Junior ISAs: Tax-Free Investing for Your Child

Forbes

ForbesLocales:

Why a Junior Stocks and Shares ISA?

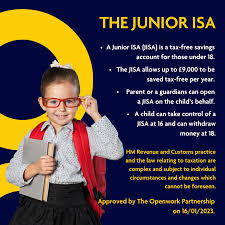

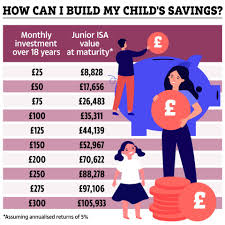

Junior ISAs allow you to invest up to GBP9,000 annually per child, sheltered from both income and capital gains tax. This means any investment growth accumulates tax-free, potentially leading to substantial gains over the years. Importantly, the funds remain the child's property, though they cannot access them until they reach the age of 18. This can be used towards education, a first home, or simply to provide a financial head start.

Top Contenders in 2026

Based on current market conditions and user feedback, the following platforms consistently rank among the best choices for Junior Stocks and Shares ISAs:

- Vanguard: Vanguard maintains a strong reputation for its commitment to low-cost investing and extensive selection of index funds. Their user-friendly platform is particularly appealing to those new to investing, providing a simple and straightforward experience. Their focus on value is a significant draw for budget-conscious families.

- Fidelity: Fidelity distinguishes itself with a robust and comprehensive investment platform. They offer a wider range of investment options, including shares, bonds, and a detailed analysis and research toolkit, catering to investors seeking greater control and insight. Fidelity's breadth of research makes it an excellent choice for parents who want to be actively involved in investment decisions.

- AJ Bell: AJ Bell's intuitive platform is consistently praised for its ease of navigation. It strikes a balanced approach, offering both managed funds and the option to invest in individual shares, making it suitable for varying levels of experience. The emphasis on user-friendliness makes it easy for less experienced parents to get started.

- Interactive Investor: Interactive Investor, a veteran in the investment platform space, caters to more seasoned investors seeking advanced tools and greater control. While potentially more complex for beginners, its comprehensive features and competitive pricing make it a worthy consideration for those with a more sophisticated investment strategy.

Key Considerations When Choosing a Provider

Selecting the right Junior Stocks and Shares ISA isn't simply about picking a name; it's about aligning the provider's offerings with your family's specific needs and investment goals:

- Fee Structure: Low fees are paramount. Even small differences in fees can significantly impact long-term returns. Prioritize platforms that minimize charges.

- Investment Options: Ensure the provider offers investments that match your child's future needs. Consider a mix of asset classes for diversification, potentially including ethical or sustainable investment options.

- Platform Usability: The platform should be easy to navigate and understand, regardless of your level of investment experience. A complicated platform can be a barrier to engagement.

- Customer Support: Responsive and knowledgeable customer service is crucial for addressing queries and resolving any issues that may arise.

- Long-Term Goals: Define what you hope to achieve for your child through this investment. Are you saving for higher education, a first home, or simply building a long-term nest egg?

Maximizing the Tax Benefits

The primary advantage of a Junior ISA is its tax-free status. Earnings are shielded from income and capital gains taxes, allowing investments to compound more effectively over time. This can significantly increase the overall value of the investment by the time the child reaches adulthood. Remember that the money belongs to the child and is theirs to use as they see fit once they turn 18.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions. Investment values can go down as well as up and you may get back less than you invest.

Read the Full Forbes Article at:

[ https://www.forbes.com/advisor/uk/investing/best-stocks-and-shares-junior-isas/ ]