Unearthing Potential 'Hidden Gems' in Late 2024: A Motley Fool Analysis

Beyond the Buzz: Unearthing Potential "Hidden Gems" in Late 2024

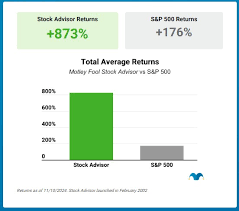

As the year draws to a close, investors are naturally reflecting on successes and considering strategies for the coming year. While headlines often focus on established tech giants and trending sectors, savvy investors know that significant returns can be found by identifying undervalued “hidden gem” stocks – companies with strong fundamentals but overlooked by the broader market. A recent article from The Motley Fool highlights several such opportunities, arguing that these lesser-known firms possess compelling growth potential at attractive valuations as we approach 2025.

The core thesis of the article revolves around finding companies demonstrating solid financial health, innovative business models, and a clear pathway to future profitability – qualities often masked by temporary market headwinds or simply due to a lack of widespread analyst coverage. It emphasizes that "hidden gems" aren't necessarily about overnight riches; they represent long-term, patient investment opportunities.

Three Stocks Highlighted as Potential Hidden Gems:

The article focuses on three specific companies: Celsius Holdings (CELH), Titan Machinery (TITN), and Etsy (ETSY). Let’s break down each one.

Celsius Holdings (CELH): The Functional Beverage Disruptor. Celsius is a rapidly growing functional beverage company, known for its energy drinks infused with vitamins and metabolic boosters. The Fool's article argues that despite already impressive growth, Celsius remains undervalued due to investor skepticism surrounding the crowded energy drink market. However, Celsius differentiates itself through its focus on fitness and wellness – appealing to a health-conscious consumer base. The company’s distribution network has expanded significantly, including partnerships with major retailers like Target and Walmart (both powerful forces in retail as discussed in previous Fool articles about retailer strength). While the article acknowledges competitive pressure from established players like Red Bull and Monster Beverage, Celsius's unique positioning and strong brand loyalty provide a buffer. Financial data shows consistent revenue growth and improving margins, suggesting that the company is effectively scaling its operations. The key risk lies in maintaining consumer interest and navigating potential pricing pressures within the beverage industry. Further information on their financial performance can be found on their investor relations page.

Titan Machinery (TITN): Riding the Agricultural Equipment Wave. Titan Machinery operates as a dealer for agricultural equipment, primarily selling brands like John Deere (a dominant player in the agriculture sector). The article points out that Titan's stock has been relatively overlooked despite benefiting from several tailwinds: strong demand for farm machinery driven by higher commodity prices and government subsidies, and a general trend toward precision farming practices requiring advanced equipment. Titan’s geographic focus – primarily serving customers in Montana, North Dakota, South Dakota, and Wyoming – provides a degree of regional specialization that allows them to build strong customer relationships. The company also offers aftermarket parts and services, generating recurring revenue streams beyond equipment sales. While the agricultural sector is cyclical and susceptible to weather patterns and commodity price volatility (as highlighted in Fool articles on agriculture investing), Titan’s diversified service offerings and strategic location help mitigate some of these risks. The article suggests that as commodity prices stabilize and farm incomes remain relatively strong, Titan's stock could see significant appreciation.

Etsy (ETSY): Reimagining the Online Marketplace. Etsy, a marketplace for handmade and vintage goods, has faced challenges in recent years after experiencing a pandemic-fueled boom. The article argues that the current market undervalues Etsy’s long-term potential. While growth rates have slowed from their peak, Etsy is actively working to improve its seller experience and expand into new product categories. The company's focus on unique, personalized items provides a distinct advantage over larger e-commerce platforms like Amazon (a frequent subject of Fool analysis regarding market dominance). Etsy’s strategy includes attracting more high-quality sellers and enhancing the platform’s marketing capabilities to reach a wider audience. The article emphasizes that Etsy’s community-driven marketplace fosters customer loyalty, which is crucial for long-term success in the competitive e-commerce landscape. The company's recent initiatives to streamline seller onboarding and offer more financial support are seen as positive steps toward revitalizing growth. The key risk lies in maintaining a balance between attracting sellers and ensuring a compelling experience for buyers.

General Investment Considerations & Caveats:

Beyond these specific stock picks, the article reinforces several important principles for identifying hidden gem stocks:

- Focus on Fundamentals: Look beyond short-term market fluctuations and analyze companies' financial statements – revenue growth, profitability margins, debt levels, and cash flow.

- Understand the Business Model: Thoroughly research how a company generates revenue and what its competitive advantages are.

- Consider Management Quality: Evaluate the experience and track record of the management team.

- Be Patient: Hidden gem stocks often require time to realize their full potential. Don't expect overnight riches.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversification is crucial for managing risk.

The article also cautions that investing in smaller, less-followed companies carries inherent risks. These stocks can be more volatile and may lack the liquidity of larger, more established firms. It stresses the importance of conducting thorough due diligence before making any investment decisions, acknowledging that past performance is not indicative of future results – a standard disclaimer for any financial advice. Finally, it reminds readers to consult with a qualified financial advisor before making any investment choices tailored to their individual circumstances.

Disclaimer: I am an AI chatbot and cannot provide financial advice. This summary is for informational purposes only and should not be considered a recommendation to buy or sell any securities.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/29/hidden-gem-stocks-to-love-at-the-end-of-the-year/ ]