AI Boom Fuels Semiconductor Demand Surge

Locales: UNITED STATES, TAIWAN PROVINCE OF CHINA

The AI Boom & Beyond: Driving Semiconductor Demand

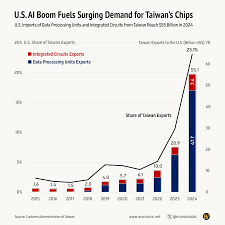

The surge in artificial intelligence (AI) applications is arguably the most significant driver of semiconductor demand. The need for increasingly powerful and efficient chips to handle AI workloads - from training complex models to running inference at the edge - is creating a sustained boom for companies specializing in these technologies. However, the demand isn't limited to AI. The automotive industry's transition to electric vehicles (EVs) and advanced driver-assistance systems (ADAS) requires a substantial increase in semiconductor content per vehicle. Similarly, the expansion of 5G networks and the proliferation of IoT devices are adding to the overall demand for chips.

1. Advanced Micro Devices (AMD): Challenging the Established Order

AMD continues its impressive run, having successfully disrupted the CPU market traditionally dominated by Intel. Its Ryzen processors have gained significant market share, offering competitive performance and value. The company's Radeon GPUs remain strong contenders in the gaming and professional visualization markets. Recent reports indicate that AMD is aggressively expanding its custom chip design business, securing contracts with cloud providers and automotive manufacturers. Analysts currently project a continued double-digit revenue growth for AMD over the next three years, fueled by its strong product pipeline and expanding customer base. While competition remains fierce, AMD's ability to innovate and adapt positions it for sustained success. The current P/E ratio, while increased from previous years due to growth, still reflects a reasonable valuation given its projected earnings.

2. Nvidia (NVDA): The AI Powerhouse

Nvidia's dominance in the AI chip market remains unchallenged. Its GPUs are the industry standard for training and deploying AI models, and the company is consistently pushing the boundaries of performance and efficiency. Beyond AI, Nvidia's data center business is thriving, as its GPUs are essential for high-performance computing tasks. The demand for Nvidia's products is exceptionally high, leading to supply constraints in some areas. Despite a premium valuation, analysts believe Nvidia's long-term growth potential justifies the price. The company is investing heavily in research and development to maintain its technological lead and expand into new markets, including autonomous vehicles and the metaverse.

3. ASML Holding (ASML): The Gatekeeper of Chip Manufacturing

ASML's position as the sole supplier of extreme ultraviolet (EUV) lithography systems remains paramount. These machines are critical for manufacturing the most advanced semiconductors, and the complexity of the technology creates a significant barrier to entry for competitors. While the semiconductor industry is cyclical, ASML benefits from the continuous need for chip manufacturers to upgrade their production capabilities. The geopolitical landscape further emphasizes ASML's strategic importance, as governments worldwide are keen to secure access to this essential technology. Despite occasional fluctuations related to the global economic climate, ASML's long-term outlook remains exceptionally positive.

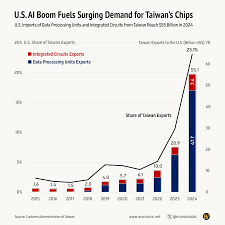

4. Taiwan Semiconductor Manufacturing (TSM): The Manufacturing Giant

TSM, the world's largest contract chipmaker, continues to be a cornerstone of the global semiconductor supply chain. It manufactures chips for a vast array of companies, including Apple, Nvidia, and AMD. The ongoing chip shortage highlighted the critical importance of TSM's manufacturing capacity, and the company is investing heavily in expanding its facilities, particularly in the United States and Japan, to diversify its production footprint and mitigate geopolitical risks. TSM's technological leadership and economies of scale provide it with a significant competitive advantage. Government incentives and the increasing demand for advanced chips are expected to drive continued growth for TSM in the coming years. The company's focus on process technology and its ability to deliver high-quality chips make it a reliable and attractive investment.

Looking Ahead: Navigating the Semiconductor Landscape

The semiconductor industry will continue to evolve rapidly, driven by technological innovation and shifting geopolitical dynamics. Investors should carefully monitor these trends and consider diversifying their portfolios to mitigate risk. While these four stocks represent compelling investment opportunities, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/02/16/4-no-brainer-seminconductor-stocks-to-buy-right-no/ ]