Meta's Share Price Slides 25-30% After Ad Revenue Decline

Locale: California, UNITED STATES

Is Meta a Buy After Its Recent Drop From “Glory”?

Summary of the 247 Wall Street article dated November 24, 2025

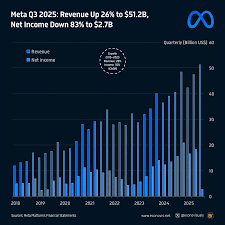

The late‑November 2025 update on Meta Platforms (ticker META) on 247 Wall Street addresses a headline question that has been buzzing on trading floors, research desks, and in the feeds of retail investors: “Is Meta still a good buy after its recent tumble from the high‑water mark it hit earlier this year?” The piece offers a fairly balanced view, weighing the company’s fundamentals against the backdrop of its sharp price decline, while digging into the macro‑environment, competitive dynamics, and the ongoing evolution of the metaverse strategy that has become Meta’s flagship narrative.

1. The Context: A Sharp Pullback

Price trajectory: The article notes that META’s share price, which had been hovering around $350 after a series of optimistic earnings in early 2025, has now fallen to $260–$270. This roughly 25‑30 % slide has left many investors asking whether the company is over‑valued relative to its own earnings potential.

Underlying cause: The main driver cited is a sluggish advertising market. Meta’s core ad revenue fell 4 % YoY in Q3 2025, a decline attributed to both tighter advertiser budgets amid rising interest rates and increased competition from alternative platforms like TikTok and X (formerly Twitter). The company’s ad‑tech investments have been described as “marginally effective” in the short term but “necessary for long‑term differentiation.”

Other headwinds: The piece also highlights that Meta has been grappling with a $8 billion annual cost‑cutting program that began in 2024, aimed at trimming redundant roles, streamlining its AI research labs, and cutting back on the heavily promoted “Meta Quest” product line. While the program has already reduced operating expenses by about $1.2 billion this fiscal year, analysts note that the transition cost is visible in the quarterly earnings, dampening earnings per share growth.

2. Fundamental Snapshot

| Metric | Q3 2025 | FY 2025 Target |

|---|---|---|

| Revenue | $34.2 billion (‑4 % YoY) | $39 billion |

| Operating margin | 28 % | 32 % |

| Net income | $5.1 billion | $6.5 billion |

| EPS | $8.50 | $10.80 |

| Forward P/E | 18.5x | 16x |

| Dividend | None | None (focus on reinvestment) |

The article emphasizes that Meta’s P/E of 18.5x is still comfortably above its historic average of 22x, suggesting that even after the dip, the stock is not “overpriced” relative to its long‑term earnings trajectory. Analysts who have been following Meta for months argue that the current valuation is “fairly valued” given the company’s “high‑margin, high‑growth, high‑capex” business model.

3. Analyst Sentiment

Several research houses are cited:

Bloomberg Intelligence: Maintains a “Buy” rating, citing a $4‑$5 billion upside in the next 12 months if Meta can deliver on its “AI‑enhanced ad platform” and maintain a 20‑30 % share of the global digital ad spend.

Morningstar: Switches to a “Hold” rating, pointing to the uncertainty around the metaverse’s commercial viability and the risk of “digital fatigue” among users.

Morgan Stanley: Issues a price target of $280 (down from $320) but maintains the “Buy” tag. Their rationale focuses on Meta’s strong cash‑flow generation and the belief that the “AI transformation” will unlock new revenue streams by 2027.

The article quotes a former Meta executive who said that the company is “focused on the long term” and that the current dip is a “natural correction” following the hype cycle of the metaverse.

4. Meta’s Metaverse Pivot

A significant portion of the piece is devoted to the metaverse strategy:

Vision: Meta’s CEO has described the metaverse as “the new operating system,” and the company has invested $20 billion since 2022 in building a “social‑centric virtual reality” ecosystem.

Reality check: Despite the ambition, the article points out that Quest headset sales have plateaued at 2 million units per quarter, while the company’s AR‑device R&D budget has doubled. Investors are skeptical because the consumer adoption curve for VR is still unproven.

