Coreweave Soars: 65% Year-Over-Year Revenue Growth

Locales: UNITED STATES, ISRAEL

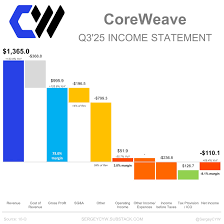

A Quarter of Exceptional Growth

The numbers tell a compelling story of rapid expansion. Coreweave reported revenue of $250 million, representing an impressive 65% year-over-year increase. This demonstrates a substantial acceleration compared to previous quarters, highlighting the company's ability to capture a significant portion of the rapidly expanding cloud market. Perhaps even more impressively, the company's earnings per share (EPS) landed at $0.15, blowing past the consensus estimate of just $0.08. This substantial beat indicates not only revenue growth but also improved operational efficiency and profitability, a key factor appealing to long-term investors. The first-quarter 2026 revenue guidance, projecting figures between $280 million and $300 million, further solidified investor confidence.

The AI Catalyst: Powering the Next Generation of Workloads

Coreweave's success isn't occurring in a vacuum. The core driver behind this impressive growth is the burgeoning demand for cloud infrastructure, specifically tailored for Artificial Intelligence (AI) and Machine Learning (ML) workloads. Businesses are increasingly reliant on AI for everything from streamlining operations and automating processes to developing innovative products and services. These AI applications demand significant computational power and storage capacity, creating a fertile ground for Coreweave's specialized platform.

What distinguishes Coreweave isn't just the provision of cloud resources, but its ability to optimize these resources for AI applications. The company's platform enables clients to efficiently scale their compute and storage needs, a critical function for businesses experimenting with and deploying resource-intensive generative AI models, like large language models (LLMs) that power advanced chatbots and image generators. The exponential growth in the adoption of these generative AI models has directly translated into increased demand for Coreweave's services.

Analyst Perspective: A Premium Justified

The enthusiasm surrounding Coreweave isn't limited to retail investors. Financial analysts are largely positive on the company's prospects, recognizing its strong position within a high-growth market. Many see Coreweave as a key enabler of the AI revolution, and believe the company is poised to capitalize on the continued expansion of the cloud market, particularly as AI adoption continues its steep ascent.

While acknowledging that Coreweave's stock isn't trading at a 'cheap' valuation, analysts argue that the company's exceptional growth rate, coupled with attractive profit margins, justifies the premium. The company's ability to consistently outperform expectations and demonstrate operational leverage suggests that the current valuation has the potential to appreciate further.

Looking Ahead: Sustaining the Momentum

The immediate reaction to Coreweave's earnings report has been overwhelmingly positive, but the question remains: can the company sustain this momentum? Future success hinges on several factors, including continued innovation within its platform, successful expansion into new geographies and industries, and the ability to navigate potential competitive pressures as other cloud providers seek to expand their AI offerings. Maintaining strong relationships with key AI developers and staying ahead of the curve in terms of infrastructure optimization will be crucial. The company's Q1 2026 guidance offers a promising glimpse into the near future, but investors will be closely watching to see if Coreweave can deliver on its ambitious projections and continue to be a driving force in the cloud and AI landscape.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/26/why-coreweave-stock-is-up-today/ ]