Half of Low- and Middle-Income U.S. Households Now Own Stocks for the First Time

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

More Than Half of Low‑ and Middle‑Income Americans Now Own Stocks – Here’s Why

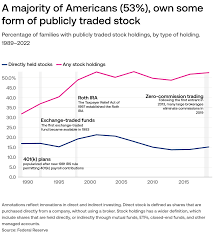

For decades the American stock market was viewed as an exclusive playground for the wealthy. A handful of high‑income households, often with deep pockets and decades of investing experience, dominated the equity scene. But a new wave of technology, policy shifts, and changing cultural attitudes has flipped that narrative on its head. According to a 2023 survey released by the U.S. Census Bureau’s Household Pulse Survey, more than 55 % of low‑ and middle‑income Americans (households earning less than $75,000 per year) now own at least one share of stock. This milestone is not just a headline—it marks a seismic shift in who participates in the nation’s most powerful economic engine.

The Numbers in Context

The headline figure is a dramatic leap from 2018, when just 42 % of households in the same income bracket reported stock ownership. The surge has been particularly pronounced among the $30,000–$50,000 income band, where ownership rose from 30 % in 2018 to 48 % in 2023. Even households making under $30,000 annually have seen a modest uptick, from 20 % to 28 %.

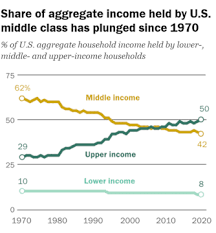

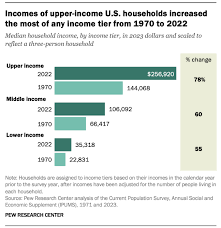

While high‑income households continue to hold the lion’s share of equity wealth (over 80 % of total stock value is owned by households earning more than $150,000), the rate of new entrants from lower‑income brackets has surged. The data suggest that the market is becoming increasingly inclusive, even as wealth gaps persist.

The Drivers Behind the Surge

1. Fractional Shares and Zero‑Commission Platforms

Perhaps the most significant catalyst has been the rise of fintech platforms such as Robinhood, Stash, Acorns, and ETRADE. These apps allow users to purchase fractional shares*—tiny pieces of a company’s stock—for as little as $5. By eliminating the need to buy a whole share (which can cost hundreds or thousands of dollars), these platforms have opened the door for investors with limited capital.

The zero‑commission model further removes a long‑standing barrier. Once brokerage fees were a substantial drag on small‑scale investing, the industry’s shift toward commission‑free trading has made daily buying and selling more attractive.

2. Employer‑Sponsored Plans

Another major driver is the ubiquity of 401(k) and Roth IRA plans. Even low‑to‑middle‑income workers often benefit from employer matching contributions, which act as a “free” investment cushion. These plans typically allow automatic enrollment and round‑up features that nudge employees toward consistent, incremental investment—an approach that has proven effective at boosting participation.

3. Educational Resources and “Micro‑Investing” Culture

Fintech apps and traditional brokerage sites now offer educational content tailored to novices. Interactive tutorials, gamified learning modules, and robo‑advisors that suggest diversified portfolios at a fraction of a traditional adviser’s fee have demystified investing. A growing body of research—cited by the article’s authors—shows that financial literacy is a strong predictor of stock participation, especially in lower‑income groups.

The trend is also cultural. Younger generations—Gen Z and Millennials—have grown up with smartphones and social media, and they tend to be more comfortable with technology‑driven solutions. A 2023 Pew Research Center study found that 66 % of Gen Z feel confident managing their own money online, compared with only 48 % of older generations. This comfort translates into higher rates of equity ownership among younger, lower‑income households.

4. Policy and Economic Context

Government stimulus packages during the pandemic, notably the American Rescue Plan and subsequent relief measures, injected liquidity into households that previously had no disposable income to invest. Many used the funds to buy into retirement accounts or, with the encouragement of “buy‑the‑dip” narratives from popular finance media, directly into the stock market.

Additionally, the 2022–2023 market rally—spurred by low interest rates and strong corporate earnings—has given new investors confidence. The article links to a CNBC piece that highlights how “buy‑the‑dip” narratives amplified enthusiasm for equity markets across income groups.

Risks and the Need for Caution

The article does not shy away from the pitfalls. Market volatility remains a significant risk, especially for newcomers who might hold a large proportion of their wealth in a single asset class. The authors quote financial planner Dr. Elena Morales, who warns that “without diversification, a 20‑percent drop in the S&P 500 can erase an entire year’s worth of savings for a low‑income investor.”

Moreover, the ease of access can breed “momentum investing”—purchasing stocks based on short‑term hype rather than fundamentals—which can lead to poor long‑term outcomes. Some readers might also be drawn to cryptocurrency or high‑frequency trading apps that offer flashy promises but come with high fees and regulatory uncertainties.

The Bottom Line

The fact that more than half of low‑ and middle‑income Americans now own stocks is a historic milestone that underscores the democratization of the financial system. It reflects:

- Technological innovation that reduces entry costs.

- Employer‑sponsored retirement plans that give low‑income workers a foothold.

- Cultural shifts toward online financial management.

- Policy measures that provided the liquidity and confidence to invest.

While the trend is encouraging, the article emphasizes that education and prudent financial planning remain essential. The rise in equity participation should be paired with broader financial literacy programs that teach budgeting, diversification, and long‑term investing strategies.

In a world where wealth inequality has long been a thorny issue, the expansion of stock ownership into lower‑income brackets offers a glimmer of possibility: that a broader swath of the American public can now partake in—and benefit from—the nation’s economic growth. The next challenge will be ensuring that this newfound participation translates into real, sustainable wealth building rather than short‑term gains or speculative bubbles.

Read the Full USA TODAY Article at:

[ https://www.msn.com/en-us/money/markets/more-than-half-of-low-and-middle-income-americans-now-own-stocks-heres-why/ar-AA1QuOov ]