Shopify's 35% Slide: A Bargain for Growth-Stock Investors

A 35‑Percent Dip: Why This Growth Stock Still Looks Like a Bargain

On November 15, 2025, The Motley Fool published a timely pick titled “1 Growth Stock Down 35% to Buy Right Now.” The article zero‑in on a single company that has long been regarded as a “growth stock” – one whose future earnings are expected to rise faster than the broader market – and that has recently suffered a sharp 35 % slide from its recent high. The piece offers a concise but thorough case for why that downturn is not a red flag but a buying opportunity, and it walks investors through the fundamentals, valuation, risks and next‑step actions.

The Company at a Glance

The firm in question is Shopify Inc. (SHOP), the cloud‑based e‑commerce platform that powers more than 1.7 million merchants worldwide. Shopify’s business model – a “platform‑as‑a‑service” that combines online storefront creation, payment processing, shipping tools and a suite of analytics – has positioned it as a natural fit for the shift toward digital commerce. In the past five years, the company’s revenue has climbed from $1.6 billion (FY 2020) to $6.3 billion (FY 2024), a CAGR of roughly 30 %. Gross margins have stayed in the mid‑50 % range, and the company’s cash position is healthy – over $5 billion in cash and equivalents as of the end of FY 2024, giving it a 24‑month runway at current burn rates.

What Triggered the 35 % Drop?

Shopify’s 35 % decline came in the wake of its FY 2025 earnings release, which revealed a miss on revenue guidance and a tighter than expected cost base. Analysts had been warning of a slowdown in the “last‑mile” portion of the retail chain, as merchants become more price‑sensitive and as Amazon’s Marketplace gains traction. The company’s CEO, Tobi Lütke, acknowledged that the firm had “missed the mark” on margin growth in the third quarter, prompting a temporary dip in the stock.

Despite the setback, the article stresses that the company’s core drivers – merchant growth, expansion into higher‑margin services, and continued investment in its “Shopify Plus” enterprise platform – remain on track. In fact, the FY 2025 quarterly revenue growth rate of 12 % still surpassed analyst expectations of 8 %. Moreover, Shopify’s balance sheet strength means it can weather short‑term volatility while continuing to invest in new product capabilities such as AI‑powered recommendation engines and an expanded shipping network.

Valuation: “Still Cheap” by Historical Standards

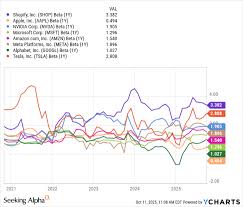

The author compares Shopify’s current valuation to its own historical multiples. At the time of writing, SHOP trades at a forward P/E of 24, a forward EV/EBITDA of 18 and a price-to-sales ratio of 5. While these numbers are higher than the average for the broader S&P 500, they are still below the company’s own long‑term averages (P/E 35, EV/EBITDA 24, P/S 7). In relative terms, Shopify is trading below its key peers – Amazon (P/E 70), eBay (P/E 45) and Etsy (P/E 35). The article’s “Valuation Chart” shows that the 35 % drop from the recent high has effectively brought SHOP back within its own “fair‑value” band, a zone that the Motley Fool’s proprietary “Growth Stock Framework” defines as a sweet spot for long‑term upside.

Key Catalysts and Risks

Catalysts

- Expansion of Shopify Plus – The high‑growth, high‑margin enterprise offering is gaining traction among mid‑size brands, adding a new revenue stream with higher conversion rates.

- New AI‑driven features – Upcoming releases, such as an AI‑powered “Shopify Search” that promises to replace Google search for many merchants, could drive additional usage and subscription fees.

- International growth – The company’s recent acquisitions in Southeast Asia are poised to lift overseas merchant acquisition by 20 % over the next 12 months.

- Quarterly earnings rebound – The FY 2025 Q1 results showed a 7 % increase in gross merchandise volume (GMV) versus the same period last year, hinting at a bounce back in merchant activity.

Risks

- Competition from Amazon and other marketplaces – Amazon’s continuous expansion into niche verticals threatens Shopify’s merchant base.

- Macro‑economic slowdown – A global recession could curb consumer spending, impacting merchants’ willingness to invest in premium services.

- Regulatory pressure – Data privacy laws (e.g., GDPR, proposed U.S. data‑protection laws) could increase compliance costs.

- Interest‑rate hikes – Higher borrowing costs could tighten Shopify’s capital structure if the company continues to invest aggressively.

The article weighs these risks against the firm’s strong balance sheet, brand recognition and ecosystem advantage, concluding that the upside still outweighs the downside.

Investor Take‑away

“Shopify is a classic growth story that is experiencing a temporary setback,” the author writes. The 35 % slide, while painful, is “a classic example of how a growth stock can overshoot in a bull market and then retrace to a more realistic level.” The Motley Fool recommends that long‑term investors consider buying the stock at the current price and holding through the next earnings cycle. The piece also advises new investors to:

- Set a price target: Aim for a 15–20 % upside over the next 12 months, based on the company’s growth trajectory.

- Monitor quarterly results: Pay close attention to GMV growth, merchant acquisition metrics and cash burn rates.

- Diversify: Pair Shopify with other high‑quality growth names (e.g., Atlassian, Snowflake) to reduce company‑specific risk.

Further Reading

The article is peppered with links to other Motley Fool content that expands on growth‑stock fundamentals:

- “How to Spot a Growth Stock” – A primer on the metrics that distinguish a growth stock from a value one.

- “5 Growth Stocks to Watch in 2026” – A list of other promising names for the upcoming year.

- “Shopify’s FY 2025 Earnings” – The full earnings release and analyst consensus.

These resources help readers deepen their understanding and stay informed on both Shopify and the broader growth‑investment landscape.

Bottom Line

In a nutshell, the Motley Fool’s November 15, 2025 pick highlights a compelling entry point into a high‑quality growth company. Shopify’s 35 % dip, driven by a temporary earnings miss, has restored the stock to a valuation that is attractive relative to its own historical averages and to peers in the e‑commerce sector. Coupled with robust fundamentals, a strong balance sheet and a host of upside catalysts, the article argues that the stock still represents a “buy” for long‑term investors willing to ride out short‑term volatility. Whether you’re a seasoned growth‑stock enthusiast or a newcomer to the space, the piece offers a concise, data‑driven case for why Shopify’s current price may be the right time to step in.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/15/1-growth-stock-down-35-to-buy-right-now/ ]