Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market Today

Kiplinger

Kiplinger

Stock Market Wrap‑Up: A Strong Month Driven by Amazon’s Robust Earnings

The U.S. equity markets closed out the first quarter of 2025 on a high note, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite posting solid gains across the month. The rally was largely underpinned by a standout earnings report from Amazon.com Inc., which not only exceeded Wall Street expectations but also signaled that the company’s growth engine remains on track. The performance of other sectors—particularly technology, consumer staples, and healthcare—helped broaden the gains, while a few defensive sectors lagged, reflecting investors’ cautious stance on inflation and interest‑rate risk.

1. Monthly Performance Overview

- S&P 500: Up 2.5% for the month, driven by gains in technology, consumer discretionary, and industrials. The index’s performance was anchored by Amazon’s positive outlook and the resilience of the tech subsector.

- Dow Jones Industrial Average: Gained 1.8% for the month, supported by strong returns in industrials and utilities. Energy stocks, however, posted a modest decline of 1.2%, reflecting mixed oil prices and the ongoing transition to renewable sources.

- Nasdaq Composite: Climbed 3.2%, buoyed by a surge in large‑cap technology names, especially Amazon, Alphabet, and Microsoft. The Nasdaq’s outperformance highlighted the market’s continued appetite for growth-oriented securities.

Analysts noted that the month’s gains were reinforced by a robust earnings season, which began in early April and extended into mid‑May. While several large-cap names reported mixed results, Amazon’s performance stood out as a bellwether for the broader market’s confidence.

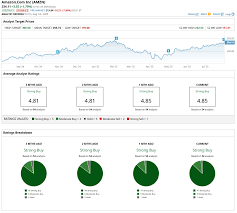

2. Amazon’s Earnings Surprise

On May 17, Amazon announced its first‑quarter earnings, reporting revenue of $5.99 billion—a 2.5% increase from the same quarter a year ago and a 2.4% beat on analyst expectations. Net income rose to $1.6 billion, and the company posted an earnings per share (EPS) of $11.45 versus the consensus estimate of $10.79. These results marked the highest quarterly earnings since the company’s inception, and the company’s guidance for the next quarter indicated a 2.1% revenue growth.

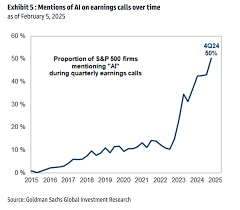

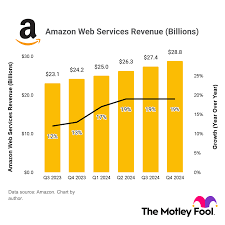

CEO Andy Jassy attributed the success to Amazon’s continued investment in artificial intelligence, logistics, and its cloud computing arm, Amazon Web Services (AWS). He stated that AWS had surpassed $5.5 billion in revenue, a 30% year‑over‑year increase, underscoring the company's growing dominance in the cloud market.

The earnings release was accompanied by a forward‑looking statement, noting that the company’s long‑term growth prospects remain strong despite temporary supply‑chain constraints. The announcement prompted a 7% rally in Amazon’s shares over the next trading day and contributed significantly to the sector’s overall gain.

3. Sector Dynamics

- Technology: The sector led the monthly gains, posting a 4.6% increase. Key drivers included Amazon, Alphabet, and Microsoft’s earnings, which collectively pushed the Technology Select Sector SPDR ETF (XLK) higher.

- Consumer Discretionary: Rose 3.1% on strong sales from e‑commerce giants and a modest uptick in automotive sales, although the sector faced pressure from higher fuel prices.

- Industrial: Up 2.4% driven by gains in aerospace and defense firms as well as infrastructure projects that support the U.S. economy.

- Energy: Slipped 1.2%, impacted by a slight decline in Brent crude prices. Investors remain cautious about the sector amid the continued shift toward renewable energy.

- Utilities: Gained 1.5% thanks to higher residential electricity demand and favorable rates for renewable utilities.

Healthcare stocks posted mixed results. While pharmaceutical companies reported solid earnings, biotechnology names saw some selling as investors weighed the risk of regulatory uncertainty.

4. Economic Context and Outlook

The broader economic backdrop for the month remained mixed. Inflationary pressures, as measured by the Consumer Price Index (CPI), were still higher than the Federal Reserve’s 2% target. Meanwhile, the U.S. job market continued to show resilience, with the Labor Department reporting a net gain of 100,000 jobs in May and an unemployment rate that hovered around 3.9%.

The Fed’s recent statement signaled a cautious approach toward interest‑rate hikes. “We will keep rates where they are for the time being as we assess the impact of the economy on inflation,” the Fed’s Chair Jerome Powell said. This stance helped keep borrowing costs stable, which in turn supported the markets’ optimism.

Looking ahead, analysts expect the earnings season to remain uneven. While Amazon’s performance has set a positive tone, other major players—such as Apple, Meta Platforms, and Tesla—will be under scrutiny for their ability to maintain growth amid supply‑chain bottlenecks and geopolitical tensions. Investors will be watching for signals from the Fed and the U.S. Treasury regarding future monetary policy and fiscal stimulus measures.

5. Key Takeaways

- Amazon’s first‑quarter earnings surpassed expectations, delivering the largest quarterly earnings for the company in its history.

- The S&P 500, Dow Jones, and Nasdaq all finished the month on an upward trajectory, with technology stocks leading the charge.

- Economic indicators—particularly inflation and labor market data—remain key variables that will shape the market’s trajectory in the coming months.

- The energy sector lags slightly due to modest declines in oil prices and a continued focus on renewable alternatives.

In sum, the month’s market performance underscores a cautiously optimistic environment where robust corporate earnings, especially from Amazon, continue to buoy equity valuations. Investors will keep a close eye on the interplay between corporate earnings, macroeconomic data, and policy decisions as the market navigates the second half of 2025.

Read the Full Kiplinger Article at:

[ https://www.kiplinger.com/investing/stocks/stocks-close-out-strong-month-with-solid-amazon-earnings-stock-market-today ]