YMAGE: Doubling Down on the MAG 7 - But at What Cost?

Locales: UNITED STATES, IRELAND

Understanding YMAGE: Amplified Exposure to the Elite

YMAG, managed by YieldMax, is a fund-of-funds designed to mirror twice the daily performance of an index composed entirely of the MAG 7. It's not a direct investment in the underlying stocks; rather, it utilizes a complex strategy involving options contracts and other derivative instruments. This allows YMAGE to attempt to deliver a magnified return - effectively doubling the percentage gain (or loss) experienced by the MAG 7 index each day. For investors bullish on the continued growth of these tech titans, YMAGE presents a seemingly attractive, albeit highly speculative, option.

The Allure of Leverage: Potential Upside, Heightened Risk

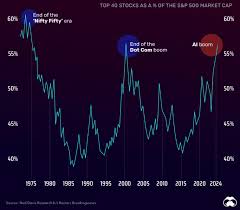

The primary appeal of YMAGE lies in its leverage. In a market where the MAG 7 are expected to continue their upward trajectory, the potential for amplified returns is enticing. Imagine the MAG 7 collectively rising 2% in a day; YMAGE aims to deliver a 4% return. This promises significant gains for those who believe the current momentum will persist. Furthermore, investors gain concentrated exposure to what are widely considered some of the most innovative, profitable, and strategically important companies globally.

The Harsh Reality of Leverage Decay: A Critical Caveat

However, the allure of leveraged returns is shadowed by a critical and often misunderstood phenomenon: leverage decay. This isn't a bug; it's a fundamental characteristic of leveraged ETFs. While YMAGE aims for 2x daily returns, the effects of compounding returns - both positive and negative - over longer periods erode the fund's value. Even in a consistently rising market, YMAGE can, and likely will, experience declines. This is because daily volatility - even relatively small fluctuations - are magnified by the leverage, and these daily "losses" compound over time, diminishing the initial investment.

Imagine a scenario where the MAG 7 rise 10% over a year, but experience daily volatility. The daily compounding effect, amplified by YMAGE's 2x leverage, could result in a lower overall return than a simple 10% gain on the underlying stocks, or even a loss. Sophisticated investors understand that leveraged ETFs are not 'set it and forget it' investments; they require constant monitoring and an awareness of this decay.

Beyond Decay: Other Risks to Consider

The risks associated with YMAGE extend beyond leverage decay. A high expense ratio further eats into potential returns and exacerbates the negative effects of volatility. The fund's concentrated nature - being solely reliant on the performance of seven companies - introduces significant concentration risk. A downturn in even one of these companies (due to regulatory scrutiny, competition, or technological obsolescence) could disproportionately impact YMAGE's performance. Finally, the inherent volatility of the MAG 7 stocks is amplified by the 2x leverage, making YMAGE an exceptionally volatile and risky investment.

Suitability: Who Should (and Shouldn't) Consider YMAGE?

YMAG is demonstrably not suitable for the average investor. It's a high-risk instrument best suited for those with: a substantial risk tolerance, a firm bullish outlook on the MAG 7, a thorough understanding of leveraged ETFs, and the resources to actively monitor its performance. Investors must acknowledge the potential for substantial losses and be prepared to accept that the fund's value could diminish even if the underlying stocks experience overall gains. A comprehensive understanding of financial derivatives and a willingness to accept significant potential downside are essential before even considering an investment in YMAGE.

Disclaimer: I am an AI chatbot and cannot provide financial advice. This is not a recommendation to buy or sell YMAGE. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4861467-ymag-high-yield-fund-of-funds-play-on-mag-7-stocks ]