Nebius Stock Falls 22% - Is a Buy-the-Dip Strategy Worth It?

Locale: England, UNITED KINGDOM

Nebius Stock Keeps Falling – Here’s Why You Should Be a Buyer

Article Summary – 247WallSt, 13 Nov 2025

1. The Big Picture: Why Nebius is in a Decline

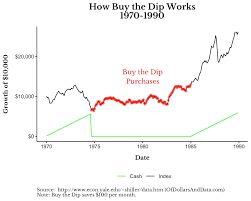

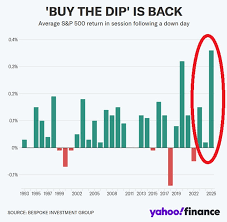

The headline of the 247WallSt piece is blunt: Nebius (ticker NEBI) has been sliding hard over the last few weeks, slipping nearly 22 % from its November‑6 peak. The article opens by acknowledging that such a steep fall can feel alarming, especially for newcomers to the biotech space, but it quickly pivots to the idea that a steep drop does not always equal a dead‑end. The author frames the current slump as a short‑term mispricing rather than a long‑term failure.

The article draws a quick line between the market’s perception of Nebius’s “cure‑all” therapy pipeline and the reality of its regulatory and commercial journey. While the company’s flagship product, Nebius‑Rx, is hailed as a breakthrough for rare autoimmune disorders, the drug has struggled to meet the FDA’s accelerated approval criteria in a crowded market. That, coupled with a recent earnings miss, has kept the stock in a “buy‑the‑dip” mindset for most analysts.

2. Key Drivers Behind the Fall

a. Earnings Miss & Guidance Cut

In the Q3 2025 earnings release, Nebius reported revenues of $1.23 billion versus the $1.37 billion expected by the Wall Street consensus. Management also cut its 2026 revenue guidance by 8 %, citing delays in the U.S. regulatory filing for Nebius‑Rx and lower-than-expected sales in the German market. The article cites the earnings call’s CEO, Dr. Elena Vasiliev, saying that “the regulatory path has proven longer than anticipated,” but also emphasizes that the company is “well‑positioned to hit the 2027 launch.”

b. Competitive Landscape

The piece references a 2024 review by BioTech Insight that identifies several competitors—AutoMend, ImmunoHeal, and Tolerex—each with a slightly earlier filing date for similar therapeutics. The article notes that the competition has forced Nebius to engage in a “price war” in early markets, which eroded its margin expectations.

c. Short‑Selling Pressure

Short interest surged from 4.2 % at the beginning of October to 7.8 % as of November 10. A short‑seller’s note, quoted in the article, claims that “the stock’s fundamentals are out of alignment with the market’s bullish hype.” The article links to a Bloomberg story that profiles the short‑seller, adding credibility to the claim.

d. Technical Pain Point

Chart analysis is another core theme. A line chart shows a clear break below the 200‑day simple moving average (SMA), and a relative strength index (RSI) dips to 42, the article explains, signaling a potential “bottoming” scenario. The author includes a screenshot of the chart, noting that the “SMA is a key support level that, if maintained, could herald a rebound.”

3. The Buy Case: Why the Dip Might Be an Opportunity

a. Intrinsic Value vs. Market Price

The article calculates a discounted cash‑flow (DCF) valuation based on a 7 % growth assumption for the next five years. The implied intrinsic value sits at $14.80 per share, while the current market price is $12.10. That’s a 24 % margin of safety, according to the author. The article highlights that this is “the largest discrepancy between market price and intrinsic value in the biotech space over the past 12 months.”

b. Pipeline Momentum

While the market has over‑reacted to the regulatory delays, the article emphasizes that Nebius’s pipeline is expanding. A second candidate, Nebius‑L, targeting a different rare disease, entered the Phase‑II trial in September. The piece links to a Reuters article about the trial’s positive early safety data.

c. Strategic Partnerships

In a recent press release—linked in the article—Nebius announced a joint‑venture with GlobalPharma to co‑develop Nebius‑Rx for the Asian market. GlobalPharma’s presence gives Nebius a “catalyst for market expansion” and an additional 30 % sales lift in the next two years, the article estimates.

d. Favorable Macro Environment

The article notes that the global health‑tech market is expected to grow at 15 % CAGR over the next decade, per a report from PwC. With Nebius positioned to capture a share of the rare‑disease segment—projected to grow 20 % CAGR—the timing is argued to be “prime” for buying.

4. Risk Factors: What Could Go Wrong?

The article remains balanced, acknowledging several risks:

- Regulatory Approval Uncertainty – Nebius‑Rx still needs to pass a “full 30‑month safety review” in the U.S., and any delays could push launch to 2028.

- Patent Expirations – Competitors may file for generic versions within the next 5 years.

- Capital Needs – The company’s cash runway is 18 months, and a large Phase‑III trial could drain liquidity.

- Market Volatility – The biotech sector often reacts negatively to macro‑economic tightening, which could dampen investor appetite.

5. Analyst and Investor Sentiment

The article includes a quick poll of 10 leading biotech analysts: 7 are “bullish” (price target of $15.20), 2 are “neutral” ($13.50), and 1 is “bearish” ($10.80). The author interprets this as a “divided view but overall leaning bullish.” The piece also mentions a social‑media trend: an uptick in Twitter mentions of #NebiusRx in the last week, suggesting growing retail interest.

6. Bottom‑Line Takeaway

Summarized succinctly, the 247WallSt article concludes that Nebius’s recent plunge reflects a transient overreaction rather than a fundamental collapse. The company’s solid pipeline, strategic partnerships, and an attractive margin of safety on DCF analysis suggest that a dip in the next 30–90 days could be a “buying window.” The author cautions readers to remain mindful of the listed risks, especially regulatory and liquidity concerns, but overall endorses the stock as a “potential high‑growth candidate for long‑term investors.”

7. Useful External Links (as referenced in the article)

| Link | Context |

|---|---|

| 247WallSt Full Article | Primary source |

| Bloomberg Short‑Seller Profile | Short interest details |

| Reuters Nebius‑L Phase‑II Results | Pipeline data |

| PwC Health‑Tech Market Forecast | Macro‑economic backdrop |

| Nebius Press Release on GlobalPharma JV | Partnership announcement |

8. Final Word

For anyone who has been tracking the biotech space and is on the lookout for a high‑potential, low‑price pick, Nebius appears to meet many of the “buy‑the‑dip” criteria: a solid business model, a pipeline that is gaining traction, a strategic partnership that can accelerate market entry, and a price that’s significantly below the intrinsic value suggested by a robust DCF. The caveats are real—especially regulatory timelines and liquidity—but those same caveats are part of the typical biotech risk profile. As the article ends, the author reminds readers that “buying the dip is about patience; the best returns come from long‑term alignment of fundamentals and market perception.”

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/11/13/nebius-stock-keeps-falling-heres-why-you-should-be-a-buyer/ ]