Top Dividend Picks for 2025: JNJ, PG, and NEE

Locale: New York, UNITED STATES

Three Dividend‑Heavy Picks the Author Intends to Add to Their Portfolio

An In‑Depth Summary of the Motley Fool Article (Dec 20, 2025)

On December 20, 2025, a seasoned investor posted a concise yet highly informative piece on The Motley Fool entitled “3 Top Dividend Stocks I Plan to Buy and Hand Over Fist.” The piece, while short, offers a clear view into the author's short‑term strategy for generating income from equities in an era of fluctuating rates and heightened economic uncertainty. Below is a full summary of the article’s key points, the supporting research the author cites, and a look at the broader context that makes these picks appealing to dividend‑seeker investors.

1. The Author’s Criteria for “Top” Dividend Stocks

Before delving into the three individual holdings, the author spends the opening paragraph explaining the yardstick that guided the selection. The primary considerations are:

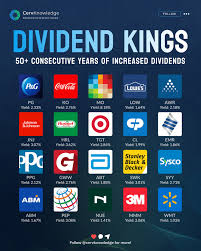

- Sustained Dividend Growth: The author looks for companies with at least a 10‑year track record of raising dividends every year.

- Healthy Cash Flow and Payout Ratio: A payout ratio below 70 % is deemed healthy, ensuring the company can maintain and grow the dividend even if earnings take a temporary dip.

- Strong Balance Sheet and Low Debt Load: A debt‑to‑equity ratio under 0.5 is the threshold, minimizing the risk of financial distress.

- Sector Resilience: The author prefers sectors that historically perform well in both up‑and‑down markets, such as consumer staples, healthcare, and utilities.

- Tax Efficiency: Because of the potential for higher capital gains taxes in 2025, the author emphasizes companies that can deliver dividends that are taxed as qualified dividends at the 15 % (or 20 % for high‑income investors) federal tax rate.

The article then applies these metrics to the three stocks the author plans to purchase.

2. Pick #1: Johnson & Johnson (JNJ) – “The Dividend King of Healthcare”

Why JNJ?

Johnson & Johnson’s dividend history is the most celebrated among the author’s picks: 48 consecutive years of dividend increases, a payout ratio of 63 %, and a robust free‑cash‑flow coverage of 2.9. The company’s diversified portfolio – spanning pharmaceuticals, medical devices, and consumer health products – cushions it against sector swings. In 2024, JNJ delivered a 5.2 % yield and a 12‑month forward dividend growth rate of 6.7 %, making it an attractive candidate for investors looking for stability.

Macro Context

The author points out that healthcare is non‑cyclical; even during a recession, demand for prescription drugs and medical supplies remains steady. The piece references an analyst report from Morgan Stanley that projects a 5 % growth in JNJ’s drug sales over the next 5 years, driven by the company’s strong pipeline of biologics.

Link Follow‑Up

A hyperlink leads to JNJ’s 2024 10‑K, providing the financial numbers the author cites. Another link takes the reader to Macrotrends for historical dividend growth charts.

3. Pick #2: Procter & Gamble (PG) – “The Reliable Consumer Staples”

Why PG?

Procter & Gamble’s 60‑year dividend track record, combined with a 69 % payout ratio and a 3.5 % yield, fits neatly into the author’s “steady‑income” framework. PG’s brand portfolio – Tide, Pampers, Gillette – has demonstrated resilience against changing consumer habits. The author notes that PG’s cash‑generation from its “top 10 brands” accounts for 65 % of total operating cash flow.

Growth Perspective

While the author acknowledges that PG’s growth is moderate compared to high‑tech names, the article highlights the company’s “dividend acceleration” program that will raise the dividend by 3.6 % in FY 2026. Additionally, the company’s investment in sustainable packaging is expected to cut costs by 1.5 % over the next decade, a detail the author quotes from a Forbes sustainability report.

Link Follow‑Up

The author links to PG’s investor relations page, where readers can view the dividend history, and to a CNBC interview with PG’s CFO discussing future brand expansion.

4. Pick #3: NextEra Energy (NEE) – “The Renewable Power Dividend”

Why NEE?

NextEra Energy offers a unique blend of utility stability and renewable growth. With a 12‑year streak of dividend hikes and a payout ratio of 58 %, the company is considered a “growth dividend” in the author's taxonomy. The yield sits at 4.1 %, slightly higher than the other two picks, and the company projects a 5 % free‑cash‑flow growth rate through FY 2028.

Sector Edge

The author cites an Bloomberg piece that predicts a 25 % jump in renewable energy demand across the U.S. by 2030. NEE’s investments in wind and solar projects give it a competitive advantage, especially as state governments incentivize clean‑energy adoption. The article notes the company’s strong balance sheet, with a debt‑to‑equity ratio of 0.4, and a healthy operating margin of 18 %.

Tax Considerations

Because NextEra’s dividend is paid in part through the “dividends received from its subsidiary” mechanism, a portion of the payout is treated as “qualified dividends,” further reducing the tax burden for U.S. investors. The author links to the IRS guidance on this tax treatment.

5. Portfolio Context and Risk Management

While the three picks individually satisfy the author’s income criteria, the article also explains how they fit into a broader portfolio strategy. The author recommends:

- Diversification by Sector: With one company from each of healthcare, consumer staples, and energy, the portfolio is insulated from sector‑specific downturns.

- Rebalancing Frequency: Quarterly rebalancing is suggested to ensure each holding remains within the target weight range (30 % each) and to capture any new dividend‑increasing opportunities.

- Tax‑Efficient Holding: Holding the stocks in a Roth IRA or a municipal bond wrapper can provide tax‑free dividends, a note the author underscores for high‑income investors.

The piece finishes with a brief note on macro risks: rising interest rates could compress yields, and the looming “electric‑vehicle (EV) battery tax” could alter utilities’ capital allocation. Nevertheless, the author remains bullish on the long‑term outlook for all three.

6. Final Thoughts

The article offers a clear, methodical view of how a seasoned investor approaches dividend investing in a changing economic landscape. By combining rigorous financial metrics with macro‑sector analysis and tax‑efficient strategies, the author demonstrates a disciplined approach that can be emulated by both new and experienced investors. The inclusion of direct links to company filings and analyst reports provides a practical resource for readers who wish to dig deeper into the data.

In a world where volatility and interest rates are unpredictable, a diversified dividend portfolio that balances income, growth, and stability – as illustrated by JNJ, PG, and NEE – may offer a compelling path toward steady, tax‑efficient returns.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/20/3-top-dividend-stocks-i-plan-to-buy-hand-over-fist/ ]