AMD, Enphase, Amazon: Stocks Poised for Growth

Locales: California, Texas, Washington, Massachusetts, UNITED STATES

Monday, February 16th, 2026 - The Motley Fool's consistent advice centers around patient, long-term investing. Identifying companies with durable competitive advantages remains the cornerstone of building wealth, and recent analysis points to a select few poised for significant growth - potentially even doubling in value. However, simply identifying stocks with potential isn't enough. Investors need to understand why these companies are positioned for success, the broader market forces at play, and the inherent risks involved.

This article expands on recent recommendations, specifically focusing on Advanced Micro Devices (AMD), Enphase Energy (ENPH), and Amazon (AMZN), examining not just their current strengths but also the evolving landscapes they operate within. We'll explore how these companies are leveraging key technological and societal shifts, and what challenges they may face in sustaining their growth trajectories.

Advanced Micro Devices (AMD): The Semiconductor Powerhouse

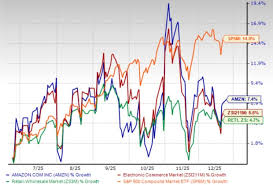

AMD's impressive performance over the past few years hasn't been a fluke. Their resurgence stems from a strategic focus on high-performance computing - specifically, CPUs and GPUs. While they've been steadily chipping away at Intel's dominance in the CPU market, their GPUs have become increasingly competitive with Nvidia, particularly in the gaming and data center spaces. This competition is driving innovation and, importantly, lowering costs for consumers and businesses alike.

However, the semiconductor industry is notoriously cyclical. Supply chain disruptions, geopolitical tensions (particularly regarding Taiwan Semiconductor Manufacturing Company, AMD's primary manufacturing partner), and increasing capital expenditure requirements pose ongoing risks. Despite these challenges, AMD's commitment to R&D, coupled with its diversification into areas like data center accelerators and embedded systems, suggests a continued ability to adapt and maintain its competitive edge. The increasing demand for AI processing will further fuel demand for advanced GPUs, and AMD is well-positioned to capitalize on this trend. Recent reports indicate AMD is heavily investing in chiplet technology, allowing for greater flexibility and scalability in chip design, which could solidify their position against competitors.

Enphase Energy (ENPH): Riding the Renewable Energy Wave

Enphase Energy has become synonymous with microinverter technology in the solar energy sector. Microinverters, unlike traditional string inverters, optimize energy production at the panel level, increasing efficiency and reliability. This is crucial as residential and commercial solar installations become increasingly prevalent. The company's integrated systems, including storage solutions, provide a complete energy management package, attracting a growing customer base.

The global push toward decarbonization and the increasing cost of traditional energy sources are driving significant growth in the renewable energy sector. Enphase is not just benefiting from this trend, they are actively shaping it. However, the company faces competition from larger, established energy players and from companies developing alternative solar technologies. Furthermore, changes in government subsidies and energy policies could significantly impact the demand for solar installations. Enphase's recent expansion into energy management software and electric vehicle charging solutions demonstrates an attempt to diversify and mitigate these risks.

Amazon (AMZN): Beyond E-commerce - The Everything Store & Cloud Leader

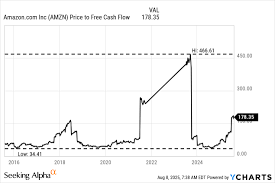

Amazon's dominance in e-commerce is well-documented, but the company is far more than just an online retailer. Amazon Web Services (AWS) remains the undisputed leader in cloud computing, providing infrastructure and services to businesses of all sizes. The Prime membership program continues to drive customer loyalty and generate recurring revenue.

Looking ahead, Amazon's investments in artificial intelligence, robotics, and healthcare represent ambitious attempts to expand into new growth areas. Their logistical network, honed over decades of fulfilling millions of orders daily, is a significant competitive advantage. However, increased regulatory scrutiny regarding antitrust concerns and data privacy, coupled with rising labor costs and potential economic slowdowns, present challenges. The company is also facing increased competition in the cloud computing space from Microsoft Azure and Google Cloud. Amazon's success will depend on its ability to continue innovating and adapting to these evolving dynamics. The company's forays into drone delivery and satellite internet (Project Kuiper) are long-term bets with potentially enormous payoffs, but also carry significant risks.

The Common Thread & Investing Considerations

The aforementioned companies share key characteristics: strong financial fundamentals, leadership positions in their respective industries, and exposure to secular growth trends. The move toward digitalization, the increasing demand for sustainable energy, and the growth of artificial intelligence are all powerful forces that should benefit these companies for years to come.

However, it's crucial to remember that investing in the stock market involves inherent risks. Market volatility, unforeseen economic events, and company-specific challenges can all impact returns. Diversification, long-term perspective, and thorough research are essential for mitigating these risks. While these stocks may double in value, there's no guarantee. Investors should carefully consider their own risk tolerance and financial goals before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/09/top-stocks-to-double-up-on-right-now/ ]