Nvidia & Etsy: Stocks with Potential for Doubling

Locales: California, Texas, UNITED STATES

Wednesday, January 21st, 2026 - The stock market's continued upward trajectory presents a compelling landscape for investors seeking opportunities for substantial returns. While the elusive search for the "next big thing" remains a challenge, certain companies demonstrate the hallmarks of compelling growth potential. Based on current analyst projections and underlying market trends, we've examined two stocks exhibiting characteristics suggesting they could potentially double in value. This is not investment advice, and diligent, personalized research remains paramount.

The Landscape: AI and the Shifting Consumer

The current market strength is largely fueled by two prominent trends: the accelerating adoption of Artificial Intelligence (AI) and a burgeoning consumer desire for personalized, unique goods. The AI boom necessitates significant computational power, and Etsy's success reflects a growing demand for individuality in a world increasingly homogenised by mass production. These contrasting drivers provide the backdrop for the stocks we'll explore.

1. Nvidia (NVDA): Powering the AI Revolution

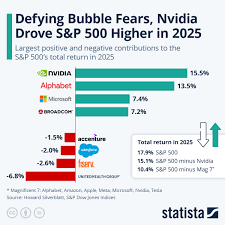

Nvidia's dominance is intrinsically linked to the explosive growth of AI. As the leading manufacturer of Graphics Processing Units (GPUs), Nvidia's chips are the essential workhorses behind AI model training and deployment, often referred to as "inference." The demand isn't just theoretical; it's tangible, emanating from cloud computing giants, autonomous vehicle developers, and research institutions all vying for access to Nvidia's advanced hardware.

The data center segment is the current engine of Nvidia's impressive growth. Beyond data centers, Nvidia maintains a strong position in the gaming market, providing a valuable and consistent revenue stream. While gaming remains important, the long-term growth potential resides squarely within the AI ecosystem.

Why the Potential for a Double? Nvidia isn't simply a chipmaker; it's a foundational element of the AI revolution. The company has cultivated a significant "moat" - a competitive advantage that's difficult for competitors to overcome. This includes its technological lead, strong relationships with key customers, and a brand synonymous with high-performance computing. As AI permeates deeper into industries like healthcare, finance, and manufacturing, the demand for powerful GPUs will likely intensify. Nvidia's pricing power, reflecting its crucial role, further reinforces its potential for significant gains. Furthermore, the relatively early stage of AI implementation suggests a long runway for continued growth - an indication the future might still hold many surprises and innovations.

2. Etsy (ETSY): The Marketplace for the Individual

Etsy's success hinges on a distinctly different, but equally compelling, market force. The company operates a vibrant online marketplace connecting independent creators and unique product seekers. In an era where consumers increasingly seek alternatives to mass-produced goods, Etsy's platform caters directly to this desire for authenticity and personalization. It's fostered a strong brand and a loyal community of both buyers and sellers.

Etsy's strategy extends beyond its core offering. Recent expansion into new product categories and strategic moves into international markets demonstrate a commitment to continued growth. The emphasis on empowering small businesses creates a powerful emotional connection with consumers, solidifying Etsy's positive brand perception and fostering customer loyalty.

Why the Potential for a Double? Etsy benefits from a powerful "marketplace effect." A larger buyer base attracts more sellers, increasing selection and value, which, in turn, draws even more buyers. This creates a positive feedback loop that strengthens the platform. The company's strong brand recognition and engaged user base act as significant barriers to entry for potential competitors. The rising trend of consumers prioritizing unique and personalized items directly aligns with Etsy's core value proposition, positioning the company favorably for continued expansion. Successfully navigating the challenges of scaling a marketplace while preserving the artisan ethos will be crucial, but the initial conditions are very promising.

Important Considerations & Disclaimer

It is vitally important to remember that stock market investments carry inherent risks. While these two companies present compelling opportunities, there are no guarantees. Market conditions can change rapidly, and unforeseen events can impact company performance. Potential investors should conduct thorough due diligence, analyze financial statements, and consider their individual risk tolerance. Seeking advice from a qualified financial advisor is always recommended before making any investment decisions. This analysis is for informational purposes only and does not constitute financial advice.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/20/2-top-stocks-to-double-up-on-right-now/ ]