Carnival to Acquire Carnival China, Simplifying Corporate Structure

Locales: UNITED STATES, UNITED KINGDOM, NETHERLANDS

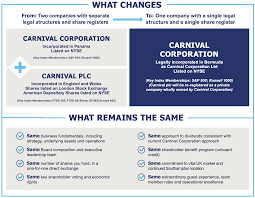

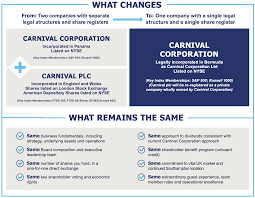

MIAMI/HONG KONG - February 21st, 2026 - Carnival Corporation, the world's largest cruise line operator, is poised to simplify its corporate structure with the full acquisition of its Hong Kong-listed subsidiary, Carnival China. The deal, announced yesterday, will dissolve the dual-listing arrangement that has been in place since 2007, bringing Carnival China fully under the umbrella of its parent company.

The move signals a strategic shift for Carnival, aiming to enhance operational efficiency, reduce complexities, and improve access to capital markets, particularly as the cruise industry continues to navigate the evolving landscape of global travel and economic conditions. For nearly two decades, the dual-listing on both the Hong Kong and New York Stock Exchanges presented administrative burdens and financial costs that are no longer deemed justifiable.

"This unification will simplify our corporate structure, enhance transparency and improve our access to both U.S. and Asian capital markets," stated Carnival Corporation CEO Josh Weinstein. The statement underscores the key drivers behind the decision - a desire for greater financial agility and a more streamlined approach to managing the company's global assets.

The original dual-listing was established to capitalize on the rapidly growing Asian cruise market, particularly in China. In 2007, Carnival saw significant potential in catering to the burgeoning middle class and increasing demand for leisure travel within the region. The Hong Kong listing allowed the company to raise capital specifically targeted at expanding its presence in Asia and tailoring cruise experiences to Asian preferences. A subsequent listing on the NYSE in 2011 further broadened the investor base.

However, several factors contributed to the shift in strategy. While the Asian cruise market remains important, its growth has been subject to fluctuations, impacted by geopolitical events, economic slowdowns, and, more recently, the pandemic. Maintaining two separate listings, each with its own regulatory requirements and reporting obligations, became increasingly expensive and inefficient. The complexity also hindered the free flow of capital and strategic decision-making.

Analysts predict the consolidation will unlock value for shareholders by streamlining overhead costs and allowing Carnival to allocate resources more effectively. A unified structure will also facilitate better coordination between Carnival's global brands - including Carnival Cruise Line, Princess Cruises, Holland America Line, and others - and its Asian operations. This synergy is expected to enhance the company's ability to respond to market changes and deliver consistent financial performance.

While the precise details of the acquisition remain subject to regulatory approvals, the expected completion timeframe is the latter half of 2026. The deal is anticipated to involve a share exchange or cash transaction, with Carnival Corporation acquiring all outstanding shares of Carnival China. The stock of Carnival China closed down 1.4% on Wednesday following the announcement, indicating investor reaction to the news. Some analysts suggest this dip may reflect uncertainty about the immediate impact on minority shareholders.

The move also has implications for the broader cruise industry. Competitors like Royal Caribbean Group and Norwegian Cruise Line Holdings are closely watching Carnival's strategy. A successful consolidation could set a precedent for other cruise lines seeking to simplify their operations and improve profitability in a competitive market. The focus will likely remain on maximizing returns in key markets, building brand loyalty, and embracing technological innovations to enhance the passenger experience.

Looking ahead, Carnival Corporation appears to be focused on solidifying its position as a global leader in the cruise industry. The unification of Carnival China is a clear indication of this ambition, signaling a commitment to operational efficiency, strategic growth, and long-term shareholder value.

Read the Full reuters.com Article at:

[ https://www.reuters.com/business/cruise-operator-carnival-unify-dual-listing-2026-02-20/ ]