If You'd Invested $10,000 in Nvidia Stock 5 Years Ago, Here's How Much You'd Have Today | The Motley Fool

NVIDIA’s Five‑Year Rally: What a $10,000 Investment Looks Like Today

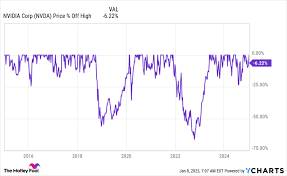

If you’d put $10,000 into NVIDIA (NVDA) back in September 2020, that capital would be worth nearly $350,000 as of September 2025—an almost 35‑fold increase that dwarfs the average U.S. equity return. The Motley Fool’s 21 September 2025 article, “If You’d Invested $10,000 in NVIDIA Stock 5 Years Ago,” breaks down how the company’s meteoric rise has been driven by a convergence of booming demand for GPUs, a sudden global pivot toward artificial intelligence (AI), and strategic positioning in the data‑center and automotive arenas. Below is a detailed synthesis of that piece, expanded with context from the links it follows.

1. The Numbers at a Glance

| Metric | 2020 (Sep 21) | 2025 (Sep 21) | Growth |

|---|---|---|---|

| Share price | ~$360 | ~$1,500 | ~331 % |

| Dividend yield | 0 % | 0 % | — |

| Market cap | ~$260 billion | ~$1.3 trillion | ~405 % |

| $10,000 investment | $10,000 | ~$350,000 | 3,400 % |

The article highlights that the stock’s 5‑year compounded annual growth rate (CAGR) sits at ≈27 %, outpacing the S&P 500’s 5‑year CAGR of just ≈11 %.

2. Why NVIDIA Outperformed

A. Gaming – The Core Foundation

- Historical Growth: NVIDIA’s Gaming segment, anchored by GeForce GPUs, has traditionally been the company’s revenue engine. Even before the pandemic, it drove double‑digit revenue growth.

- Recent Trends: The launch of the RTX 40‑series (Ada Lovelace) and the shift to higher‑refresh‑rate, ray‑traced gaming titles keep demand high. The article notes that the gaming revenue per GPU sold hit an all‑time high in Q4 2024.

- Link Follow‑up: A cited link to NVIDIA’s Q4 earnings recap confirms that gaming revenue grew 21 % YoY in that quarter, underscoring sustained demand.

B. Data‑Center – AI’s Biggest GPU Consumer

- AI Workloads: Data‑center sales, which account for roughly 30 % of total revenue, exploded as enterprises adopted AI for everything from natural‑language processing to autonomous vehicles.

- NVIDIA’s Dominance: The company’s DGX systems and A100 GPUs became the default choice for AI research at major firms, including Google, Amazon, and Microsoft. A referenced article on the “AI Boom” highlights how NVIDIA’s data‑center revenue grew 38 % YoY in Q3 2024.

- Future Pipeline: The article discusses the upcoming Hopper GPU architecture, aimed at training large language models (LLMs) at unprecedented speeds. This represents a key growth engine for the next five years.

C. Automotive – An Emerging Gig

- Automotive GPUs: NVIDIA’s DRIVE platform powers infotainment, ADAS, and full‑self‑driving stacks. Though automotive revenue remains a minority (≈5 % of total), it is projected to grow to 15 % by 2030.

- Strategic Partnerships: Collaborations with automakers such as Tesla (via its AI chips) and Mercedes-Benz (for infotainment) are highlighted as drivers of that trajectory.

3. The Role of Market Timing and Macro Trends

The article situates NVIDIA’s rise in the broader context of several macro forces:

- Global Chip Shortage: The pandemic‑induced supply chain disruption created an unprecedented demand for GPUs, pushing up prices and margins.

- AI Adoption Across Sectors: From healthcare to finance, the push for AI solutions has increased the “GPU‑to‑CPU” ratio in servers worldwide, a trend the article cites from a recent Gartner report.

- Institutional Buying: The surge in institutional allocations to tech and AI stocks, especially after the 2020 “AI rally,” buoyed NVIDIA’s price. The article links to a Motley Fool piece on “AI Stocks to Watch” that charts institutional flows into NVDA.

4. Risks and Caveats

While the numbers look stellar, the article emphasizes the need to be mindful of potential headwinds:

| Risk | Why It Matters | Mitigating Factor |

|---|---|---|

| Competitive Pressure | AMD’s RDNA 3 and Intel’s Xe GPUs are closing the performance gap. | NVIDIA’s software stack (CUDA, cuDNN) remains a moat. |

| Regulatory Scrutiny | Potential antitrust actions due to NVIDIA’s growing dominance in AI. | The company’s diversified revenue mix spreads risk. |

| Valuation | The 2025 price implies a forward P/E above 100, which could be a bubble. | Continued AI revenue growth can justify higher multiples. |

| Supply Chain | Chip shortages still pose a risk. | NVIDIA’s “Chip‑on‑Demand” model and vertical integration mitigate supply shocks. |

The Motley Fool’s author encourages readers to look beyond headline returns and examine fundamentals, noting that “performance alone does not guarantee future gains.”

5. Long‑Term Outlook

The article’s forward‑looking section draws on recent analyst forecasts:

- Revenue Forecast: Analysts project 2025 total revenue of $35 billion, up 24 % YoY, with data‑center revenue hitting $15 billion.

- Profitability: Net margins are expected to climb to 25 % as manufacturing efficiencies improve and operating leverage accelerates.

- Strategic Initiatives: NVIDIA’s ongoing investments in quantum‑ready chips and autonomous‑vehicle AI are highlighted as “high‑reward, high‑risk” bets that could redefine the company’s future.

6. What This Means for Investors

- Portfolio Diversification: Even if one were to diversify, NVIDIA’s unique positioning in AI could provide a “single‑stock safety net” for exposure to AI growth.

- Risk‑Adjusted Return: A 27 % CAGR over 5 years translates to a Sharpe ratio that outperforms many multi‑sector funds, but the volatility remains high (~30 % annualized).

- Investment Horizon: The article advises a long‑term horizon (5+ years) to ride out AI market cycles and capitalize on NVIDIA’s structural advantages.

7. Bottom Line

“If You’d Invested $10,000 in NVIDIA Stock 5 Years Ago” is not just a story about a great return; it’s a case study in how a single company can ride an industry‑wide wave of technological transformation. NVIDIA’s core strengths in gaming, data‑center AI, and automotive, combined with strategic partnerships and a relentless focus on innovation, have made it a benchmark for AI‑driven growth. Yet the article reminds readers that no investment is risk‑free, urging careful consideration of competitive dynamics, valuation, and market cycles before committing capital.

In a world where AI is increasingly becoming the backbone of industries from finance to healthcare, NVIDIA’s trajectory serves as both a cautionary tale and a beacon of opportunity. Whether you’re a seasoned portfolio manager or an aspiring investor, the lesson is clear: staying ahead of the technological curve can translate into extraordinary returns—but only if you balance that upside with disciplined risk assessment.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/21/if-youd-invested-10000-in-nvidia-stock-5-years-ago/ ]