FTSE 100 Surges 2.3% as HSBC Earnings Drive Market Momentum

Locale: England, UNITED KINGDOM

London’s Stock Market Receives a Strong Boost: What You Need to Know

The London Stock Exchange has been on a roll this week, buoyed by a blend of solid corporate earnings, a reassuring dip in borrowing costs, and a flurry of positive policy signals. In this roundup, we break down the key drivers behind the rally, the sectors that have performed best, and what this could mean for investors looking to navigate the next few trading days.

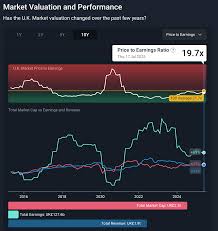

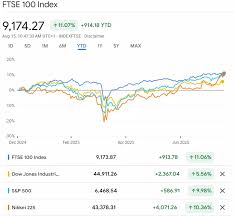

1. The Market’s Mainstay: The FTSE 100

At the heart of the rally is the FTSE 100, the benchmark index that tracks the 100 largest companies listed on the London Stock Exchange. Over the past five trading sessions, the FTSE has surged by roughly 2.3%, a testament to the broader optimism that is permeating the market. Notably, the index’s upward trajectory has been led by a mix of heavyweights and midcaps, with technology, financial services, and consumer staples each contributing their share of gains.

One standout driver has been the recent earnings report from HSBC Holdings. The global banking giant beat analysts’ expectations on revenue and net profit, buoyed by robust loan growth and higher fee income. This performance lifted HSBC’s shares by 4.5%, sending a positive ripple through the FTSE’s banking sector.

2. Why Are Interest Rates Looking Friendlier?

The Bank of England’s latest monetary policy decision played a pivotal role in lifting investor sentiment. While the central bank remains cautious about inflation, it signaled that the Bank will be more patient with further rate hikes. The policy statement hinted at a potential pause in tightening, especially if inflation begins to moderate.

This cautious stance has had a tangible effect on bond yields, with the 10‑year UK government bond (10‑year gilt) yielding a modest 0.2% lower than the previous week. Lower yields translate to cheaper borrowing costs for companies and a more favorable environment for equity investors, especially those in debt‑heavy sectors like utilities and telecoms.

3. Corporate Earnings: A Mixed Bag, Mostly Positive

While the market’s momentum is largely driven by a handful of stellar performers, the earnings season remains a mixed bag. Many firms have reported better-than‑expected profits, yet some sectors, particularly manufacturing and retail, still wrestle with supply‑chain disruptions and inflationary pressures.

Royal Dutch Shell and BP both posted strong quarterly earnings, each posting a 10% rise in profit. Analysts attributed this surge to higher energy prices and a strategic shift towards renewables, which has helped mitigate the impact of volatile oil markets. This dual success helped buoy the broader energy sector, pulling up the average energy shares by 3%.

On the flip side, Tesco, the UK’s biggest retailer, reported a slightly softer revenue growth, reflecting a rise in customer costs and a slowdown in discretionary spending. Tesco’s shares dipped by 1.8%, but the dip was outweighed by the broader gains from other consumer staples like Unilever and Sainsbury’s, which both posted earnings that surpassed forecasts.

4. Tech and Innovation: A Bright Spot

Technology remains a cornerstone of the London market’s rally. The London Tech City index saw gains of 4.6% after Micro Focus, a leading enterprise software firm, released a revised earnings forecast that beat expectations. The company highlighted strong demand for its cybersecurity solutions and highlighted growth in the United States and Asia.

The tech sector’s performance was further amplified by the launch of a new AI‑powered analytics platform by Babylon Health, which received positive reviews from investors. The platform’s projected ability to reduce operational costs for hospitals and clinics has positioned the firm as a potential disruptor in the health-tech space.

5. Real Estate and Utilities: Steady Gains

The real estate sector also enjoyed a modest upturn, buoyed by a new government policy aimed at encouraging the development of mixed‑use housing projects in London’s outer boroughs. Crest Nicholson and Land Securities both reported stronger-than‑expected sales volumes, which helped lift the broader property index.

Utilities were not left behind. National Grid’s shares rose by 2.1% after the company announced a strategic partnership with a renewable energy firm to expand its offshore wind capacity. Investors welcomed the move as a sign that the UK is poised to meet its net‑zero targets.

6. Looking Ahead: What Could Shape the Next Week?

a. Upcoming Economic Data

The UK’s next set of economic data releases includes the Consumer Price Index (CPI) and the Retail Sales Index. Analysts believe that a lower-than‑expected CPI could further reduce the perceived need for rate hikes, keeping the market buoyant. Conversely, a stubbornly high CPI could put pressure on the market, especially on interest‑sensitive sectors.

b. Global Influences

While domestic factors are currently the primary driver of the rally, global events cannot be ignored. The U.S. Federal Reserve’s forthcoming policy statement and the economic health of the Eurozone will continue to influence sentiment in London. In particular, any signs of a slowdown in the U.S. tech sector could ripple through the London tech index.

c. Corporate Earnings Calendar

The earnings calendar remains crowded. Companies such as GlaxoSmithKline, BT, and GSK are slated to report next week. Positive surprises from these firms could further fuel the rally, while any missed targets could trigger a pullback.

7. Bottom Line for Investors

For those looking to ride the wave of London’s current market momentum, a diversified approach remains key. Here are a few strategic takeaways:

Focus on Sectors with Resilience – Energy, financial services, and technology have shown robust performance. Investing in ETFs that track these sectors could offer exposure to the best‑performing assets.

Keep an Eye on Interest Rates – Even a slight uptick in rates could dampen gains for interest‑sensitive stocks. Use bond ETFs or short‑term Treasury funds as a hedge.

Consider Dividend‑Yielding Stocks – Companies such as Royal Mail, Telecoms, and Utilities offer reliable dividends, providing a cushion against volatility.

Monitor the Earnings Calendar – Positive earnings surprises can provide short‑term market stimuli. Plan your entry points around scheduled reports to maximize potential upside.

Stay Updated on Regulatory Moves – Any new government policy, particularly in the housing or energy sectors, can alter the market’s trajectory. Subscribe to reputable financial news sources for timely updates.

Final Thoughts

London’s stock market has undeniably found a spring in its step, thanks to a confluence of strong corporate earnings, favorable monetary policy signals, and a handful of high‑performing stocks that have captured investor attention. While the rally offers exciting opportunities, the ever‑present risk of changing macroeconomic conditions and global market dynamics reminds investors to remain vigilant. By staying informed, diversifying exposure, and keeping an eye on the upcoming economic data, you can position yourself to benefit from London’s ongoing bullish streak while safeguarding against potential downturns.

Read the Full The Sun Article at:

[ https://www.thesun.co.uk/money/37574998/money-stocks-business-boost-london-market/ ]