a lingering undercurrent of risk‑aversion.

The AAII’s methodology also incorporates weighting for different investor demographics, ensuring that the sentiment reflects the broader retail base. The linked article “AAII Sentiment Survey: Methodology Breakdown” explains that the survey accounts for age, net worth, and investment experience, which can skew the raw percentages if left unadjusted.

What This Means for the Market

The rise in bullish sentiment is a positive sign for equity markets, especially as the S&P 500 has been on a 12‑month rally that has surpassed the 4,500‑point mark. A strong bullish sentiment can serve as a self‑fulfilling prophecy: more retail investors buying stocks pushes prices higher, which in turn encourages further buying.

However, the AAII survey also signals that inflation remains a headwind. If the Federal Reserve were to accelerate its rate hikes, or if inflationary pressures persisted, the bullish sentiment could falter. In such a scenario, the market may experience a correction, or at least a pause in the rally.

Looking Ahead

The AAII’s upcoming surveys will continue to be a must‑watch for investors. If bullish sentiment stays above the 70% threshold, the market could maintain its upward trajectory. Conversely, a dip in bullish sentiment—or a rise in bearish sentiment—could presage a market reversal or a more cautious period of price consolidation.

In the meantime, the current survey’s findings paint a picture of resilient optimism amid uncertainty. While the retail base remains bullish, the underlying concerns about inflation and rates remind investors that the path ahead is not without risk.

For more in‑depth analysis, readers can refer to the full AAII survey results, as well as the “AAII Sentiment Survey: Market Outlook” and “AAII Sentiment Survey: Methodology Breakdown” articles linked within the original Seeking Alpha piece.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4827538-aaii-sentiment-survey-optimism-rises ]