India's Stock Market Outperforms US and Global Averages

Locales: UNITED STATES, INDIA

New Delhi, January 24th, 2026 - The Indian stock market continues its remarkable ascent, consistently outpacing both the United States and the global average. This surge, which began noticeably in 2024 and has sustained momentum, has captured the attention of investors worldwide, prompting a crucial question: is it still a worthwhile investment opportunity, or has the market run its course?

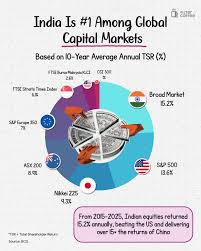

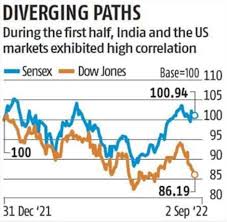

The data paints a compelling picture. Since the beginning of 2024, India's Nifty 50 index has delivered an impressive return of over 12%, significantly eclipsing the gains of the S&P 500, which has seen a more modest increase of just above 4%. Looking back five years, the Nifty 50 has climbed nearly 115%, demonstrating a dramatic divergence from the S&P 500's 55% rise. Even over the last decade, the Nifty 50 has surged an astounding 213%, narrowly exceeding the S&P 500's 208% performance. While the difference between the Nifty 50's 213% and S&P 500's 208% performance might seem negligible, the sheer scale of these figures over a ten-year period underscores the magnitude of India's market dominance.

What's Fueling the Boom?

The Indian market's stellar performance isn't based on luck; it's driven by a confluence of powerful economic and demographic factors. India's designation as one of the world's fastest-growing major economies remains a key driver. This robust growth is underpinned by a young and rapidly expanding middle class. As more Indians enter the workforce and their incomes rise, a greater proportion is being reinvested into the financial markets, particularly in stocks and mutual funds. The increase in household savings channeled towards financial assets has been a significant contributor to the market's strength. International investors, recognizing India's potential, have also been actively injecting capital into the nation's stock market.

"India possesses an exceptionally compelling demographic story," observes Matthew McLennan, chief investment officer for Asia at Federated Hermes, a sentiment echoed by many analysts.

A Word of Caution: Valuations and Risks

Despite the compelling narrative, some experts are voicing concerns about potential overheating. The rapid ascent has led to elevated valuations, raising the possibility of a market correction. Rohit Singhania, vice president for equity research at Axis Securities, cautions about these high valuations, noting that some stocks are trading at multiples significantly exceeding their earnings.

Beyond valuation concerns, potential investors should also be cognizant of geopolitical risks. Tensions with neighboring countries remain a factor to monitor. Policy uncertainty, inherent in any developing economy, poses a further challenge. Governmental regulations can abruptly change, impacting businesses and potentially undermining market confidence. Sudden shifts in taxation policies, for instance, could negatively impact corporate profits and market sentiment.

So, Should You Invest in India Now?

The consensus among financial advisors is that India can and should be part of a well-diversified global portfolio. However, a cautious and informed approach is critical. For investors with a long-term perspective and a tolerance for risk, India presents a potentially lucrative opportunity. It's essential to recognize that market volatility is inevitable, and a correction is always a possibility. Diversifying investments across various asset classes and geographies is paramount to mitigating risk. Investing solely in the Indian market is generally discouraged.

McLennan reinforces this point, advising, "India can be part of a broader, well-diversified global portfolio." The key takeaway is that while India's market boom is impressive, due diligence and prudent risk management remain vital for any investor considering exposure.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/savingandinvesting/this-asian-nation-s-stocks-are-beating-america-and-the-world-should-you-invest-1-000/ar-AA1UGhq2 ]