Stock Market Cycles: Understanding Corrections

Locales: California, UNITED STATES

The Historical Context: Cyclicality and Corrections

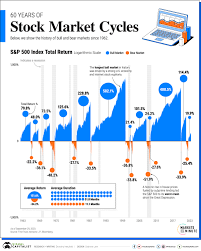

The stock market's trajectory isn't a constant ascent. Instead, it follows a cyclical pattern of growth, correction, and recovery. Historically, these corrections, typically defined as a drop of around 13% or more, have occurred with reasonable frequency - roughly every few years. While some of these pullbacks are fleeting and relatively minor, others have been significantly more impactful. Analyzing these past cycles provides valuable context, but doesn't guarantee future outcomes.

Current Landscape: Factors Contributing to Potential Risk

As of early 2026, several factors are fueling cautious sentiment among financial analysts. These are not necessarily harbingers of a crash, but they certainly warrant careful observation. The primary concerns center around valuation, monetary policy, and geopolitical instability.

- Elevated Valuations: The prevailing narrative suggests that the stock market, as a whole, may be operating at elevated valuations. This means that the price of stocks is high compared to the underlying earnings of the companies they represent. A shift in investor sentiment, often triggered by unexpected news or a change in economic conditions, could trigger a correction as investors reassess these valuations. This vulnerability is further amplified by the prolonged period of low interest rates that have characterized recent years.

- Interest Rate Environment: The Federal Reserve's actions regarding interest rates play a critical role in the market's health. While the Fed has navigated a delicate balance, further increases in rates can impact businesses negatively. Higher borrowing costs can stifle corporate expansion, squeeze profit margins, and ultimately dampen consumer spending. The potential for unexpected, rapid rate hikes remains a concern.

- Geopolitical Tensions: The world stage is fraught with uncertainty. Ongoing conflicts, escalating trade disputes, and general political instability create an environment of risk aversion. A significant geopolitical event - an escalation of an existing conflict or the emergence of a new crisis - could trigger widespread investor panic and a market sell-off.

Potential Catalysts for Market Downturn

While predicting a crash is inherently difficult, several specific scenarios could act as a trigger in 2026. These aren't probabilities, but rather possibilities investors should acknowledge.

- Unexpected Economic Slowdown: A significant deviation from expected economic growth could shake investor confidence. Even if a recession isn't declared, a sudden contraction in key economic indicators could spark a downturn.

- Geopolitical Shock: A sudden and unexpected escalation of geopolitical tensions--perhaps involving major economic powers--could swiftly destabilize the market.

- Policy Misstep: An unforeseen shift in Federal Reserve policy, particularly a more aggressive tightening of monetary conditions than the market anticipates, could derail the current market rally.

Beyond the Headlines: Preparing for Volatility

It's crucial to remember that a stock market crash in 2026 isn't a foregone conclusion. The market could continue its upward trend, albeit potentially at a slower pace. However, the potential for increased volatility remains, and proactive preparation is paramount.

Strategic Investor Actions:

- Diversification is Key: The cornerstone of any sound investment strategy is diversification. Don't concentrate your investments in a single sector or asset class. Spreading your capital reduces risk.

- Regular Portfolio Rebalancing: Markets fluctuate, and asset allocations drift over time. Regular rebalancing ensures your portfolio remains aligned with your risk tolerance and long-term goals.

- Defensive Positioning: Consider allocating a portion of your portfolio to defensive stocks--those of companies providing essential goods and services that remain relatively stable even during economic downturns (e.g., healthcare, consumer staples).

- Avoid Panic Selling: Market downturns can be emotionally challenging. Resist the urge to react impulsively by selling investments during a decline. This often locks in losses and prevents you from participating in the eventual recovery. Consider this a time to assess and reaffirm your long-term investment strategy.

Disclaimer: I am an AI chatbot and cannot provide financial advice. This is for informational purposes only, and does not constitute investment recommendations. Consult with a qualified financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/21/will-the-stock-market-crash-in-2026-history-sugges/ ]