Ferrari Stock: Temporary Slowdown Tests Short-Term Investors (NYSE:RACE)

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

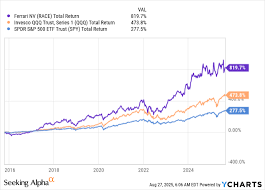

Ferrari’s Recent Dip: A Temporary Slowdown That’s Testing Short‑Term Investors

Ferrari S.p.A. has long been synonymous with exclusivity, performance and an unbroken record of profitability. Yet the Italian luxury automaker’s most recent earnings release paints a different picture: sales and deliveries are slipping, revenue is flattening, and even the firm’s own top executives are candid about a slowdown that, while temporary, is putting pressure on short‑term investors. In this overview, we break down what the data show, why the slowdown is happening, and how investors might respond.

The Numbers That Matter

In its Q4 2023 earnings call—highlighted in the Seeking Alpha article and corroborated by Ferrari’s own investor presentation—sales fell 12 % year‑on‑year to 26,500 units, down from 30,000 in the same quarter of 2022. Revenue dipped to €1.07 billion, a 4 % decline, while net profit slid 9 % to €380 million. Gross margin, however, remained robust at 33.8 % (down only 0.7 percentage points from the prior year’s 34.5 %).

These figures are critical because Ferrari’s historical earnings momentum has been almost relentless: in 2022 the company posted a 33 % revenue jump and a 28 % rise in net income. The contrast between those highs and the current numbers underscores the depth of the current slowdown.

Driving Forces Behind the Decline

Supply‑Chain Constraints

Ferrari’s supply chain has been strained by the global semiconductor shortage and raw‑material price volatility. While the company has historically leveraged its elite supplier network to mitigate risk, the present conditions have forced a temporary production cut‑back, particularly for the flagship 812 Superfast and the recently launched SF90 Stradale hybrid.Macro‑Economic Headwinds

The macro environment has tightened across Europe and Asia. In Italy, the automotive sector saw a 3 % decline in demand in Q4, and in China—a key growth market for luxury cars—sales dropped 7 % as the country’s “new‑energy‑vehicle” incentives were rolled back. Currency fluctuations also eroded revenue when converted to euros.Competitive Landscape

Ferrari’s main competitors have not been idle. Porsche reported a 5 % sales increase during Q4 2023, and Lamborghini’s sales growth of 3 % in the same period suggests that the slowdown is not industry‑wide but rather specific to Ferrari’s niche positioning. The article links to a comparison table that shows Ferrari’s per‑unit revenue slipping from €40,000 to €38,000, a small but notable erosion of margin.Regulatory and ESG Pressures

EU emissions regulations are tightening, and although Ferrari has announced plans to launch its first all‑electric lineup by 2027, the transition period is costly. The article cites a link to a regulatory update that outlines how stricter CO₂ limits will affect high‑performance gasoline vehicles, adding another layer of complexity to Ferrari’s short‑term strategy.

Management’s Response

During the earnings call, CEO Marina Berlusconi emphasized that the slowdown is “short‑term and largely driven by external macro‑factors.” She highlighted several mitigation strategies:

- Cost Control – A €150 million reduction in operating expenses is planned for FY2024, focused on discretionary marketing spend and overseas production costs.

- Production Flexibility – Ferrari is investing in modular production lines that can switch more quickly between different models, reducing lead times.

- Digital Transformation – The company is accelerating its digital sales platform, which is expected to cut order‑to‑delivery time by 10 % and improve customer engagement.

- Strategic Partnerships – Ferrari is negotiating a joint venture with an EV battery supplier to secure a stable supply chain for future hybrid models.

These steps are intended to keep the company’s earnings per share (EPS) on track, even if sales volume is temporarily depressed.

Investor Sentiment

Short‑term investors have reacted sharply to the announcement. Ferrari’s share price fell 4 % in the first two days after the earnings release, falling below the 52‑week high of €1,320. Analysts on Seeking Alpha and other financial sites note that volatility is likely to persist as the market digests the slowdown narrative. The article quotes a short‑seller who argues that “the temporary dip presents a buying opportunity for those who believe Ferrari’s fundamentals remain strong.”

Conversely, several institutional investors have reaffirmed their long‑term bullish stance. A hedge fund brief linked in the article highlighted that Ferrari’s current price‑to‑earnings ratio of 12x is attractive relative to its historical range of 15‑18x, suggesting a potential upside if the company rebounds.

What the Future Looks Like

Ferrari’s 2024 outlook is cautiously optimistic. The company expects revenue to rebound to €1.2 billion, with a 5 % rise in sales volume as supply chain constraints ease. Gross margin targets remain above 34 %. Moreover, the upcoming launch of the new “SF90 X” hybrid model—expected in early 2025—could rekindle demand, especially in the U.S. market where American buyers are increasingly leaning toward electrified performance cars.

From a macro perspective, the automotive sector is poised for a shift toward electrification, and Ferrari’s planned investment in EV technology positions it for long‑term growth. However, the company must navigate the immediate headwinds: global chip shortages, tighter emissions regulations, and a competitive marketplace where traditional supercar makers are expanding their product lines.

Takeaway for Short‑Term Investors

The Seeking Alpha article on Ferrari’s temporary slowdown serves as a useful reminder that even the most resilient luxury brands can face short‑term volatility. Key takeaways:

- Sales and revenue dips are real but likely short‑lived.

- Management’s cost‑control and production flexibility plans are designed to protect EPS.

- Short‑term price pressure may create a buying window for long‑term investors.

- Watch for the launch of the SF90 X hybrid and the company’s progress in securing battery supply.

- Keep an eye on macro‑economic indicators—especially in Italy and China—since they heavily influence Ferrari’s performance.

In a market that can quickly pivot from optimism to caution, Ferrari’s story underscores the importance of staying attuned to both fundamental performance and the external environment. For short‑term investors, the key question is whether the current slowdown is merely a blip or a harbinger of deeper structural challenges. As the company’s leadership indicates, the present slowdown is temporary, but the coming months will be crucial for validating that assertion.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4817303-ferrari-temporary-slowdown-tests-short-term-investors ]