Lithium Miners News For The Month Of August 2025

Lithium Miners News – August 2025: Production, Projects, and Market Dynamics

In the past month, the lithium‑mining sector has seen a steady stream of corporate announcements, project developments, and macro‑drivers that are reshaping the industry’s landscape. From the opening of new extraction facilities in South America to a surprising uptick in lithium‑price forecasts, August 2025’s news cycle offers investors a clear snapshot of where the supply chain is heading and what risks and opportunities loom.

1. Production and Asset Expansion

Albemarle Corp. (ALB)

Albemarle’s August 2025 quarterly report highlighted a 12 % increase in output at its Greenbushes, Western Australia, lithium‑brine plant – the world’s largest lithium‑brine operation. The company also announced the commissioning of a new processing plant in Chile’s Atacama Desert, designed to bring its “Cauchari‑Salar” assets online by the first quarter of 2026. Management projected a 4 % YoY rise in lithium carbonate throughput from the new facility, a key metric that analysts will watch closely as global EV‑battery demand surges.

Sociedad Química y Minera de Chile (SQM)

SQM’s August press release confirmed that its new “Cauchari” lithium‑carbonate plant, a joint venture with Albemarle, has achieved initial production levels of 15,000 t of lithium carbonate per year – a 30 % increase over the previous year’s output. In addition, SQM is accelerating the construction of a dedicated “Salar Aguas” lithium‑hydroxide plant in the Atacama, slated to be operational by mid‑2027. The move underscores SQM’s intent to diversify its product mix in anticipation of rising battery‑grade lithium‑hydroxide demand from premium OEMs.

Lithium Americas Corp. (LAC)

Lithium Americas announced that its flagship Maras lithium‑brine project in Peru has reached the “production‑ready” status, with an expected commercial start in late 2025. The company also unveiled a 25 % stake sale of its North American lithium‑mining subsidiary, “Coyote Creek,” to a strategic investor, generating $200 million in cash that will be used to fund the Maras expansion.

Pilbara Minerals Ltd. (PLM)

Pilbara Minerals updated its board on the progress of the “Garda” lithium‑hydroxide facility in Western Australia. Construction is on schedule, with a projected first‑product milestone of 6,000 t of lithium‑hydroxide per year in 2026. The company is also exploring partnerships to secure an additional 10 % of its supply chain from local brine sources.

Other Regional Highlights

- Tianqi Lithium Corp. (TL): The Chinese miner announced a 6 % increase in lithium‑carbonate output in Q2, driven by higher yields at its Inner Mongolia and Sichuan sites.

- Ganfeng Lithium (GFLY): Ganfeng reported a new joint venture with a European battery manufacturer to develop a battery‑grade lithium‑hydroxide plant in Spain, set to start production by 2028.

2. Strategic M&A and Investor Moves

Albemarle & SQM Joint Venture

The Albemarle‑SQM partnership continues to grow. In August, the two firms announced a third joint venture to develop a high‑purity lithium‑hydroxide facility in Chile. This venture is designed to capture the premium lithium‑hydroxide segment, with an estimated capacity of 12,000 t yr‑1, and will be financed through a combination of equity and debt, leveraging Albemarle’s strong cash flow.

Lithium Americas & Coyote Creek Sale

Lithium Americas’ sale of its North American lithium‑mining unit to an undisclosed strategic partner marked a significant shift in its portfolio. The divestiture frees up capital for the company to accelerate its Maras project while reducing its exposure to U.S. regulatory uncertainty.

Tianqi’s Investment in Pilbara Minerals

Tianqi Lithium announced a $250 million minority stake in Pilbara Minerals, aiming to secure a long‑term supply of lithium‑hydroxide for its growing battery‑cell portfolio. This cross‑border partnership is part of Tianqi’s broader strategy to diversify geographically and mitigate geopolitical risk.

3. Market Drivers and Macro‑Factors

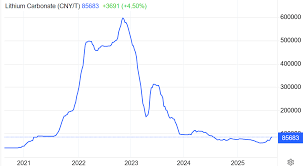

Lithium Price Trends

In August 2025, WTI‑based lithium prices traded around $70 per lb, a 10 % YoY rise attributed to tightening global supply and rising EV‑battery orders. Analysts note that the price spike could be transitory if new production capacity – particularly the projected output from Chile’s Cauchari‑Salar and Brazil’s upcoming lithium‑brine projects – comes online.

Battery‑Industry Demand

Automotive OEMs – including Tesla, Volkswagen, and Hyundai – announced 2025 production targets that surpass 1.8 million EVs worldwide. This surge has reinforced demand for high‑purity lithium‑hydroxide and lithium‑carbonate. Battery manufacturers, such as CATL and LG Energy Solution, are actively seeking supply agreements that lock in long‑term lithium supply at stable prices.

Regulatory Landscape

- U.S.: The Biden Administration’s “Build America, Buy America” policy has been extended to battery manufacturing, providing incentives for U.S.‑based lithium‑processing plants.

- EU: The European Commission’s “European Battery Alliance” has earmarked €3 billion for lithium‑processing facilities, targeting a 25 % domestic supply of critical materials by 2030.

- China: The Ministry of Industry and Information Technology (MIIT) announced a new subsidy framework for lithium‑processing plants that meet stringent environmental standards, encouraging companies like Ganfeng to expand domestic capacity.

4. Environmental, Social, and Governance (ESG) Developments

Recycling Initiatives

Several miners have announced recycling pilots. Pilbara Minerals is testing a lithium‑hydroxide recovery process from spent battery cathodes, aiming to capture 80 % of lithium from end‑of‑life vehicles. Ganfeng Lithium will launch a pilot plant in Shanghai to produce “green” lithium‑carbonate, utilizing a closed‑loop water‑recycling system that reduces freshwater consumption by 40 %.

Sustainability Reporting

Albemarle published its first integrated sustainability report, detailing progress against the United Nations Sustainable Development Goals (SDGs). The report highlights the company’s carbon‑neutral operations target by 2035 and a 15 % reduction in water use per ton of lithium produced.

5. Bottom Line for Investors

The August 2025 lithium‑mining news cycle signals a period of accelerated capacity expansion, strategic consolidation, and regulatory support. While lithium prices remain elevated, the coming months will test whether the industry can keep pace with the rapid demand growth. Investors should pay particular attention to:

- Operational milestones at new facilities in Chile and Australia, which are key to meeting the 2025‑2026 production targets.

- Supply‑chain partnerships that secure long‑term contracts and mitigate geopolitical risks.

- ESG performance, as battery‑material demand is increasingly tied to sustainability credentials.

For those looking to position themselves ahead of the next battery‑revolution wave, the players that can combine production scalability with robust ESG frameworks will likely lead the market.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4816675-lithium-miners-news-for-august-2025 ]