Clearway Energy: Powering the AI Boom

Locales: California, Texas, Illinois, UNITED STATES

Monday, February 16th, 2026 - Clearway Energy (CWEN) is rapidly transitioning from a solid renewable energy play into a key enabler of the Artificial Intelligence (AI) boom. While the company has historically focused on providing clean energy through wind and solar farms, a significant shift in market dynamics, driven by the insatiable power demands of AI infrastructure, is positioning Clearway for accelerated growth and making its current valuation increasingly attractive.

Clearway Energy operates a diverse portfolio of renewable energy assets - including wind and solar farms - alongside critical transmission infrastructure. Traditionally, the company has sold power to utilities under long-term Power Purchase Agreements (PPAs), providing a stable, albeit sometimes challenged, revenue stream. Recent years saw headwinds due to fluctuations in wholesale electricity prices. However, this narrative is undergoing a dramatic reversal, fueled by the exponential growth of AI.

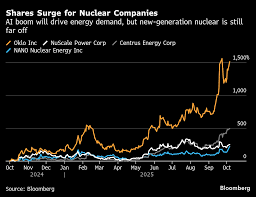

The AI-Driven Energy Surge: Beyond the Hype

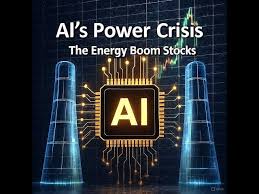

The current AI revolution isn't just about sophisticated algorithms and impressive software. It's fundamentally a hardware-intensive undertaking. Training and running AI models requires enormous computational power, necessitating massive investments in data centers. These aren't your average server farms; they are sprawling complexes consuming unprecedented amounts of electricity. The scale of investment is staggering. Microsoft (MSFT) is currently deploying $100 billion into AI infrastructure development, while Amazon (AMZN) is committing $150 billion. Nvidia (NVDA), the dominant supplier of GPUs vital for AI processing, is experiencing explosive growth, signaling the broader industry's momentum.

This isn't a short-term trend. The demand for AI is predicted to grow exponentially across industries, from autonomous vehicles and healthcare to finance and entertainment. This translates into a sustained and increasing need for reliable, affordable, and - increasingly - sustainable power. Data centers are becoming notoriously power hungry, and there's growing public and corporate pressure to reduce their carbon footprint. This is where Clearway Energy steps in.

Clearway's Strategic Advantage: Location, Location, Location

Clearway Energy isn't simply benefiting from the general increase in power demand; it's uniquely positioned to capitalize on it. The company's renewable energy assets are strategically located near major data center hubs across the United States. This proximity is crucial. It minimizes transmission losses, reduces energy delivery costs, and ensures a more reliable power supply - factors that are paramount for data center operators. Furthermore, Clearway's existing transmission infrastructure provides a vital link in delivering this power where it's needed most.

Beyond the existing portfolio, Clearway boasts a substantial development pipeline of new renewable energy projects. This pipeline will allow the company to rapidly expand its capacity and meet the growing demand from data centers. The PPA structure, while initially designed for stability, now offers a powerful advantage. They provide predictable revenue streams, shielding Clearway from the volatility of spot electricity markets and allowing for confident investment in expansion. We've seen a trend in recent contracts where PPAs increasingly incorporate "green premiums" - recognizing the value of renewable energy sources - further boosting Clearway's revenue potential.

Valuation and Investment Potential

Currently, Clearway Energy trades at a price-to-earnings (P/E) ratio of approximately 13. Considering its strong growth prospects, strategically positioned assets, and predictable revenue stream, this valuation appears significantly undervalued. While not a "growth stock" in the traditional tech sense, the accelerating demand from AI is fundamentally reshaping Clearway's growth trajectory. Analysts are increasingly revising their price targets upwards, reflecting the anticipated impact of the AI buildout.

Navigating the Risks

Despite the promising outlook, potential investors should be aware of the risks. Regulatory changes concerning renewable energy incentives and grid infrastructure remain a factor. Weather patterns, inherent to renewable energy sources, can affect short-term production. And, as with any company carrying debt, rising interest rates could increase borrowing costs. However, Clearway's long-term PPAs and diversified asset base mitigate some of these risks.

Looking Ahead

Clearway Energy is no longer just a renewable energy company. It is becoming a critical infrastructure provider for the AI revolution. The confluence of surging energy demand, strategic asset locations, and a robust PPA structure creates a compelling investment opportunity. As the AI boom continues to unfold, Clearway Energy is poised to deliver substantial value to its shareholders.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4867311-clearway-energy-has-accelerating-growth-from-ai-buildout ]