AI integration: Meta claims that AI will be the “glue” that stitches the metaverse together—improving avatar realism, facilitating real‑time language translation, and driving content recommendation. Analysts note that while this may enhance user engagement, it’s unclear how it will translate into direct revenue.

Competitive landscape: The article also references competitors, such as Microsoft’s Mesh and Google’s ARCore, which are also exploring immersive tech but have less brand‑centric influence. That said, Apple’s rumored AR glasses could change the market dynamics significantly, potentially putting Meta at a disadvantage if Apple’s hardware dominates the user base.

5. Macro‑Economic Factors

Meta’s performance is intertwined with broader macro conditions:

Interest rates: The article quotes data from the Federal Reserve indicating that rate hikes are continuing to curb inflation. Higher rates translate into higher advertising costs for brands and lower consumer discretionary spending—both adverse to Meta’s ad revenue.

Consumer sentiment: Surveys cited in the piece show that consumer confidence indices are slowly improving, but still below 100 (the neutral level). That uncertainty has caused many advertisers to pause campaigns, contributing to Meta’s revenue slowdown.

Supply chain: The global semiconductor shortage has impacted the manufacturing of Quest and other hardware. Meta’s procurement strategy includes diversified sourcing, but the article notes a short‑term lag in hardware output that might further pressure margins.

6. Risks Highlighted

The article lists several risk factors that could further dent Meta’s valuation:

- Regulatory pressure: Meta faces scrutiny over data privacy, especially in the EU where the Digital Markets Act could impose stricter compliance costs.

- Ad revenue concentration: About 70 % of revenue comes from ads; a shift in advertiser preferences could quickly erode earnings.

- User growth slowdown: While Meta’s daily active users (DAUs) have plateaued at 2.7 billion, growth in new regions has slowed.

- Competitive disruption: Emerging platforms, especially those built on blockchain or decentralized models, could siphon user engagement and ad spend.

7. Bottom Line: Should You Buy Meta?

The article concludes that Meta’s price drop is a “buy opportunity” for investors who are comfortable with a medium‑to‑long‑term hold. Key takeaways include:

- Valuation is now attractive: With a forward P/E of 18.5x and a projected earnings growth of 12–15 % over the next 12 months, the stock sits at a reasonable multiple.

- Long‑term catalysts remain strong: Meta’s AI investments and the potential monetization of the metaverse could deliver significant upside once the ecosystem matures.

- Risk profile is elevated: The company’s heavy reliance on advertising, regulatory uncertainty, and competition for the emerging metaverse space mean that short‑term volatility is expected.

Investors are advised to monitor the next earnings cycle for updates on ad revenue recovery, cost‑cutting milestones, and metaverse milestones (such as the release of new Quest hardware or user engagement metrics). If Meta’s quarterly earnings can reverse the YoY decline and show consistent margin expansion, the stock’s upside could materialize as the article’s “Buy” consensus suggests.

8. Follow‑Up Resources

The 247 Wall Street piece links to several additional sources that readers might consult for deeper dives:

- Meta’s Q3 2025 earnings call transcript (Bloomberg or Investor Relations)

- Morningstar’s detailed report on Meta’s financials

- Wall Street Journal analysis on the metaverse’s viability

- SEC filings for the latest on Meta’s capital expenditures and debt profile

These links provide context for the company’s strategic direction and help investors gauge how Meta’s recent performance aligns with broader market trends.

Final Thought

The article on 247 Wall Street paints a picture of a company that, while experiencing a noticeable price correction, still holds the hallmarks of a high‑growth, high‑margin tech firm. For those willing to ride the long‑term cycle of digital advertising and immersive tech, Meta’s current valuation could be an attractive entry point. As always, investors should balance the optimism of Meta’s AI and metaverse ambitions against the realistic risks of a rapidly changing digital landscape.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/11/24/is-meta-stock-a-buy-after-its-recent-drop-from-glory/ ]