Caution: Massive stock market short squeeze underway

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Massive Stock‑Market Short‑Squeeze On the Horizon – What Investors Need to Know

By [Your Name] – Research Journalist

Published on FinBold, 19 September 2025

The global equity markets are currently riding a wave of volatility that has analysts and traders alike watching for a possible “short squeeze” on an unprecedented scale. FinBold’s latest piece, “Caution: Massive Stock‑Market Short Squeeze Underway,” warns that a confluence of macro‑economic pressures, sector‑specific catalysts, and the extraordinary concentration of short positions could trigger a rapid surge in prices across a wide swath of the market. Below is a comprehensive overview of the article’s key points, insights, and the practical implications for investors.

1. What Is a Short Squeeze?

A short squeeze occurs when a heavily short‑positioned stock sees a sudden upward price move, forcing traders who bet against it (short sellers) to buy shares to cover their positions. The buying frenzy can, in turn, drive the price higher—often in a self‑reinforcing cycle. Historically, the most dramatic short squeezes have involved high‑profile stocks such as GameStop (GME) and AMC Entertainment (AMC), but the current scenario may encompass a broader set of equities, from large‑cap tech giants to small‑cap cryptocurrency‑related firms.

2. Why Is This Squeeze “Massive”?

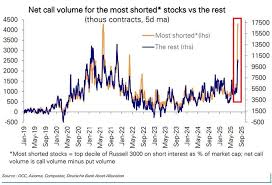

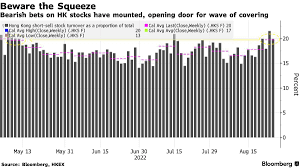

a. Concentrated Short Interest

FinBold’s analysis points out that a growing number of market participants have taken sizeable short positions in a handful of sectors, notably:

Artificial Intelligence (AI): NVIDIA (NVDA), Advanced Micro Devices (AMD), and Intel (INTC) all carry short interest ratios that have risen sharply in the past 12 months. Analysts suggest that the sustained overvaluation—especially in AI‑related sub‑segments—has encouraged short sellers to bet on a correction.

Cryptocurrency‑Linked Stocks: Companies such as Coinbase (COIN), MicroStrategy (MSTR), and Square (SQ), which hold large cryptocurrency balances, have seen their short interest climb as crypto markets have cooled. Short sellers are positioning for a possible collapse in the broader crypto ecosystem.

Retail and E‑commerce: Amazon (AMZN) and eBay (EBAY) also carry significant short positions, reflecting a growing sentiment that the retail transformation narrative may be nearing its peak.

b. Macroeconomic Catalysts

The U.S. Federal Reserve’s recent hikes in the federal funds rate have tightened monetary conditions, raising borrowing costs for both consumers and corporations. As a result, growth‑oriented stocks—especially those with high price‑to‑earnings (P/E) multiples—have become increasingly vulnerable to a re‑pricing of risk. Short sellers view these conditions as an invitation to bet against a potential downturn in the tech and growth‑sector space.

c. Momentum from Market Sentiment

FinBold cites research that shows a strong correlation between high short‑interest levels and market sentiment shifts. In markets that have recently been buoyed by optimism around AI breakthroughs and digital transformation, a sudden reversal in sentiment can act as a trigger. “The market is at a tipping point,” the article notes, “where short sellers are ready to act if there’s a spark.”

3. How the Squeeze Might Play Out

The article outlines several possible scenarios:

| Scenario | Drivers | Likely Impact |

|---|---|---|

| Sector‑specific rally | A bullish catalyst (e.g., a major AI product launch, or a favorable crypto‑regulation outcome) | Sharp upward moves in targeted stocks, forcing short sellers to cover. |

| Broader market rally | Macro‑economic rebound, easing inflation concerns, or a shift in Fed policy | A widespread “market‑wide” squeeze that could lift indices along with shorted names. |

| Limited short covering | Minor catalysts or a muted reaction to news | Modest price upticks that may not fully unwind short positions. |

FinBold emphasizes that short squeezes can be “volatile and unpredictable.” A rapid spike in a few names could trigger a “domino effect” as traders scramble to hedge and cover across correlated sectors.

4. Key Stocks to Watch

The FinBold article highlights several names that carry both high short interest and potential for a squeeze:

NVIDIA (NVDA) – The leading GPU maker has a short interest ratio of approximately 5.3×, a notable increase from 2.9× last year. The company’s AI‑driven earnings guidance, coupled with a potential rebound in data‑center demand, makes it a prime candidate.

Coinbase (COIN) – With an expanding short interest (currently 4.7×), the crypto exchange’s reliance on Bitcoin and other digital assets puts it at risk if the crypto market continues to dip.

AMC Entertainment (AMC) – Still in a precarious position, AMC’s short interest remains around 7.9×, and any resurgence in movie‑going or a new distribution strategy could spark a squeeze.

Microsoft (MSFT) – Though a more conservative bet, the software giant’s short interest (2.2×) is rising due to concerns over the Office suite’s growth.

Tesla (TSLA) – The electric‑vehicle maker’s short interest has surged (3.6×) as analysts debate the sustainability of its high P/E ratio.

5. What This Means for Investors

a. Risk of Losses

If a short squeeze erupts, short sellers may face “margin calls” and forced buying that can result in significant losses. Long‑position holders in the same stocks could see rapid price volatility, which can erode returns or trigger stop‑loss orders.

b. Opportunities for Long Positions

Conversely, the article cautions that investors holding long positions in these stocks might benefit from the upward momentum of a squeeze. The challenge lies in timing the entry and exit to capture gains while avoiding overexposure.

c. Importance of Diversification

FinBold stresses the importance of maintaining a diversified portfolio. Concentrating too heavily in sectors with high short interest amplifies risk. A balanced mix of defensive, growth, and income‑generating assets can help mitigate the impact of a sudden market shock.

d. Monitoring Short‑Interest Metrics

Investors are encouraged to keep a close eye on short‑interest ratios and “short‑interest‑to‑float” percentages. Many brokerage platforms provide real‑time data that can help gauge the potential for a squeeze.

6. Final Takeaway

The FinBold article presents a sober warning: the confluence of macro‑economic tightening, concentrated short positions in AI, crypto, and retail stocks, and a market that has recently rewarded speculative growth narratives creates a fertile environment for a large‑scale short squeeze. While such events can generate outsized returns for long positions, they also pose a significant risk to short sellers and investors with insufficient hedging or diversification.

In essence, the market is poised on a precipice—either it could plunge deeper into volatility, or it could deliver a rapid rally that forces many shorts to cover. For investors, the lesson is clear: stay alert, maintain discipline, and diversify to navigate the potential storm.

Further Reading

- FinBold’s “Short Interest in the Market: Where Short Sellers Are Betting” – provides detailed data on short‑interest trends.

- FinBold’s “AI Stocks: The Next Frontier or Overvalued Bubble?” – explores the valuation dynamics of the AI sector.

- FinBold’s “Crypto‑Linked Equity: A New Frontier for Short Sellers?” – analyzes the intersection of cryptocurrency markets and equity shorting.

For more in‑depth analysis and real‑time market data, visit FinBold’s website and subscribe to their premium research newsletters.

Read the Full Finbold | Finance in Bold Article at:

[ https://finbold.com/caution-massive-stock-market-short-squeeze-underway/ ]