Nike Eyes S&P 500 Dividend Aristocrat Status

Investopedia

InvestopediaLocales: Oregon, UNITED STATES

Monday, January 19th, 2026 - Nike (NKE), the global athletic apparel and footwear giant, is making significant strides toward a coveted designation: inclusion in the S&P 500 Dividend Aristocrats index. This prestigious ranking signifies a long-term commitment to rewarding shareholders and reflects a history of financial stability and consistent growth. Currently, Nike boasts a 23-year streak of annual dividend increases, placing it tantalizingly close to achieving the 25-year threshold required for inclusion.

Understanding the Dividend Aristocrat Club

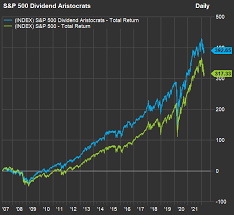

The S&P 500 Dividend Aristocrats index isn't simply a list of companies paying dividends; it's a highly selective group. To earn a place, companies must meet three crucial criteria: they must be a component of the S&P 500, demonstrate a minimum of 25 consecutive years of annual dividend increases, and maintain a dividend yield of at least 2%. This rigorous selection process ensures that only the most reliable and shareholder-focused businesses are recognized.

Why Investors Value Dividend Aristocrats

Investors flock to Dividend Aristocrats for several key reasons. These companies typically represent established, financially robust entities capable of generating consistent and substantial cash flow. This reliable income stream enables them to not only maintain but also consistently increase dividend payouts over time. For income-seeking investors, this predictable revenue is particularly attractive, providing a steady income stream regardless of broader market fluctuations. Furthermore, Dividend Aristocrats often exhibit greater resilience during economic downturns. The regular dividend payments act as a buffer, cushioning investors against potential losses and offering a degree of stability often lacking in more volatile investments. The long history of consistent growth inspires confidence in the company's management and future prospects.

Nike's Solid Dividend History and Current Standing

Nike's 23-year record of consecutive dividend increases is a testament to the company's strong performance and commitment to returning value to its shareholders. This consistency demonstrates a disciplined approach to financial management and a willingness to share profits with investors. While Nike's current dividend yield of approximately 1.07% is noticeably lower than the 2% yield required to be a Dividend Aristocrat, analysts suggest that this is largely offset by the company's significant growth potential and the unparalleled strength of its brand. Nike's continuous innovation, global reach, and loyal customer base underpin this optimism.

What Nike's Inclusion Would Mean for Investors

Upon reaching the 25-year milestone, Nike will automatically be incorporated into the Dividend Aristocrats index. This event is anticipated to positively influence investor sentiment, potentially driving increased demand for Nike stock and further boosting its valuation. The inclusion would signal to the market that Nike is a company of unwavering financial strength and a dependable long-term investment. However, experts caution that inclusion in the Dividend Aristocrats isn't a guaranteed pathway to continued success. The stock's performance ultimately hinges on Nike's underlying business fundamentals, including sales growth, market share, and effective management of operational costs, as well as overall prevailing market conditions. While the label is prestigious, it's not a substitute for thorough due diligence and a comprehensive understanding of the company's prospects.

Looking Ahead: The Broader Significance

Nike's journey towards becoming a Dividend Aristocrat highlights the importance of long-term value creation and consistent shareholder rewards. It serves as a powerful signal of the company's financial health and strategic commitment. As Nike approaches this milestone, it reinforces the company's reputation as a reliable investment choice and illustrates the ongoing importance of dividend growth in attracting and retaining investors. The anticipation surrounding this potential inclusion is indicative of the broader trend towards valuing companies that prioritize consistent returns and sustainable growth, rather than solely chasing short-term gains.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/nike-stock-could-join-an-exclusive-club-what-to-know-about-the-dividend-aristocrats-nke-11886723 ]