Magnificent Seven Showdown: Which Stock Reigns Supreme?

If Forced to Choose Just One: Which Magnificent Seven Stock Would You Pick? (And Why It’s Probably Not Who You Think)

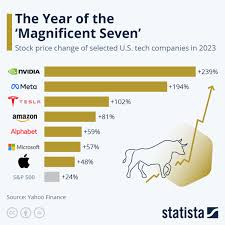

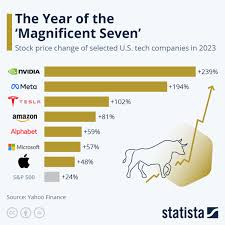

The "Magnificent Seven" – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL/GOOG), Amazon (AMZN), Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META) – have dominated the stock market's narrative for years, driving significant gains and capturing investor attention. These tech giants represent a substantial portion of the S&P 500’s overall performance, and many investors hold at least some exposure to them. But what if you were limited to owning just one? The recent article on Fool.com explores this hypothetical scenario, delving into each company's strengths, weaknesses, and future prospects to determine which stock would be the most compelling long-term investment.

The core argument presented in the article isn’t about declaring a definitive "winner." Instead, it emphasizes understanding why certain stocks might be more resilient and offer better growth potential than others, especially given current market conditions and potential economic headwinds. While Nvidia's meteoric rise driven by AI has been undeniable (more on that shortly), the author ultimately argues that Microsoft is the most compelling choice for a single Magnificent Seven investment.

A Quick Look at the Contenders & Their Challenges:

The article systematically assesses each company, highlighting their key drivers and potential pitfalls:

- Apple (AAPL): Apple remains a powerhouse with its loyal customer base and premium branding. However, growth is slowing as smartphone market saturation increases globally. The article points out that while services revenue continues to grow, it's not enough to fully offset the decline in iPhone sales. The dependency on China for both manufacturing and sales also presents a significant geopolitical risk – something Apple has been actively trying to mitigate through diversification (see [ Apple’s supply chain moves ]).

- Alphabet (GOOGL/GOOG): Alphabet’s dominance in search and online advertising is undeniable, but competition from AI-powered alternatives like Microsoft's Copilot poses a serious threat. While Google Cloud is growing, it lags behind Amazon Web Services (AWS) and Azure (Microsoft's cloud offering). The article notes that regulatory scrutiny surrounding antitrust issues also adds uncertainty.

- Amazon (AMZN): Amazon’s e-commerce business faces margin pressure due to increased competition and rising shipping costs. While AWS remains a significant profit center, its growth rate has slowed. The company’s diversification into areas like healthcare is promising but still in its early stages.

- Nvidia (NVDA): This is the stock that's been capturing headlines. Nvidia’s GPUs are essential for AI development and training, fueling explosive revenue growth. However, the article cautions that Nvidia's valuation is currently incredibly high, reflecting near-perfect expectations. Furthermore, competition in the AI chip market is intensifying (see [ Nvidia's Competition ]), and geopolitical factors could disrupt its supply chain. The article acknowledges Nvidia’s vital role but suggests the risk-reward profile isn't as attractive as other options at its current price.

- Tesla (TSLA): Tesla's early lead in electric vehicles is being challenged by established automakers. Price cuts to maintain market share are squeezing margins, and Elon Musk's increasingly erratic behavior adds another layer of risk. The article highlights the increasing competition and concerns about Tesla’s long-term profitability.

- Meta Platforms (META): Meta has made a significant pivot towards AI and the metaverse, with its Reality Labs division burning billions. While recent earnings have shown promise, particularly regarding cost controls and ad revenue growth, the success of its metaverse ambitions remains highly uncertain.

Why Microsoft Stands Out:

The article argues that Microsoft's strength lies in its diversified business model and consistent execution. Here’s a breakdown of why it emerges as the preferred choice:

- Broad Business Portfolio: Unlike many of its Magnificent Seven peers, Microsoft isn't reliant on a single product or market segment. Its cloud computing (Azure) business is thriving, complementing its established software businesses like Windows and Office 365.

- AI Integration Across the Board: Microsoft has strategically integrated AI into its existing products and services, including Bing (powered by OpenAI's technology), Copilot (integrated across Microsoft 365), and Azure’s AI offerings. This approach allows them to capitalize on the AI boom without betting everything on a single, speculative venture like Meta’s metaverse.

- Strong Financial Position: Microsoft boasts a massive cash hoard and generates substantial free cash flow, providing financial flexibility for acquisitions, research & development, and shareholder returns.

- Relatively Conservative Valuation (Compared to Nvidia): While not "cheap," Microsoft's valuation is considered more reasonable than Nvidia’s, offering potentially better downside protection.

- OpenAI Partnership: The deep partnership with OpenAI, the creator of ChatGPT, gives Microsoft a significant advantage in the AI race and provides a constant stream of innovation. (See [ Microsoft & OpenAI ]).

The Takeaway:

Choosing just one Magnificent Seven stock is a thought experiment designed to highlight the importance of considering risk and reward, diversification (even within a concentrated portfolio), and long-term growth potential. While Nvidia's AI dominance is undeniable, its high valuation makes it a more speculative bet. Microsoft’s diversified business model, strong financial position, and strategic approach to AI integration make it the most compelling choice for investors seeking stability and sustainable growth within this elite group of tech giants. The article concludes that even if you can hold multiple stocks, understanding why Microsoft is considered a standout provides valuable insights into assessing the overall landscape of these influential companies.

Disclaimer: This summary is based on the provided URL and does not constitute financial advice. Always conduct your own research before making investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/26/if-i-could-buy-only-1-magnificent-seven-stock-in-2/ ]