AI Investment Hype Cools Down

Locales: Virginia, California, New York, UNITED STATES

January 20, 2026 - The initial fervor surrounding artificial intelligence (AI) investments has noticeably subsided, according to a recent survey conducted by The Motley Fool. While the long-term potential of AI remains undeniable, the exuberance that characterized the early years of the AI boom has given way to a more cautious and discerning approach amongst investors. This article analyzes the evolving sentiment and outlines the key factors driving this shift.

From Hype to Reality: A Cooling Market

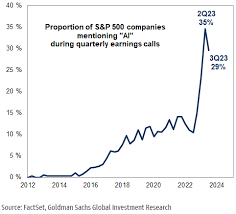

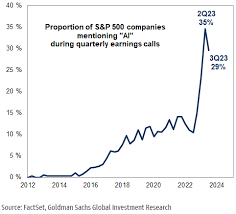

Just a few short years ago, AI stocks were experiencing a period of unprecedented growth. Driven by widespread excitement and promises of revolutionary technological advancements, investors were eager to pour capital into companies operating in the AI space. However, as we enter 2026, the market has matured, and the narrative has changed.

The Motley Fool's recent survey reveals a significant cooling of enthusiasm. While nearly all respondents acknowledge the continued importance and long-term growth prospects of AI, the speculative frenzy of the past has largely dissipated. Many investors are now critically reviewing their portfolios and questioning the valuations of companies previously considered 'can't miss' opportunities.

The Valuation Question: A Core Concern

The primary driver of this sentiment shift is valuation. Numerous AI-focused companies have seen their stock prices skyrocket, frequently outpacing actual revenue or profitability. This has led to concerns about whether these inflated prices are sustainable. Investors are now confronting a crucial question: are these valuations justified by the underlying business fundamentals?

One investor participating in the survey captured the prevailing feeling: "I got caught up in the AI hype a few years ago. Now, I'm wondering if I overpaid for some of these stocks." This sentiment is widespread, reflecting a broader recognition that many AI companies are trading at exceptionally high multiples, creating a potential bubble risk.

The focus has shifted from simply identifying companies that use AI to evaluating the actual profitability and business models that support these high valuations. Investors are demanding more tangible evidence of a path to sustainable earnings growth, and are no longer willing to simply accept promises of future AI dominance.

Strategic Adjustments and Investor Actions

The changing sentiment has prompted a noticeable shift in investment strategies. Some investors are opting to reduce their holdings in AI stocks, cautiously trimming positions to mitigate potential losses. Others have taken more drastic measures, selling their AI investments outright.

The Motley Fool's advisory stance is clear: a thorough reassessment of AI holdings is now essential. If a company's valuation doesn't align with its core fundamentals, a reevaluation of the investment thesis is warranted. This isn't necessarily a bearish signal on AI as a whole, but rather a call for more disciplined and informed investing.

Looking Ahead: A More Selective Future

The future of AI investing remains complex, with ongoing technological advancements and evolving market dynamics. However, one thing is certain: the era of blindly investing in companies simply because they mention AI in their marketing materials is over.

To succeed in the AI investment landscape going forward, investors will need to adopt a more selective and disciplined approach. This requires thorough due diligence, a deep understanding of the underlying businesses, and a willingness to make difficult decisions based on data and analysis, rather than hype. Future success hinges on identifying companies with a genuine competitive advantage, a clear path to profitability, and a management team capable of executing on their vision - all while maintaining a realistic perspective on valuation.

While the long-term potential of AI remains substantial, a more tempered and considered approach is now the key to navigating this evolving market.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/20/motley-fool-2026-ai-survey-ai-investor-sell/ ]