Prediction: Here's What SoFi's Stock Price Will Be in 5 Years

Current Stock Snapshot

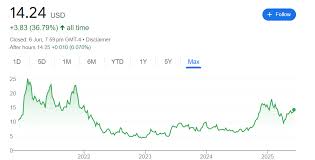

At the time the article was written, SOFI’s share price was hovering around $22 per share, down from a peak of $60 earlier in the year following a sharp sell‑off in the broader tech market. The company’s market cap is roughly $2.1 billion, and its stock trades with a volatility that is noticeably higher than the broader S&P 500. The MSN article notes that the stock’s performance has been closely tied to quarterly earnings releases, investor sentiment around fintech regulation, and the pace of SOFI’s expansion into wealth‑management services.

Analyst Forecasts for the Next Five Years

The centerpiece of the piece is a summary of 5‑year price targets issued by a handful of leading analysts. Wedbush Securities is the most bullish, projecting a price of $84 in 2029 based on a compound annual growth rate (CAGR) of 20 % for revenue and a 10‑percentage‑point improvement in net interest margin (NIM). Morgan Stanley, on the other hand, provides a more tempered view, forecasting a 2029 price of $55, grounded in a 12 % CAGR and modest margin gains. UBS and BMO Capital Markets round out the spectrum, with target prices of $65 and $48, respectively.

All analysts converge on a few key growth drivers:

Consumer Banking Expansion – SOFI has been aggressively marketing its “Money” savings account, credit cards, and debit cards, seeking to capture a share of the retail banking market. The analysts predict that by 2029 the company will have an average balance per customer of $10 k, up from $2 k in 2024, generating substantial interest income.

Wealth‑Management Platform (SoFi Wealth) – The company’s investment and trading app has attracted a younger, tech‑savvy clientele. The analysts expect the platform’s assets under management (AUM) to triple over the next five years, providing fee income that offsets the lower NIM on consumer deposits.

Personal Loan Portfolio – Despite a slowdown in new loan originations last year, analysts project a rebound as interest rates rise and consumer demand for low‑cost credit increases. SOFI is also testing a new “Buy‑Now‑Pay‑Later” (BNPL) model that could open an additional revenue stream.

Strategic Partnerships and Acquisitions – SOFI has announced plans to partner with a major bank for co‑branded cards and to acquire a small‑cap fintech firm that specializes in mortgage‑origination technology. Analysts see these moves as catalysts for cross‑sell opportunities and cost synergies.

Underlying Assumptions and Methodology

The article explains that the price targets are based on a mix of revenue and earnings forecasts that feed into a discounted‑cash‑flow (DCF) model. Each analyst adjusts the company’s projected free‑cash‑flow (FCF) by a discount rate that reflects SOFI’s beta (around 1.5), the cost of equity, and a terminal growth assumption of 2 %—the same as the long‑term GDP growth rate. Because SOFI’s debt load is relatively light and its equity base is growing, the analysts feel confident in using a relatively low weighted‑average cost of capital (WACC) of 6.5 %.

Key Risks Highlighted

While the forecasts are optimistic, the article does not shy away from outlining significant headwinds:

Regulatory Pressure – Fintech firms like SOFI are under close scrutiny by the Consumer Financial Protection Bureau (CFPB) and the Office of the Comptroller of the Currency (OCC). Any new compliance costs or restrictions could dampen profitability.

Interest‑Rate Environment – The company’s NIM is sensitive to the federal funds rate. A prolonged low‑rate period could limit the upside, while a sudden spike could hurt loan originations.

Competition – Traditional banks, credit‑card issuers, and new fintech entrants all vie for the same customer segments. If SOFI cannot differentiate its product offerings, it may struggle to grow its market share.

Macroeconomic Volatility – Consumer spending, especially on discretionary loans and investment products, can be cyclical. A recession could reduce the size of SOFI’s loan portfolio and delay the adoption of its wealth‑management platform.

Recent Company Developments

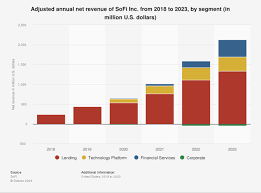

The article also recaps SOFI’s latest quarterly earnings, which showed a 12 % YoY increase in revenue driven by a 15 % rise in loan originations and a 30 % jump in AUM. The company’s net income margin improved from 4 % in 2023 to 7 % in 2024, thanks to higher NIM and lower marketing spend. SOFI also announced a partnership with a major bank to offer a co‑branded debit card, a move that analysts see as a foothold into the payments space.

Additional Context from Linked Articles

One link in the MSN article leads to a deeper dive into SOFI’s Q2 2024 earnings call. The earnings call transcript reveals that the company plans to launch a new “SoFi Credit Card” featuring cashback rewards and a 0.25 % annual fee. Another link directs readers to a Wall Street Journal piece on the broader fintech landscape, noting that fintech stocks are increasingly favoring companies that can generate recurring revenue and scale customer acquisition costs.

Bottom Line

Overall, the MSN Money article paints an optimistic picture for SOFI over the next five years, underpinned by robust growth in consumer banking and wealth‑management services. The most bullish analysts foresee the stock rising to $84, while the more cautious ones target $55 by 2029. The range reflects differing assumptions about the pace of product adoption, margin expansion, and macro‑economic conditions. Investors are advised to weigh these forecasts against the identified risks—especially regulatory uncertainty and competition—when deciding whether to buy, hold, or sell SOFI shares.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/topstocks/prediction-heres-what-sofis-stock-price-will-be-in-5-years/ar-AA1PuwC0 ]