TBSI, CAL, PAY, HTZ, AMR, ISTA. Top Losing Stocks With Negative Price Friction In Morning Trade Today

June 30, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, announced today its proprietary Market Maker Friction Factor Report for June 30, 2009. Since late October market makers are now required to be on the bid as much as they are on the offer and for like amounts of stock. This afair market makinga requirement is designed to prevent market makers from manipulating stock prices. Here is a list of the top companies with the largest losses this morning and negative price friction (bearish). This means that there was more selling than buying in the stocks and their stock prices dropped faster with less Friction. TBS International (NASDAQ: TBSI), Continental Airlines (NYSE: CAL), VeriFone Holdings (NYSE: PAY), Hertz Global (NYSE: HTZ), AMR Corp (NYSE: AMR) and ISTA Pharmacueticals (NASDAQ: ISTA). To access Friction Factor, Naked Short Data and SqueezeTrigger Prices on all stocks please visit http://www.buyins.net .

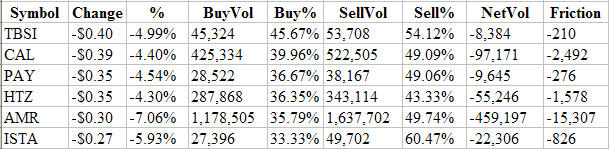

Market Maker Friction Factor is shown in the chart below:

Symbol Change % BuyVol Buy% SellVol Sell% NetVol Friction

TBSI -$0.40 -4.99% 45,324 45.67% 53,708 54.12% -8,384 -210

CAL -$0.39 -4.40% 425,334 39.96% 522,505 49.09% -97,171 -2,492

PAY -$0.35 -4.54% 28,522 36.67% 38,167 49.06% -9,645 -276

HTZ -$0.35 -4.30% 287,868 36.35% 343,114 43.33% -55,246 -1,578

AMR -$0.30 -7.06% 1,178,505 35.79% 1,637,702 49.74% -459,197 -15,307

ISTA -$0.27 -5.93% 27,396 33.33% 49,702 60.47% -22,306 -826

Click here to view chart:

Analysis of the Friction Factor chart above shows that each of the six stocks mentioned above have high net dollar losses (Change) and extremely low price friction in their stocks. The Friction Factor displays how many more shares of buying than selling are required to move a stock higher by one cent or how many more shares of selling than buying moves a stock lower by 1 cent.

For example, the chart above shows TBSI with a dollar loss this morning of -$0.40 and a Friction Factor of -210 shares. That means that it only takes 210 more shares of selling than buying to move TBSI lower by one penny. This means the Market Makers are allowing the stock to drop quickly (low friction). The combination of low friction and negative market direction can drive prices lower faster than normal.

TBS International Limited (NASDAQ: TBSI), together with its subsidiaries, engages in the ocean transportation of dry cargo through owned and chartered vessels. It offers liner, parcel, bulk, and vessel chartering services. The company operates a fleet of multipurpose tweendeckers, and handysize and handymax bulk carriers that carry steel products, salt, sugar, grain, fertilizers, chemicals, metal concentrates, aggregates, and general cargo. It operates its business around trade routes between Latin America and Japan, and South Korea and China, as well as ports in North America, Africa, the Caribbean, and the Middle East. The company also provides cargo scheduling, loading, and discharge services. It serves industrial shippers in various markets, including mining companies, steel manufacturers, trading companies, heavy industry, industrial equipment enterprises, and construction companies. As of December 31, 2008, the company operated 47 controlled fleet vessels, including 45 owned ships and 2 ships charter-in with an option to purchase. TBS International Limited was founded in 1993 and is based in Hamilton, Bermuda.

Continental Airlines, Inc. (NYSE: CAL), an air carrier, engages in the transportation of passengers, cargo, and mail. As of December 31, 2008, the company owned or leased 350 mainline jets and 282 regional aircraft. It flew to 120 domestic and 121 international destinations, as well as offered additional connecting service through alliances with domestic and foreign carriers. Continental Airlines operates its domestic route system primarily through its hubs at Newark Liberty International Airport in the New York metropolitan area; George Bush Intercontinental Airport in Houston, Texas; and Hopkins International Airport in Cleveland, Ohio. The company directly serves destinations throughout Europe, Asia, Canada, Mexico, Central and South America, and the Caribbean. Continental Airlines, Inc. was founded in 1934 and is based in Houston, Texas.

