Nvidia: AI Revolution Fuels Continued Growth

Locales: California, Texas, Washington, New York, Illinois, UNITED STATES

Understanding 'Strong Buy' Ratings

A 'strong buy' rating signifies that a significant majority of analysts covering a particular stock believe it has substantial upside potential. This assessment is based on factors such as financial health, projected growth, competitive positioning, and overall market conditions. However, it's crucial to remember that analyst ratings represent opinions and should be one factor in a broader investment strategy. Individual financial goals and risk tolerance should always take precedence.

The 13 'Strong Buy' Stocks - A Deeper Dive

Let's examine the companies initially listed, grouping them by sector and adding context relevant to the early 2026 market:

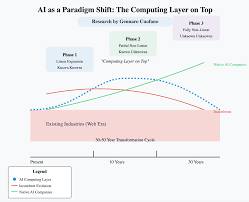

1. Technology Powerhouses: The technology sector remains a dominant force, and several stocks on the list exemplify this. Nvidia (NVDA) continues to thrive, fueled by the ongoing AI revolution and its crucial role in data centers and autonomous vehicle development. While GPU supply chain challenges eased in late 2025, future demand remains exceptionally high. Advanced Micro Devices (AMD) is aggressively challenging Nvidia and Intel, leveraging innovative product designs and aggressive marketing. Competition in the CPU/GPU space remains intense. Alphabet (GOOGL) maintains its advertising dominance, and its cloud initiatives (Google Cloud) are gaining ground against Amazon's AWS, suggesting a more competitive cloud market than previously anticipated. Apple (AAPL), while facing headwinds from global economic fluctuations, remains a cash-generating machine and continues to innovate, with recent rumors suggesting a significant expansion into augmented reality applications. Microsoft (MSFT), particularly its Azure cloud platform, is demonstrating robust growth, and the integration of AI across its product suite (including the Office suite) is proving a key differentiator.

2. E-Commerce & Cloud Titans: Amazon (AMZN)'s diversified revenue streams--e-commerce, AWS, and advertising--continue to provide stability. While e-commerce growth has slightly moderated from its pandemic peak, AWS remains a critical profit driver. Salesforce (CRM), the leading CRM provider, is crucial for businesses managing customer relationships, and its expansion into adjacent markets positions it for continued success.

3. Financial Services: Bank of America (BAC) benefits from the prevailing economic conditions, characterized by moderate growth and elevated interest rates (though concerns regarding a potential rate cut in late 2026 exist). Both Visa (V) and Mastercard (MA) are beneficiaries of the global shift towards cashless transactions. Adoption rates in emerging markets are particularly promising.

4. Disruptive Innovation: Tesla (TSLA) remains the undisputed leader in the electric vehicle market, but faces increasing competition from both established automakers and emerging EV startups. Its energy storage and solar panel businesses are expanding, though profitability remains a key focus area.

5. Consumer Staples & Retail: Home Depot (HD)'s performance is intertwined with the housing market; recent data suggests a stabilization after a period of volatility. Costco (COST)'s membership-based model and value-driven offerings continue to attract customers, making it a relatively recession-resistant investment.

Market Considerations for 2026

The early part of 2026 presents a complex market landscape. Inflation, while cooling from previous years, remains a concern. Geopolitical instability continues to introduce volatility. Artificial intelligence remains a key driver, but also introduces uncertainty regarding its long-term impact on the economy and workforce. Interest rate policy by the Federal Reserve is a significant factor influencing the overall market direction.

Important Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. This list represents a snapshot in time based on analyst ratings as of January 15, 2026, and may be subject to change.

Read the Full Insider Monkey Article at:

[ https://www.insidermonkey.com/blog/13-best-strong-buy-stocks-to-invest-in-right-now-1669845/ ]