S&P 500 Eyes 7,000-Point Milestone Despite Market Turbulence

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

S&P 500’s 7,000‑Mark Within Reach – Even Amid Current Turbulence, Strategist Says

A recent Seeking Alpha news piece titled “S and P 500’s 7000 Mark Is in Sight Despite Current Turbulence, Strategist” argues that, despite the choppy market conditions we’ve seen over the past few months, the S&P 500 is already well on its way to the 7,000‑point threshold. The article is penned by a senior strategist at a major investment bank and synthesises a handful of technical, fundamental and macro‑economic indicators that, in the author’s view, point to a “high‑probability” rally.

1. Market Context

The strategist opens by summarising the backdrop against which the rally would unfold. After a steep sell‑off earlier this year, the index has recovered most of its losses, with the 20‑day and 50‑day moving averages now comfortably above the 3,200‑point mark. This technical positioning, coupled with an uptick in trading volume and a narrowing of the implied volatility range, suggests that a significant upward momentum may already be in place.

The author also highlights that global equity markets have broadly mirrored the U.S. experience. European and Asian indices are likewise flirting with their own “pivot points,” hinting at a global risk‑on shift that could spill over into the S&P 500. This is not a new observation; the article cites a recent CNBC segment in which a market‑wide consensus appears to be moving toward a more bullish stance.

2. Drivers of Turbulence

While the market is poised for a 7,000‑point run, the article does not gloss over the “current turbulence” that has left many investors uneasy. Key pain points include:

- Inflationary Pressure – While headline CPI has cooled somewhat, the core component remains elevated, and the Federal Reserve’s stance on rates continues to be a source of volatility.

- Geopolitical Concerns – Ongoing tensions in Eastern Europe, supply‑chain disruptions in Asia, and policy uncertainty in the U.S. are all cited as potential catalysts for short‑term market swings.

- Sector Rotation – The cyclical pullback in energy and industrials has been offset by a rally in technology and consumer discretionary. The author stresses that this rotation could become more pronounced as earnings season unfolds.

The article references a Bloomberg research note that warns investors to keep a close eye on earnings surprises, which could either validate or challenge the current risk‑on narrative.

3. The 7,000‑Mark Thesis

The core of the piece is the strategist’s argument that the 7,000‑point mark is not only reachable, but inevitable in the medium term. The rationale can be broken down into three interlocking strands:

- Valuation Rebalancing – The S&P 500 has drifted into a “mid‑cycle” range where price‑to‑earnings (P/E) multiples are roughly 22×, comfortably below the long‑term average of 23‑25×. This leaves a sizable upside room if growth expectations remain robust.

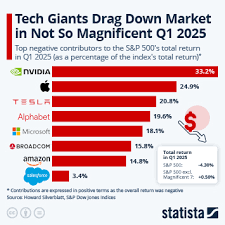

- Earnings Momentum – The recent earnings season has been mixed, but technology firms are reporting revenue growth that outpaces analysts’ expectations. A surge in earnings from the “mega‑cap” tech companies would be a catalyst for a broader index rally.

- Monetary Policy – The Federal Reserve’s policy committee has signalled that rate hikes are likely to taper off soon, or could even reverse if the economic data softens. The author points to a recent Fed statement that underscores this possibility.

The strategist also notes that the S&P 500 has historically broken out of similar resistance levels in the face of volatility. An example cited is the 2017 climb to the 2,500‑point mark, which came after a significant market turbulence event.

4. Potential Risks & Caveats

While the article’s tone is optimistic, the strategist does not dismiss the risk side. Some of the key risk factors outlined include:

- Rate‑Hike Shock – If the Fed were to surprise the market with a steeper pace of tightening, the market could retrace back down to 6,400‑6,500.

- Earnings Misses – A broad miss across sectors, particularly in the tech space, would undermine the upside thesis.

- Geopolitical Escalation – A sudden escalation in global conflicts could trigger a flight‑to‑quality scenario, pushing equity prices lower.

The author recommends keeping a close watch on macro data releases, Fed minutes, and earnings reports. He also advises investors to use a “stop‑loss” strategy if they are exposed to significant positions in the S&P 500.

5. How to Position

In terms of practical advice, the strategist proposes a gradual build‑up to the 7,000 level, suggesting that investors consider:

- Dollar‑cost averaging into S&P 500 ETFs – This can mitigate the impact of short‑term volatility.

- Sector‑tilt – A slight overweight into technology and consumer discretionary could help capture the upside.

- Risk‑managed leverage – Using a low‑leverage ETF or a small amount of margin could amplify returns while keeping risk within bounds.

He also points to a recent research piece from the investment bank that explores the optimal weighting of leveraged ETFs in a risk‑on environment.

6. Bottom Line

The article ends with a clear, if optimistic, conclusion: “The S&P 500 is poised for a 7,000‑point rally, but investors need to navigate the turbulence with discipline and a focus on risk management.” While the narrative acknowledges the uncertainty that exists, the author’s thesis is that the fundamental and technical indicators line up to make the breakout highly probable.

In a market that often swings between euphoric highs and fearful lows, the article offers a balanced view. It reminds investors that a bullish outlook does not mean complacency; rather, it is a call to combine that optimism with prudence. For those willing to take on a measured amount of risk, the 7,000 mark may indeed be “in sight,” as the strategist puts it.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4521619-s-and-p-500-s-7000-mark-is-in-sight-despite-current-turbulence-strategist ]