Want to Invest Like Warren Buffett? Remember These 2 Words. | The Motley Fool

How to Invest Like Warren Buffett: Key Lessons From The Oracle of Omaha

Warren Buffett, the legendary investor behind Berkshire Hathaway, has long been revered for turning a modest partnership into a multi‑trillion‑dollar behemoth. Yet, his success does not stem from some mysterious algorithm or secret stock‑picking software. It comes from a set of time‑tested principles that are accessible to anyone willing to adopt a disciplined, long‑term mindset. A recent analysis on The Motley Fool distills these principles into a concise playbook for investors who want to emulate Buffett’s style without becoming a Buffett replica. Below is a 500‑plus‑word summary of the key takeaways, organized by the core themes the article highlights.

1. Know the Business You’re Buying

Buffett’s first rule is deceptively simple: invest in companies you understand. He famously described his investment universe as “the businesses that produce great products or services, and that have a durable competitive advantage.” In practice, this means researching the company’s products, market dynamics, and growth prospects before committing any capital. The article underscores that the modern investor must go beyond the headlines and dig into earnings reports, balance sheets, and industry analysis to see whether the business truly delivers value to customers.

2. Look for Durable Competitive Advantages

Buffett refers to this “moat” concept as the ability of a firm to sustain its profits and earnings growth over time. Companies with high brand recognition, proprietary technology, cost leadership, or network effects typically have a wider moat. The Fool’s article explains that investors should evaluate a firm’s return on equity (ROE) and free cash flow as proxies for competitive strength. It also cautions against chasing hype‑driven growth at the expense of a proven moat, reminding readers that the best returns come from businesses that can fend off competition indefinitely.

3. Focus on Quality, Not Just Value

A common misconception is that Buffett is a pure value investor, but the article argues that quality is the most important component of his strategy. While a low price‑to‑earnings (P/E) ratio is attractive, Buffett also scrutinizes the company’s earnings stability, management integrity, and capital allocation. The Fool article recommends assessing a firm’s price‑to‑book (P/B) ratio, dividend history, and debt levels to gauge quality. Buffett famously avoided companies with high debt or unstable earnings; the same approach applies today.

4. Price Matters, But Don’t Price‑Shop Entirely

Buffett’s “margin of safety” philosophy is a balancing act between buying quality at a bargain and overpaying for mediocre companies. The article explains that the discounted cash flow (DCF) model is a useful tool for estimating intrinsic value, but it’s equally important to watch the market price relative to fundamentals. Buffett often bought shares at a 20–30 % discount to intrinsic value, and the Fool piece suggests that this threshold can be a useful guideline for retail investors.

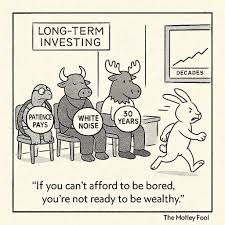

5. Keep a Long‑Term Horizon

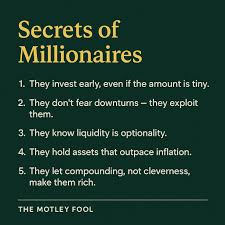

Time is Buffett’s greatest ally. The article emphasizes that his portfolio rarely changes, except when a company’s fundamentals deteriorate or a better opportunity arises. This approach demands patience, especially during volatile markets. The Fool’s analysis notes that the best returns come from holding top‑quality stocks for at least 10–20 years, allowing compounding to play out fully.

6. Avoid Leverage and Over‑Diversification

Buffett warns against excessive debt and “over‑diversification,” which can dilute returns. The article cites his own practice of investing in only a handful of outstanding companies—often a single stock or a few key holdings. For the average investor, the takeaway is to build a focused portfolio of a handful of well‑researched stocks rather than chasing every market trend. It also stresses maintaining a healthy balance of cash to seize opportunities when the market dips.

7. Let Management Lead

Management quality is a recurring theme in Buffett’s letters. The article reminds readers to evaluate a firm’s leadership, specifically their track record in capital allocation—how they reinvest earnings, buy back shares, or pay dividends. Buffett’s preference for “management that can’t be bettered” is a timeless principle that helps investors avoid costly mistakes.

8. Ignore Market Timing

The Fool’s piece stresses that Buffett’s success is not a result of “timing” the market. Instead, he focuses on buying when a stock is undervalued relative to its intrinsic worth. The article encourages investors to resist the urge to chase short‑term price swings, pointing out that trying to time the market often results in missed opportunities and higher transaction costs.

9. Use Tax‑Advantaged Accounts Wisely

While Buffett’s wealth is largely tax‑free thanks to his 50 % ownership of Berkshire Hathaway, the article notes that individual investors can mimic his long‑term approach by using tax‑advantaged accounts (IRA, Roth IRA, 401(k)). These vehicles allow compounding to thrive without the drag of capital gains taxes, aligning with Buffett’s philosophy of maximizing after‑tax returns.

10. Stay Humble and Continuous Learners

Finally, the article captures Buffett’s famed humility and intellectual curiosity. He has repeatedly admitted that he can be wrong and stresses the importance of continuous learning. For retail investors, this translates into a mindset of ongoing education—reading annual reports, studying market dynamics, and remaining open to adjusting one’s thesis when new information emerges.

Putting the Rules Into Action

The article concludes by outlining a simple, step‑by‑step framework for applying these rules:

- Define your “investing universe”—a set of industries you understand well.

- Screen for quality using ROE, free cash flow, debt ratios, and dividend history.

- Assess moat strength by reviewing competitive advantages and market share trends.

- Calculate intrinsic value via a conservative DCF or comparable valuation multiples.

- Set a price‑to‑intrinsic‑value target (20–30 % discount).

- Build a concentrated portfolio of 5–10 high‑confidence picks.

- Hold for the long term, only rebalancing when fundamentals shift.

By following this disciplined playbook, investors can adopt the same principles that propelled Warren Buffett’s legendary track record. The Fool’s article, while concise, offers a comprehensive roadmap that demystifies Buffett’s strategy and makes it attainable for anyone willing to apply thoughtful analysis, patience, and humility to their investing journey.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/01/want-to-invest-like-warren-buffett-remember-these/ ]