GENova Biotherapeutics (GVBP) SqueezeTrigger Price is $0.43. Approximately 57 Million Shares Shorted Since July 2009 According

September 17, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, is initiating coverage of GENova Biotherapeutics (OTCBB: GVBP) after releasing the latest short sale data to September 2009. From July 2009 to September 2009 approximately 382 million total aggregate shares of GVBP have traded for a total dollar value of approximately $166 million. The total aggregate number of shares shorted in this time period is approximately 57 million shares. The GVBP SqueezeTrigger price of $0.43 is the volume weighted average short price of all short selling in GVBP. A series of short squeezes has begun as shares of GVBP have jumped from $0.06 to a high of $1.18 and 62% of all shares shorted in GVBP are now out-of-the-money. To access SqueezeTrigger Prices ahead of potential short squeezes beginning, visit http://www.buyins.net.

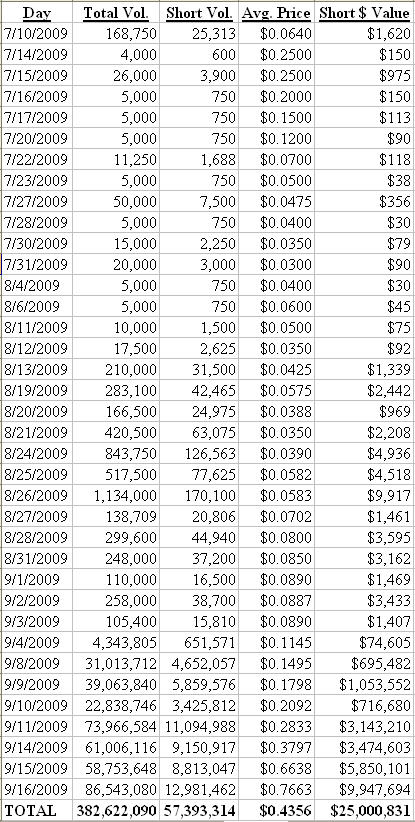

Day Total Vol. Short Vol. Avg. Price Short $ Value

7/10/2009 168,750 25,313 $0.0640 $1,620

7/14/2009 4,000 600 $0.2500 $150

7/15/2009 26,000 3,900 $0.2500 $975

7/16/2009 5,000 750 $0.2000 $150

7/17/2009 5,000 750 $0.1500 $113

7/20/2009 5,000 750 $0.1200 $90

7/22/2009 11,250 1,688 $0.0700 $118

7/23/2009 5,000 750 $0.0500 $38

7/27/2009 50,000 7,500 $0.0475 $356

7/28/2009 5,000 750 $0.0400 $30

7/30/2009 15,000 2,250 $0.0350 $79

7/31/2009 20,000 3,000 $0.0300 $90

8/4/2009 5,000 750 $0.0400 $30

8/6/2009 5,000 750 $0.0600 $45

8/11/2009 10,000 1,500 $0.0500 $75

8/12/2009 17,500 2,625 $0.0350 $92

8/13/2009 210,000 31,500 $0.0425 $1,339

8/19/2009 283,100 42,465 $0.0575 $2,442

8/20/2009 166,500 24,975 $0.0388 $969

8/21/2009 420,500 63,075 $0.0350 $2,208

8/24/2009 843,750 126,563 $0.0390 $4,936

8/25/2009 517,500 77,625 $0.0582 $4,518

8/26/2009 1,134,000 170,100 $0.0583 $9,917

8/27/2009 138,709 20,806 $0.0702 $1,461

8/28/2009 299,600 44,940 $0.0800 $3,595

8/31/2009 248,000 37,200 $0.0850 $3,162

9/1/2009 110,000 16,500 $0.0890 $1,469

9/2/2009 258,000 38,700 $0.0887 $3,433

9/3/2009 105,400 15,810 $0.0890 $1,407

9/4/2009 4,343,805 651,571 $0.1145 $74,605

9/8/2009 31,013,712 4,652,057 $0.1495 $695,482

9/9/2009 39,063,840 5,859,576 $0.1798 $1,053,552

9/10/2009 22,838,746 3,425,812 $0.2092 $716,680

9/11/2009 73,966,584 11,094,988 $0.2833 $3,143,210

9/14/2009 61,006,116 9,150,917 $0.3797 $3,474,603

9/15/2009 58,753,648 8,813,047 $0.6638 $5,850,101

9/16/2009 86,543,080 12,981,462 $0.7663 $9,947,694

TOTAL 382,622,090 57,393,314 $0.4356 $25,000,831

*short volume is approximated using a proprietary algorithm. **average short price is calculated using a volume weighted average short price. ***short volume is the total short trade volume and does not account for covers.

