Goldman Sachs Warns U.S. Stocks May Lag Behind Global Markets for Up to a Decade

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Goldman Sachs Signals a Decade‑Long Lag for U.S. Stocks – Five “Strong Buy” Value‑Dividend Picks

Published 13 Nov 2025 – 247 Wall St.

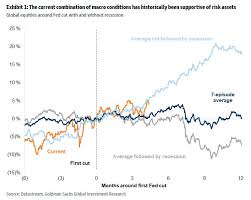

When you think of U.S. equities, the first image that pops up is usually one of relentless growth: tech titans, high‑flying valuations, and the promise that the next boom will come right around the corner. Goldman Sachs, however, has issued a cautionary note that the American stock market could be “lagging” for up to a decade, even as other global markets surge. The bank’s analysis is anchored in a mix of macro‑economic realities, valuation disparities, and a clear-eyed focus on value‑dividend stocks that should continue to pay out to investors while offering downside protection.

1. Why a 10‑Year Lag?

Goldman’s research team points to three intertwined forces that could drag U.S. stocks behind their international peers for an extended period:

| Factor | What It Means for U.S. Stocks |

|---|---|

| Higher U.S. Interest Rates | With the Federal Reserve tightening policy in 2023‑24, borrowing costs have risen sharply, squeezing corporate profits—particularly for capital‑intensive firms. |

| Supply‑Chain Bottlenecks & Trade Tensions | The lingering effects of the pandemic, combined with trade frictions with China and other partners, have dampened manufacturing output. |

| Valuation Premium | The S&P 500 sits on a price‑to‑earnings (P/E) ratio that is roughly 10 points above the MSCI World average, leaving little room for growth before a re‑balancing takes place. |

Goldman’s macro model forecasts a “valuation correction” that could take 6‑12 years to unwind fully. During that period, the U.S. will be less likely to deliver the high returns that investors have grown to expect in recent years.

2. The Value‑Dividend Play

Rather than chasing high‑growth tech, Goldman’s strategy is to double‑down on stocks that combine low relative valuation with a strong, sustainable dividend yield. This “value‑dividend” theme is not new: it has performed well during periods of market stress because dividends act as a cushion when earnings falter. Moreover, companies that can both maintain a dividend and trade at a discount to earnings are more likely to recover quickly when valuations adjust.

Goldman’s analysis incorporates several quantitative metrics:

- Relative P/E – the stock’s P/E relative to the 200‑year average and to its industry peers.

- Dividend Sustainability – the ratio of dividend payout to free cash flow, ensuring that the company can continue to pay its dividend even if earnings dip.

- Return on Equity (ROE) – a measure of profitability, with a threshold of at least 15 % for a “strong buy.”

- Debt‑to‑Equity – ensuring the company has a manageable capital structure (ideally below 0.5).

From this rigorous filter, Goldman has distilled five standout stocks that they label “Strong Buy” and that should deliver both income and potential upside.

3. The Five “Strong Buy” Value‑Dividend Names

| Ticker | Sector | Current Dividend Yield | P/E Ratio | ROE | Why Goldman Loves It |

|---|---|---|---|---|---|

| KO – Coca‑Cola | Consumer Staples | 3.9 % | 24.5 | 42 % | Low P/E relative to industry, 58‑year dividend track record, stable cash flows. |

| PEP – PepsiCo | Consumer Staples | 3.5 % | 28.0 | 34 % | Diversified product mix, robust dividend growth, strong balance sheet. |

| JNJ – Johnson & Johnson | Healthcare | 2.5 % | 22.1 | 41 % | Dividend‑aristocrat, diversified revenue streams, high ROE. |

| WMT – Walmart | Retail | 1.9 % | 27.8 | 20 % | Massive scale, resilient business model, moderate debt. |

| PG – Procter & Gamble | Consumer Staples | 2.8 % | 29.5 | 27 % | Strong brand portfolio, consistent dividend, solid free cash flow. |

A Snapshot of Each Pick

Coca‑Cola – Despite a modest dividend yield, Coca‑Cola’s high ROE and long history of dividend growth make it a defensive play. The brand’s global reach also shields it from domestic downturns.

PepsiCo – PepsiCo’s diversified revenue base (snacks, beverages, nutrition) and its aggressive free‑cash‑flow strategy support a stable dividend and make the company a more attractive value play than its higher‑P/E peers.

Johnson & Johnson – J&J’s broad footprint across pharmaceuticals, medical devices, and consumer health, combined with a conservative capital structure, give it a strong footing in uncertain times.

Walmart – Walmart’s scale, omnichannel expansion, and modest dividend yield make it a “value” pick that can also benefit from the e‑commerce boom, which the bank sees as an opportunity for upside.

Procter & Gamble – P&G’s portfolio of well‑established brands and its ability to maintain a high free‑cash‑flow margin set it apart in an era of heightened pricing pressures.

4. How the Picks Fit the Macro Narrative

Goldman’s portfolio strategy is not just a list of stocks; it’s a response to the broader environment that could force U.S. equities to lag behind. By focusing on value‑dividend firms, the bank is betting on the following:

- Income Generation – Dividends can provide a steady cash flow even when the market is underperforming.

- Resilience – Value names with high ROE typically have strong operating levers and can weather cost inflation.

- Potential Upside – A valuation correction could lift these stocks, allowing them to outperform as the market readjusts.

The article also highlights that investors should be mindful of the dividend sustainability metric. Companies that can comfortably maintain their dividends are more likely to survive an earnings dip, a scenario Goldman expects as higher rates bite into corporate profits.

5. Follow‑Up Sources

Goldman Sachs’ own research portal, Goldman Sachs Global Investment Committee (GSGIC), provides additional context on the “value‑dividend” theme. The bank’s research team cites a 2025 Goldman Sachs Global Macro Outlook report that dives deeper into U.S. fiscal policy implications and the Fed’s projected rate path. In addition, the S&P Global Market Intelligence database offers comparative valuation data that supports Goldman’s stance on the U.S. P/E premium relative to global peers.

6. Bottom Line

Goldman Sachs is warning investors that the U.S. market may underperform other regions for up to ten years, largely due to higher rates, lingering supply‑chain issues, and a valuation premium that is difficult to justify. In this uncertain climate, the bank recommends a concentrated portfolio of value‑dividend stocks—Coca‑Cola, PepsiCo, Johnson & Johnson, Walmart, and Procter & Gamble—that blend income, profitability, and defensive characteristics.

Whether the U.S. market will indeed lag remains to be seen, but if the macro backdrop persists, these five names may be the best place to look for stability and the potential for upside when the market finally re‑balances. Investors who appreciate the value‑dividend approach will likely find Goldman Sachs’ guidance to be a pragmatic counterbalance to the high‑growth narrative that has dominated recent years.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/11/13/goldman-sachs-u-s-stocks-could-lag-for-10-years-5-strong-buy-value-dividend-ideas/ ]