Amazon, Etsy, and Tesla: A 2026 Growth Stock Review

AOL

AOLLocales: California, Texas, New York, UNITED STATES

Sunday, January 18th, 2026 - As we navigate the evolving economic landscape of 2026, identifying promising growth stocks remains a key focus for investors. While the risks are inherent - and diversification is always paramount - certain companies continue to demonstrate resilience and innovative potential. This article expands on initial assessments and analyzes the current trajectory of three companies previously highlighted: Amazon (AMZN), Etsy (ETSY), and Tesla (TSLA). Please remember this is not financial advice. Conduct thorough research before making any investment decisions.

The Shifting Landscape of Growth Investing

Five years since the initial report, the investing climate has changed. Inflation, while cooling from its peak, continues to impact consumer spending. Geopolitical instability remains a persistent concern, influencing supply chains and market confidence. Furthermore, the rise of generative AI has reshaped expectations for technological advancement, impacting company valuations and strategic priorities. Growth stock investors must now consider these factors with even greater scrutiny.

1. Amazon: Beyond E-Commerce, a Cloud-Powered Ecosystem

Amazon's dominance is undeniable, but its evolution since 2021 is particularly noteworthy. While e-commerce remains a vital component, Amazon Web Services (AWS) continues to be the bedrock of its financial strength. Recent reports indicate AWS has successfully navigated the challenges of increased competition from Microsoft Azure and Google Cloud, retaining a significant market share. Crucially, Amazon's aggressive investment in artificial intelligence - particularly in generative AI - has started yielding results, streamlining internal operations and offering new services to businesses.

- Recent Performance: Amazon's stock demonstrated a period of stabilization after initial volatility in 2022-2023, driven by consistent AWS profitability and surprisingly robust consumer spending during the holiday season of 2025. The impact of regulatory scrutiny regarding its market power remains a factor.

- Growth Potential: The future for Amazon hinges on successfully integrating AI across its entire ecosystem, further optimizing AWS and expanding into new areas like healthcare and logistics. The rollout of Prime Air delivery services, though initially plagued by delays, is now showing signs of operational efficiency, promising to revolutionize last-mile delivery.

2. Etsy: Cultivating a Community in a Changing Marketplace

Etsy's unique position as a marketplace for handmade and vintage goods presented both opportunities and challenges. The initial pandemic-era boom has subsided, prompting a shift in strategy focused on bolstering seller support and expanding buyer demographics. A critical update has been the development of more sophisticated AI-powered tools for sellers to optimize their listings and manage their businesses, effectively lowering the barrier to entry and increasing platform engagement.

- Recent Performance: Etsy has experienced a more moderate growth trajectory than initially projected. The company faced headwinds from rising shipping costs and increased competition from larger online retailers offering similar "handmade" or "unique" products.

- Growth Potential: Etsy's future relies on solidifying its community and appealing to a broader audience. Expansion into international markets, particularly in Asia, and leveraging its AI tools to enhance the shopping experience are key priorities. A recent acquisition of a smaller platform specializing in personalized gifts has positioned Etsy well for the increasing demand for customized products.

3. Tesla: Powering the Energy Transition and Battling Competition

Tesla remains at the forefront of the electric vehicle revolution, but the competitive landscape has intensified significantly. While Elon Musk's public persona continues to generate headlines (and occasional market fluctuations), the company's commitment to innovation - particularly in battery technology and autonomous driving - remains the core driver of its value. Tesla's expansion into energy storage and solar solutions has also gained traction, contributing to a more diversified revenue stream.

- Recent Performance: Tesla's stock price has been subject to increased scrutiny as traditional automakers have ramped up their EV offerings, and supply chain issues persist, though significantly mitigated compared to previous years.

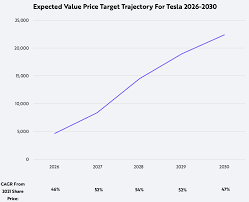

- Growth Potential: Tesla's next phase of growth relies on navigating increased competition, improving production efficiency, and expanding its charging infrastructure globally. The highly anticipated release of the 'Cybertruck' has been pivotal to demonstrating design innovation and market appeal. Further advancements in Full Self-Driving (FSD) capabilities, when and if successfully implemented, could unlock substantial value.

Understanding the Risks Remains Crucial

Investing in growth stocks inherently carries higher risk. High price-to-earnings ratios indicate a significant expectation for future growth; failing to meet those expectations can lead to substantial declines. Economic uncertainty and increased interest rates continue to present challenges, potentially impacting investor sentiment and stock valuations. Diversification across asset classes and a long-term investment horizon remain crucial for mitigating risk and maximizing potential returns.

Read the Full AOL Article at:

[ https://www.aol.com/finance/3-growth-stocks-invest-1-113500609.html ]