Click here to view chart:

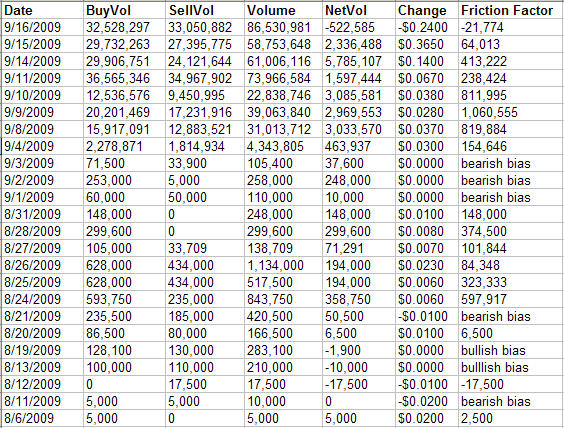

Market Maker Friction Factor is shown in the chart below:

Date BuyVol SellVol Volume NetVol Change Friction Factor

9/16/2009 32,528,297 33,050,882 86,530,981 -522,585 -$0.2400 -21,774

9/15/2009 29,732,263 27,395,775 58,753,648 2,336,488 $0.3650 64,013

9/14/2009 29,906,751 24,121,644 61,006,116 5,785,107 $0.1400 413,222

9/11/2009 36,565,346 34,967,902 73,966,584 1,597,444 $0.0670 238,424

9/10/2009 12,536,576 9,450,995 22,838,746 3,085,581 $0.0380 811,995

9/9/2009 20,201,469 17,231,916 39,063,840 2,969,553 $0.0280 1,060,555

9/8/2009 15,917,091 12,883,521 31,013,712 3,033,570 $0.0370 819,884

9/4/2009 2,278,871 1,814,934 4,343,805 463,937 $0.0300 154,646

9/3/2009 71,500 33,900 105,400 37,600 $0.0000 bearish bias

9/2/2009 253,000 5,000 258,000 248,000 $0.0000 bearish bias

9/1/2009 60,000 50,000 110,000 10,000 $0.0000 bearish bias

8/31/2009 148,000 0 248,000 148,000 $0.0100 148,000

8/28/2009 299,600 0 299,600 299,600 $0.0080 374,500

8/27/2009 105,000 33,709 138,709 71,291 $0.0070 101,844

8/26/2009 628,000 434,000 1,134,000 194,000 $0.0230 84,348

8/25/2009 628,000 434,000 517,500 194,000 $0.0060 323,333

8/24/2009 593,750 235,000 843,750 358,750 $0.0060 597,917

8/21/2009 235,500 185,000 420,500 50,500 -$0.0100 bearish bias

8/20/2009 86,500 80,000 166,500 6,500 $0.0100 6,500

8/19/2009 128,100 130,000 283,100 -1,900 $0.0000 bullish bias

8/13/2009 100,000 110,000 210,000 -10,000 $0.0000 bullish bias

8/12/2009 0 17,500 17,500 -17,500 -$0.0100 -17,500

8/11/2009 5,000 5,000 10,000 0 -$0.0200 bearish bias

8/6/2009 5,000 0 5,000 5,000 $0.0200 2,500

Click here to view chart:

Analysis of the Friction Factor chart above shows that in the trading days preceding this report that market makers have been making a positively biased market (70% bullish and 30% bearish bias to trading) in shares of GVBP. The Friction Factor displays how many more shares of buying than selling are required to move GVBP higher by one cent or how many more shares of selling than buying moves GVBP lower by 1 cent.

The chart below shows the broker dealers acting as market makers in shares of GVBP through August 2009.

Rank Market Maker Volume thru August Percent of Volume

1 Knight Equity Markets, L.P. 1,211,059 27%

2 Hudson Securities, Inc. 1,200,750 27%

3 Noble International Invest. 782,500 17%

4 Sterne, Agee & Leach, Inc. 688,000 15%

5 Domestic Securities, Inc. 238,100 5%

6 Automated Trading Desk 180,000 4%

7 R. F. Lafferty & Co., Inc. 25,000 <1%

8 Burt Martin Arnold Securities 20,000 <1%

9 Natexis Bleichroeder Inc. 5,000 <1%

Click here to view chart:

Short sellers and the broker dealers accepting their short sale orders will be monitored daily for compliance with the new Reg SHO requirements. In late October 2008 the SEC updated Regulation SHO requiring that all short sellers must locate, borrow and deliver any shares they have shorted, no exceptions, by T+3 settlement date. If not, a buy-in must be forced by the broker dealer that the short seller transacted through by the opening of the market on T+4. Since a company first appears on the naked short list when short sellers have been failing to deliver for 5 consecutive trading days, GVBP should theoretically never be on the naked short list. BUYINS.NET will monitor the OTCBB naked short list daily and issue an alert and notify the SEC and FINRA should short sellers fail to deliver and GVBP appears on the exchangea�s Threshold Security List.

About GENova Biotherapeutics

GENova is positioning itself as the world's leading bioscience company in the development and commercial licensing of novel therapeutic proteins that disrupt the advance of life-threatening cancers. The company leverages cutting-edge research collaborations to achieve breakthroughs in anti-cancer treatments, and then licenses these drug product candidates to Big Pharmaceutical and Biotechnology companies such as Pfizer, Amgen, Myriad Genetics, Medarex, and Biogen Idec.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,650,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each montha�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. A third party has paid $995 per month to purchase data for information provided in twelve monthly reports. The data service can be cancelled at any time. The third party or its affiliates own shares of GVBP and can benefit from a rise in the share price. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor. By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State. Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net