Russell 2000 Surges, Outperforming Nasdaq 100

Locales:

The Numbers Tell a Story

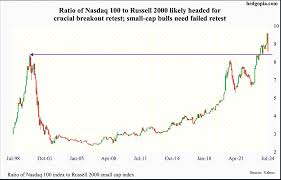

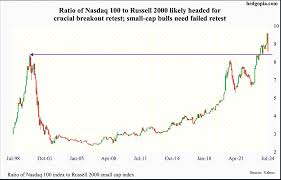

As of February 21, 2026, the Russell 2000 has delivered an impressive 18.8% return over the last 12 months. This significantly outpaces the 13.8% gain recorded by the Nasdaq 100 during the same period. While it's crucial to acknowledge the Nasdaq 100's historical dominance - boasting a remarkable 152.8% five-year return compared to the Russell 2000's 39.7% - the recent reversal is undeniable. This isn't simply a statistical anomaly; it suggests a fundamental shift in investor sentiment and market dynamics.

Decoding the Shift: Beyond the Headline Numbers

Several converging factors are contributing to this unexpected outperformance. The most prominent is a noticeable rotation away from high-growth technology stocks. For much of the past decade, investors have been willing to pay a premium for future earnings potential, fueling the valuations of tech companies. However, concerns about slowing growth, increased competition, and the potential for higher interest rates have led to a re-evaluation of these investments.

Investors are now increasingly prioritizing value - seeking companies that are currently undervalued relative to their fundamentals. Small-cap companies, often overlooked during extended bull markets, frequently present this type of opportunity. They are frequently less covered by analysts, allowing for potential undiscovered gems. Furthermore, smaller companies often have greater potential for rapid growth if economic conditions improve - a key factor in the current investment climate.

The Interest Rate and Economic Cycle Connection

The Russell 2000's sensitivity to macroeconomic factors is another critical piece of the puzzle. Small-cap companies are typically more vulnerable to changes in interest rates and the overall economic cycle than their large-cap counterparts. Higher interest rates increase borrowing costs, impacting their ability to invest and expand. However, this also means they are poised to benefit more significantly when interest rates stabilize or begin to fall. Currently, the Federal Reserve's monetary policy is a key driver; any signals regarding future rate cuts can disproportionately benefit small-cap stocks.

Consumer spending is also a vital component. Small-cap companies often cater to more localized markets and are more directly impacted by consumer discretionary spending. A strengthening economy and increased consumer confidence translate directly into higher revenues for these businesses. The recent positive trends in consumer spending, despite ongoing inflationary pressures, are undoubtedly supporting the Russell 2000's performance.

Is This a Broadening of Market Leadership?

The question now is whether this outperformance is a temporary blip or the beginning of a more sustained trend. While the Nasdaq 100 is still a fundamentally strong index, the Russell 2000's recent gains could signal a broadening of market leadership. This means that investors are beginning to look beyond the usual suspects and explore opportunities in a wider range of companies.

This shift may also indicate a potential market correction. Extended periods of dominance by a single sector, like technology, are often followed by a rebalancing. Investors may be taking profits from their tech holdings and reallocating capital to other areas of the market, contributing to the Russell 2000's rise. Diversification is a cornerstone of sound investment strategy, and a broader market rally, driven by small-cap gains, could benefit overall portfolio performance.

What to Watch in the Coming Months

The next few months will be crucial in determining the trajectory of this trend. Key indicators to watch include: economic growth data, inflation reports, Federal Reserve policy announcements, and corporate earnings releases from both large-cap and small-cap companies. A continued improvement in economic conditions and a more dovish stance from the Federal Reserve would likely further support the Russell 2000's momentum. Conversely, a slowdown in economic growth or a hawkish turn from the Fed could dampen its prospects.

Investors should carefully consider their risk tolerance and investment goals when making allocation decisions. While the Russell 2000 offers potential for higher returns, it also carries greater volatility than the Nasdaq 100. A well-diversified portfolio that includes both large-cap and small-cap stocks is often the most prudent approach in a changing market environment.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4548929-small-caps-steal-the-lead-russell-2000-quietly-outruns-nasdaq-100-over-the-past-year ]