Are We Looking At A Market Meltdown?

Attempting to fetch the article content.Are We Looking at a Market Meltdown? – A Comprehensive Summary

The Seeking Alpha piece titled “Are We Looking at a Market Meltdown” opens with a sobering look at the confluence of macro‑economic signals that could presage a severe downturn in U.S. equity markets. The author frames the discussion around three core themes: the persistence of inflation, the Federal Reserve’s aggressive tightening stance, and the fragility of corporate earnings in the face of rising borrowing costs.

Yield Curve Inversion and Interest‑Rate Dynamics

A key driver in the article is the inverted U.S. Treasury yield curve, which has been in place since the early months of 2023. The 2‑year/10‑year spread reached an all‑time high of 130 basis points, a level historically associated with imminent recessions and equity sell‑offs. The piece references the Treasury Department’s daily yield data and charts the upward trend in 2‑year yields versus the stagnation of longer‑term rates. By linking to the official Treasury website, the author lets readers see the real‑time graph of the spread, underscoring its acceleration.Fed’s Tightening Cycle and Inflation Outlook

The article explains how the Fed’s rapid series of rate hikes—six consecutive 25‑basis‑point increases followed by a 50‑basis‑point jump—has pushed the federal funds target range into the 4.75–5.00 % band. The author cites the Federal Open Market Committee (FOMC) meeting minutes to show that officials remain “highly concerned” about headline inflation still above the 2 % target. Even after the most recent 25‑basis‑point hike, the Fed’s projections still expect inflation to remain above target through 2025, which the author interprets as a signal that the economy may be over‑heated.Corporate Earnings Vulnerability

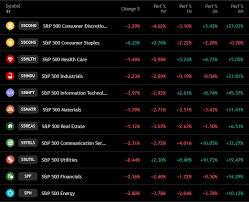

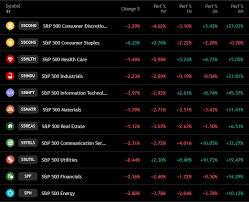

Corporate profitability is highlighted as the third pillar of the risk narrative. The author references earnings season data from the S&P 500, noting that many companies are trimming growth guidance as cost‑of‑capital pressures mount. A link to the S&P Global Earnings Release page reveals that only 4 out of 10 major indices beat analyst consensus in Q4 2023, a sharp decline from the 60 % beat rate seen in 2022. This erosion of earnings optimism, the article argues, could erode investor confidence and trigger a wave of sell‑offs.Risk Appetite and Market Sentiment

The piece dives into the technical side of market behavior, noting the sharp rise in the CBOE Volatility Index (VIX). At the time of writing, the VIX touched a 13‑month high of 20.6, indicating heightened fear among traders. The author links to the CBOE website where a live VIX chart can be viewed, allowing readers to see the spike in real time. The article also discusses the equity risk premium, which has widened to 4.3 % from the 3.6 % seen in 2022, suggesting that investors are demanding more compensation for holding risky assets.Potential Triggers and Bottom‑Line Risks

The article concludes by mapping out several technical and fundamental triggers that could ignite a market crash. These include: A sharp decline in the S&P 500 below the 4,200 level, breaking a 12‑month high. A sudden reversal of the yield curve, with the 10‑year rate falling below the 2‑year rate by 200 basis points. A rapid widening of corporate credit spreads beyond 100 basis points. An unexpected increase in inflation or a surprise Fed rate hike.By linking to the Bloomberg Markets page, the author provides a dashboard of real‑time data on these indicators, enabling readers to monitor the situation as it evolves.

Bottom‑Line Takeaway

The Seeking Alpha article paints a picture of a market in a precarious state. With inflation stubbornly high, the Fed’s tightening cycle still in full swing, corporate earnings under pressure, and risk sentiment at historic lows, the probability of a significant market downturn appears higher than in recent years. While a definitive “meltdown” cannot be predicted with certainty, the convergence of these warning signs warrants caution from investors, as the author advises a more defensive stance and a re‑evaluation of exposure to high‑beta equities.

Overall, the article serves as a timely warning that blends macro‑economic data, policy analysis, and technical market indicators into a cohesive narrative that helps readers understand the risks of a potential market collapse.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4829523-are-we-looking-at-a-market-meltdown ]