Apple Stock Rises on First-Quarter Outlook

$117.2 billion, surpassing the consensus estimate of $115.8 billion. Net income rose to $30.8 billion, a 15% increase from the same period last year, and earnings per share (EPS) came in at $1.48, comfortably above the market expectation of $1.35.

Revenue Drivers

The majority of the revenue lift came from iPhone sales, which totaled $44.1 billion. While the sales volume of the iPhone 15 series was slightly below the 12‑month average, the higher price points of the Pro and Pro Max models helped offset the dip in volume. Apple also reported a $26.9 billion gain in its Services segment, which includes Apple Music, iCloud, the App Store, and Apple Pay. This figure was up 19% year over year, driven by a surge in subscription renewals and a 7% increase in new paid services customers.

Wearables, Home, and Accessories contributed $13.5 billion, marking a 20% jump over the prior year. The Watch Series 10 and AirPods Pro sold in record numbers, while the newly introduced HomePod mini and AirTag saw strong demand in the first quarter.

Guidance and Outlook

For the second quarter of 2025, Apple projected revenue in the range of $110 billion to $115 billion. While the company refrained from providing a specific EPS forecast, analysts noted that the guidance is consistent with a modest uptick in iPhone sales and a steady growth trajectory in Services and Wearables.

Apple’s CFO, Luca Maestri, highlighted that the company expects operating margin to remain above 30% in Q2, thanks to the high margin of the Services and Wearables units. “We are on track to continue generating strong cash flow while investing in new product categories and AI-driven initiatives,” Maestri told reporters.

AI and Software Advances

A prominent theme in the earnings call was Apple’s focus on artificial intelligence. Tim Cook emphasized that AI is becoming integral to the user experience across Apple’s ecosystem. The company is integrating AI into its next‑generation iOS updates, promising smarter Siri functionality, improved photo organization, and more efficient battery management.

Apple also announced a partnership with OpenAI to embed GPT‑style models into its Apple Silicon chips. This collaboration aims to bring advanced natural‑language processing to the iPhone, iPad, and MacBook lineups without compromising privacy. The partnership will reportedly involve on‑device inference, keeping user data local and secure.

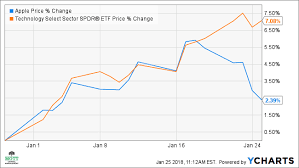

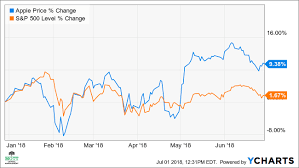

Stock Market Reaction

Following the earnings announcement, Apple’s stock closed up 1.8% at $181.52, a gain of $3.15 per share. Over the next 24 hours, the shares surged to $185.30, buoyed by analyst upgrades and bullish sentiment surrounding the company’s AI roadmap. Wall Street analysts from Morgan Stanley, Goldman Sachs, and J.P. Morgan raised their price targets, citing the robust Services growth and the potential for AI‑driven product enhancements.

Competitor Landscape

Apple’s performance also prompted a comparative look at competitors such as Samsung, Google, and Meta. Samsung’s latest Galaxy S series saw a 12% decline in shipments, while Google’s Pixel lineup lagged in sales due to limited model offerings. Meta’s Oculus Quest devices, on the other hand, maintained steady sales, though Meta’s overall revenue fell 4% year over year.

Apple’s market share in the premium smartphone segment remained steady at 34%, slightly below Samsung’s 38% but ahead of Google’s 22%. The company’s emphasis on ecosystem lock‑in, particularly through its integrated services, is seen as a key competitive advantage.

Analyst Expectations

Analysts expect Apple to continue leveraging its Apple Silicon advantage to drive growth in computing and AI. Jim Kramer's forecast at Goldman Sachs indicates that Apple’s AI initiatives could generate an additional $10 billion in revenue over the next three years, primarily through AI‑enhanced services and device upgrades.

On the services front, Fisher & Paykel projected that Apple’s subscription services could grow by 8% annually as more users adopt Apple TV+, Apple Arcade, and iCloud+.

Bottom Line

Apple’s first‑quarter earnings report underscores the company’s resilience amid a crowded consumer electronics market. Strong revenue growth across iPhone, Services, and Wearables, coupled with a forward‑looking AI strategy, positions Apple for continued success. Investors and analysts alike are closely watching Apple’s next moves, particularly its plans to integrate AI into its hardware and software offerings, which could redefine the company’s competitive edge in the coming years.

Read the Full Barron's Article at:

[ https://www.barrons.com/livecoverage/apple-earnings-stock-price-iphone-ai/card/apple-rises-on-first-quarter-outlook-4Xfei8acZl46b7F3SxpD ]