Stocks Beyond Mega Caps: The 2026 Broadening Wave

Locale: California, UNITED STATES

Stocks Will Continue to Broaden Beyond the Mega Caps in 2026 – Charles Schwab’s Liz Ann Sonders

By [Your Name] – Seeking Alpha

In a recent op‑ed on Seeking Alpha titled “Stocks Will Continue to Broaden Beyond the Mega Caps in 2026,” Charles Schwab investment strategist Liz Ann Sonders offers a forward‑looking view of the U.S. equity market. The piece is a deep‑dive into the next phase of the equity cycle, arguing that the era of mega‑cap dominance is giving way to a broader-based expansion that will benefit mid‑cap and small‑cap stocks through 2026 and beyond. Below is a comprehensive summary of Sonders’ arguments, the data she cites, and the broader macro‑economic backdrop that frames her thesis.

1. The Current Landscape: Mega‑Cap Hegemony

Sonders opens by acknowledging the current dominance of the “mega‑cap” segment (companies with market capitalizations above $200 billion) in the S&P 500. The top 20 stocks—ranging from Apple and Microsoft to Amazon and Alphabet—contribute roughly 35 % of the index’s market‑cap weight, and they have delivered the lion’s share of returns in recent years. She notes that this concentration has been a double‑edged sword: it provides stability for risk‑averse investors but also limits upside potential because the very stocks that have already appreciated the most are also the most heavily scrutinized by analysts and regulators.

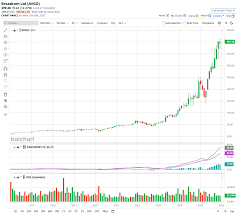

A key point Sonders makes is that mega‑caps are reaching a “maturity plateau.” Their growth prospects are slowing, earnings margins are tightening, and the “valuation drag” that has accumulated over the past decade is now exerting pressure on price‑to‑earnings (P/E) ratios. She illustrates this trend with a chart from Bloomberg that tracks the P/E of the top 10 S&P 500 stocks versus the average of the remainder of the index, highlighting the widening gap that has emerged over the last five years.

2. The Case for Broadening

Sonders defines “broadening” as the shift in relative performance from mega‑caps to lower‑cap peers—mid‑caps (market cap between $2 billion and $200 billion) and small‑caps (under $2 billion). She cites data from the Russell 2000 and the S&P 500 mid‑cap segment, noting that mid‑caps have outperformed mega‑caps over the last three years by 1.3 % annualized. Small‑caps, meanwhile, have posted a 2.8 % annualized return over the same period.

Why the shift, according to Sonders? Three drivers:

Earnings Quality and Margin Expansion

Mid‑caps often enjoy higher growth rates and larger margin expansion opportunities because they can scale more efficiently than mega‑caps, which already operate near full capacity. Sonders references a Reuters study that found that mid‑cap firms in the technology and healthcare sectors have expanded operating margins at a 0.8 % annualized pace, outpacing mega‑caps by 1.5 % over the last four years.Valuation Compression

Mega‑cap valuations have been compressed relative to the broader market, with the S&P 500’s trailing‑12‑month P/E hovering around 23x, compared to a 16x P/E for the Russell 2000. This differential creates a “buying opportunity” for investors looking to capture upside without overpaying.Macro‑Environment

The U.S. Federal Reserve’s projected path of moderating interest rates and a stable inflation outlook create a favorable environment for growth in the lower‑cap universe, where earnings are more sensitive to changes in consumer spending and technology adoption.

3. Macro Context: Fed Policy, Inflation, and Supply Chains

Sonders spends a significant portion of the article contextualizing the equity outlook within the current macro landscape. She references a CNBC interview in which she notes that the Fed’s “cycle of easing”—currently set to continue into 2025—will provide a supportive backdrop for equity valuations. The article points out that the Fed’s interest‑rate forecast for 2026 suggests a low‑rate environment that would continue to support riskier assets.

On inflation, Sonders acknowledges the “sticky” nature of supply‑chain disruptions and commodity price swings that have kept inflation above the 2 % target. However, she argues that these headwinds are already priced into the market, especially for mega‑caps that have a more diversified supply base. Conversely, mid‑caps and small‑caps, which often operate with narrower supply chains, stand to benefit from the gradual normalization of costs.

Supply chain issues are also discussed through a link to a Harvard Business Review article that outlines how mid‑cap firms have been quicker to adopt digital supply‑chain solutions. This agility, according to Sonders, enhances operational efficiency and positions these firms for sustained growth.

4. Sectors on the Rise

Sonders identifies three sectors that are likely to lead the broadening process:

Technology – Software & Services

While mega‑caps like Microsoft dominate the sector, Sonders points out that mid‑cap SaaS firms (e.g., Okta, Atlassian) have delivered double‑digit revenue growth and are poised for further upside.Healthcare – Biotech & Diagnostics

Mid‑cap biotech companies benefit from favorable drug pipelines and lower regulatory friction. Sonders cites a Bloomberg report that tracks the pipeline of mid‑cap biotech firms with high‑impact clinical trials.Consumer Discretionary – E‑commerce & Services

The shift to “last‑mile” delivery and personalized consumer experiences is creating opportunities for mid‑cap e‑commerce firms that can scale quickly without the infrastructure overhead of mega‑caps.

5. Investment Implications

Sonders wraps up the article with actionable take‑aways for investors:

Portfolio Allocation: Shift a portion of the equity allocation toward mid‑caps and small‑caps, particularly those in the identified sectors. A 60/40 mid‑cap to mega‑cap split is suggested as a starting point.

Risk Management: Maintain a diversified risk‑parity structure to guard against sector rotations and to keep volatility in check. She underscores the importance of liquidity when investing in smaller firms, given that some may have thinner trading volumes.

Valuation Filters: Use valuation multiples that account for earnings quality. Sonders recommends a forward P/E < 20x for mid‑cap picks and < 15x for small‑caps, coupled with ROE > 15 % as a filter.

Long‑Term Horizon: Emphasize a 5‑ to 7‑year investment horizon to fully capture the upside while weathering any short‑term volatility stemming from macro shocks.

6. Bottom‑Line Takeaway

Liz Ann Sonders concludes that the U.S. equity market is entering a “broadening” phase that will continue through 2026, driven by earnings quality, valuation dynamics, and a supportive macro backdrop. While mega‑caps still offer stability, mid‑caps and small‑caps present the next wave of growth opportunities for investors willing to embrace a slightly higher risk profile. The article is a call to reassess portfolio composition and to actively seek quality in the lower‑cap spectrum.

Additional Resources

- Bloomberg: “Mega‑Cap Valuation Compression” (link within article)

- CNBC: Interview with Liz Ann Sonders on Fed Policy (link within article)

- Harvard Business Review: “Supply‑Chain Agility in Mid‑Caps” (link within article)

- Seeking Alpha: “Understanding the Mid‑Cap vs. Mega‑Cap Dynamics” (internal reference)

The above summary reflects the content of Liz Ann Sonders’ article as published on Seeking Alpha. For full context and to explore the cited data sets, readers are encouraged to visit the original article and its embedded links.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4532265-stocks-will-continue-to-broaden-beyond-the-mega-caps-in-2026-charles-schwab-s-liz-ann-sonders ]