[ Mon, Feb 03rd 2025 ]: MSN

[ Mon, Feb 03rd 2025 ]: MSN

[ Mon, Feb 03rd 2025 ]: MSN

[ Mon, Feb 03rd 2025 ]: Investing

[ Mon, Feb 03rd 2025 ]: Forbes

[ Mon, Feb 03rd 2025 ]: MSN

[ Mon, Feb 03rd 2025 ]: MSN

[ Mon, Feb 03rd 2025 ]: FXStreet

[ Mon, Feb 03rd 2025 ]: Forbes

[ Mon, Feb 03rd 2025 ]: MarketWatch

[ Mon, Feb 03rd 2025 ]: MSN

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

[ Mon, Feb 03rd 2025 ]: WOPRAI

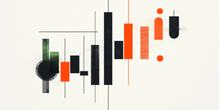

Trade war 2.0 playbook: What it means for your portfolio?

FXStreet

FXStreetThis marks the beginning of Trade War 2.0. For investors, this means it's time to rethink exposure to tariff-sensitive sectors. Some industries will benefit from reshoring and U.S. manufacturing incentives, while others will struggle with higher costs. Let's break down the playbook.

Read the Full FXStreet Article at:

[ https://www.fxstreet.com/analysis/trade-war-20-playbook-what-it-means-for-your-portfolio-202502031002 ]

Similar Stocks and Investing Publications

[ Sun, Feb 02nd 2025 ]: Investing

[ Sun, Feb 02nd 2025 ]: MSN

[ Fri, Jan 31st 2025 ]: Kiplinger

[ Tue, Jan 14th 2025 ]: Investing

[ Fri, Jan 10th 2025 ]: MSN

[ Wed, Jan 01st 2025 ]: CoinTelegraph

[ Thu, Dec 19th 2024 ]: Morningstar

[ Thu, Dec 19th 2024 ]: Investing

[ Thu, Dec 12th 2024 ]: Business Insider

[ Tue, Dec 03rd 2024 ]: Thomas Matters

[ Sat, Nov 30th 2024 ]: Thomas Matters

[ Fri, Nov 29th 2024 ]: Thomas Matters