VeriFone Holdings, Inc. (NYSE: PAY) designs, markets, and services electronic payment solutions that enable secure electronic payments among consumers, merchants, and financial institutions. The companya�s countertop electronic payment systems accept magnetic, smart card, and contactless/RFID cards; and support credit, debit, check, electronic benefits transfer, and various pre-paid products, including gift cards and loyalty programs. It offers wireless system solutions that support IP-based CDMA, GPRS, and Wi-Fi technologies, as well as a Bluetooth communications solution. The company also provides various products for the point of sale applications, including displays, user-friendly interfaces, ECR interfaces, durable key pads, and signature capture functionality. In addition, it offers various products for petroleum companies, such as integrated electronic payment systems that combine card processing, fuel dispensing, ECR functions, and secure payment systems for integration with petroleum pump controllers and systems. Further, the company provides server-based transaction products; secure payment hardware and software integration modules; and VeriShield Protect, a solution that encrypts and protects consumer card data. Additionally, it offers various client services, including payment system consulting, deployment, on-site and telephone-based installation and training, help desk support, repairs, replacement of impaired system solutions, asset tracking, and reporting; and project management services for turn-key application implementations. VeriFone Holdings serves financial institutions, payment processors, petroleum companies, retailers, government organizations, and healthcare companies, as well as independent sales organizations in the United States, Europe, Latin America, Asia, and Canada. The company is headquartered in San Jose, California with an additional office in Rosh Haayin, Israel.

Hertz Global Holdings, Inc. (NYSE: HTZ), through its subsidiaries, engages in the car and equipment rental businesses worldwide. It operates in two segments, Car Rental and Equipment Rental. The Car Rental segment engages in the ownership and lease of cars. This segment operates car rental locations at or near airports, as well as in central business districts and suburban areas of cities in North America, Europe, Brazil, and the Pacific. In addition, it operates retail used car sales locations in the United States and France. The Equipment Rental segment rents earthmoving equipment, material handling equipment, aerial and electrical equipment, air compressors, generators, pumps, small tools, compaction equipment, and construction-related trucks. In addition, this segment sells new equipment and consumables. The company also offers claim administration services, such as investigating, evaluating, negotiating, and disposing of various claims, including third-party, first-party, bodily injury, property damage, general liability, and product liability. Hertz Global serves various industries, such as construction, petrochemical, automobile manufacturing, railroad, power generation, and shipbuilding. The company was founded in 1918 and is headquartered in Park Ridge, New Jersey.

AMR Corporation (NYSE: AMR), through its subsidiaries, operates in the airline industry in the United States. The company, through its principal subsidiary, American Airlines, Inc., provides scheduled jet service to approximately 150 destinations throughout North America, the Caribbean, Latin America, Europe, and Asia. American Airlines also operates as a scheduled air freight carrier, providing a range of freight and mail services to shippers. AMR Corporation, through its subsidiary, AMR Eagle Holding Corporation, owns and operates two regional airlines, providing connecting service from nine of American's high-traffic cities to smaller markets throughout the United States, Canada, Mexico, and the Caribbean under the name American Eagle. The company serves 250 cities in 40 countries with approximately 3,400 daily flights. As of December 31, 2008, AMR Corporation owned and leased aircrafts in operation included 626 American Airlines Aircrafts and 266 AMR Eagle Aircrafts. The company was founded in 1934 and is headquartered in Fort Worth, Texas.

ISTA Pharmaceuticals, Inc. (NASDAQ: ISTA), an ophthalmic pharmaceutical company, discovers, develops, and markets therapies for inflammation, ocular pain, glaucoma, allergy, and dry eye in the United States. The company offers Xibrom for the treatment of inflammation and pain following cataract surgery; Istalol for the treatment of glaucoma; and Vitrase for use as a spreading agent. Its developing products include Bepotastine ophthalmic solution for allergic conjunctivitis; T-Pred, a Phase III clinical trial product candidate for the treatment of steroid-responsive inflammatory ocular conditions; Ecabet Sodium, a Phase IIb clinical trial product, for the treatment of dry eye syndrome; and Bepotastine nasal for the treatment of allergic rhinitis. The companya�s products developing products also include a steroid product candidate to treat ocular inflammation; iganidipine to enhance ocular nerve blood flow; and a formulation of latanoprost for the treatment of glaucoma. It sells its products primarily to drug wholesalers, retailers, and distributors, including chain drug stores, hospitals, clinics, government agencies, and managed healthcare providers. ISTA Pharmaceuticals was formerly known as Advanced Corneal Systems, Inc. and changed its name to ISTA Pharmaceuticals, Inc. in March 2000. The company was founded in 1992 and is headquartered in Irvine, California.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,550,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each montha�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. None of the companies in this report have paid to be included in this report. From time to time we will mention a company that may have previously paid $995 per month for market data purchased from BUYINS.NET. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET, FRICTION FACTOR and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor.

By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State. Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net