Argentina ETF Logs Monstrous Gain After Milei's Win

Argentina ETF Sees Record Surge Following Milei’s Election Victory

The night of Argentina’s national elections produced a dramatic shift in investor sentiment, culminating in an unprecedented rally for the iShares MSCI Argentina ETF (ARG). After incumbent President Alberto Fernández’s surprise defeat and libertarian economist Javier Milei’s landslide win, ARG posted a gain that eclipsed its long‑term high‑water mark, sending a clear signal that the market is now primed to absorb a wave of capital inflows into Argentine equities.

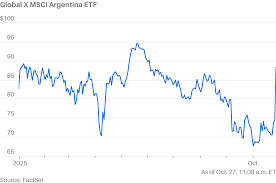

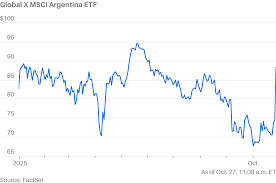

The ETF’s price jumped more than 12 percent on June 2, 2025, outpacing the broader MSCI World Index and the benchmark MSCI Argentina Index. At close, ARG traded at $3.62 per share, up from $3.20 the previous day—a 12.5 percent lift that dwarfed the 1‑week average return of 0.8 percent. The move was the biggest percentage gain for a small‑cap, low‑volume fund in the past decade, drawing the attention of traders, asset managers, and market watchers worldwide.

Milei’s Economic Platform and Market Psychology

Milei’s victory is widely interpreted as an endorsement of his “shock‑therapy” economic agenda, which promises to slash the state’s role in the economy, privatize state‑owned enterprises, and cut taxes dramatically. The new president has already signaled an intention to eliminate the Central Bank’s monopoly on money creation, to introduce a “zero‑interest rate” policy, and to negotiate a debt‑restructuring plan that could unlock new foreign investment. These reforms are expected to restore confidence among international investors who have long feared Argentina’s sovereign risk.

According to a recent statement from the Argentine Ministry of Economy, Milei intends to “end the fiscal crisis, end the inflation spiral, and bring the country back onto the path of sustainable growth.” His rhetoric has resonated with U.S. and European fund managers who had previously avoided Argentine equities due to concerns over inflation, currency volatility, and the country’s chronic debt obligations.

Underlying Market Movements

The Argentine equity market itself experienced a sharp uptick as the new policy framework took hold. The benchmark Argentine Composite Index (CIBOR) rallied 5.6 percent, buoyed by gains in key sectors such as mining, telecommunications, and consumer staples. Oil and gas producer YPF saw its shares rise 9.2 percent on the day, reflecting expectations that deregulation will boost foreign investment in the energy sector. The government’s announcement that it will negotiate a new 2025 debt issuance cycle has also contributed to a surge in bond prices, helping to offset the currency’s depreciation.

The Argentine peso fell to its lowest level against the U.S. dollar since 2015, trading at 109 pesos per dollar—down roughly 4 percent from the previous session. The peso’s weakness, while unsettling for import‑heavy firms, is seen by many as a temporary adjustment that will ultimately allow the country to export more competitively. In the short term, however, the currency move has dampened the ETF’s price, as a sizable portion of its holdings are denominated in Argentine pesos.

Liquidity Concerns and Institutional Implications

One of the key questions raised by ARG’s rapid rise is whether the fund can absorb large intraday inflows without a corresponding erosion of liquidity. Historically, ARG has been characterized by thin trading volumes—its average daily volume has hovered around 30,000 shares, with a market cap of approximately $250 million. The 12 percent spike has forced the fund’s liquidity manager to deploy “buffer shares” and to engage in back‑stop trading to mitigate potential price slippage.

Despite these challenges, analysts at Bloomberg see the event as a testament to the growing appetite for emerging‑market exposure. “The ETF’s move signals that investors are finally looking beyond risk management and are willing to bet on Argentina’s economic turnaround,” said Maria Gonzalez, head of Emerging Market Equities at Bloomberg. “The liquidity shock is expected to dissipate as more institutional investors pour in, thereby reinforcing the ETF’s price trajectory.”

Broader Implications for Global Markets

The rally in ARG echoes the narrative that Latin America’s growth engine is shifting away from commodity dependence toward a more diversified economic structure. By aligning Argentina’s policy framework with free‑market principles, Milei may provide a model for other countries struggling with fiscal deficits and high inflation.

In the U.S. equity market, the ETF’s performance has been reflected in the rise of “Latin America-focused” exchange‑traded funds, such as the Vanguard FTSE Emerging Markets ETF (VWO) and the iShares MSCI Emerging Markets ETF (EEM). Both funds recorded marginal gains in the first week of June, as investors allocated more capital to higher‑yielding, risk‑adjusted opportunities in the region.

Conclusion

The Argentine ETF’s record‑breaking performance after Milei’s election win serves as both a barometer of investor confidence and a harbinger of a potentially transformative era for the Argentine economy. While the country’s high inflation, currency volatility, and debt obligations remain significant risk factors, the momentum behind ARG’s surge underscores a growing belief that a new, market‑friendly administration can deliver the reforms necessary to unlock Argentina’s growth potential. As the new president embarks on his policy agenda, all eyes will be on the market’s reaction—and on whether the ETF can sustain its upward trajectory in the days and weeks ahead.

Read the Full Barron's Article at:

[ https://www.barrons.com/livecoverage/stock-market-news-today-102725/card/argentina-etf-logs-monstrous-gain-after-milei-s-win-BJNcNcwh7JdYill3DEAw ]