GE Vernova Stock Soars on Optimistic Revenue Projections

Locales: UNITED STATES, SWITZERLAND

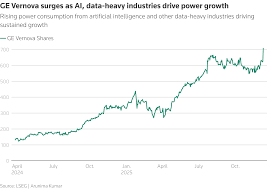

February 12th, 2026 - Shares of GE Vernova (GEV) experienced a significant jump today, fueled by optimistic revenue projections unveiled by the company's management team. The positive outlook comes as GE Vernova continues its journey as an independent entity, spun off from General Electric (GE) in 2025. While the separation was intended to unlock focused growth, the initial period has been under intense scrutiny by investors eager to see the new company establish its identity and deliver sustainable returns.

The surge in stock price, observed throughout the trading day, directly correlates with the newly shared expectations of stronger-than-anticipated revenue growth. This optimism isn't simply a matter of internal projections; it's rooted in demonstrable demand increases within the rapidly evolving power and energy landscape, specifically concerning renewable energy technologies and critical grid modernization solutions. During a recent investor presentation, GE Vernova leadership highlighted the robust order backlog and increasing customer interest as key indicators of this positive trend.

Beyond the Numbers: A Deeper Dive into the Drivers

The global energy sector is undergoing a fundamental shift. Governments and consumers alike are prioritizing the transition to cleaner, more sustainable energy sources. This isn't a fleeting trend, but a long-term structural change driven by climate concerns, regulatory pressures, and economic incentives. GE Vernova, with its core competencies in power generation, renewable energy (wind, hydro, solar), and grid infrastructure, is strategically positioned to benefit directly from this transformation.

Specifically, the demand for grid modernization is soaring. Existing grids, many of which are decades old, are ill-equipped to handle the influx of intermittent renewable energy sources like solar and wind. Integrating these sources requires significant upgrades to improve grid reliability, resilience, and efficiency. GE Vernova offers a suite of technologies, including advanced grid management software, high-voltage equipment, and energy storage solutions, to address these challenges.

Furthermore, the company is expanding its offerings in hydrogen technology, a potentially game-changing fuel source for decarbonizing various sectors, including power generation and transportation. Early investments in hydrogen-powered turbines and fuel cell technology are starting to yield promising results, attracting both public and private investment.

Investor Reaction and Market Implications

The market's enthusiastic reaction to the revenue guidance suggests a growing confidence in GE Vernova's ability to capitalize on these opportunities. Investors are clearly recognizing the company's potential to become a key player in the energy transition. The stock increase isn't just a short-term spike; analysts predict continued upward momentum if GE Vernova consistently delivers on its promises.

The positive sentiment surrounding GEV is also influencing broader market perceptions of the renewable energy sector. Other companies involved in clean energy technologies are experiencing increased investor interest, suggesting a wider rally could be underway. This ripple effect highlights the systemic importance of GE Vernova's success.

Challenges and Considerations

Despite the positive outlook, GE Vernova isn't without its challenges. Supply chain disruptions, inflation, and geopolitical uncertainties continue to pose risks to the company's operations. The competitive landscape is also fierce, with established players and emerging startups vying for market share.

Moreover, the integration of various GE legacy businesses into a cohesive, independent entity remains an ongoing process. Streamlining operations, improving efficiency, and fostering a unified company culture are crucial for long-term success.

Looking Ahead: What to Watch for

In the coming months, analysts will be closely monitoring several key metrics to assess GE Vernova's progress. These include:

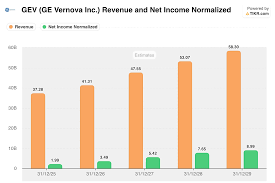

- Revenue Growth: Tracking the company's ability to achieve its projected revenue targets is paramount.

- Order Backlog: A healthy and growing order backlog provides visibility into future revenue streams.

- Profit Margins: Improving profitability is essential for sustainable growth and shareholder value.

- Innovation: Continued investment in research and development will be critical for maintaining a competitive edge.

- Project Execution: Successfully delivering on large-scale infrastructure projects is vital for building customer trust and expanding market share.

Ultimately, GE Vernova's future hinges on its ability to execute its growth strategy and effectively navigate the complexities of the rapidly changing energy landscape. However, the initial signals are promising, suggesting that the company is well-positioned to thrive in the era of clean energy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/11/heres-why-ge-vernova-stock-popped-higher-today-hin/ ]