Vanguard FTSE All-World ex-US ETF declares quarterly distribution of $0.3532

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Vanguard FTSE All‑World ex US ETF Declares Quarterly Distribution of $0.03532

On Thursday, September 6, 2024, Vanguard announced that its FTSE All‑World ex US ETF (ticker VEU) will pay a quarterly distribution of $0.03532 per share. The ex‑dividend date is set for September 9, 2024, with the record date on September 12, 2024 and payment expected on September 23, 2024. The distribution follows the same pattern Vanguard has used for its previous four quarters, and the amount represents a modest increase from the $0.03526 per share paid in the first quarter of 2024.

What is VEU?

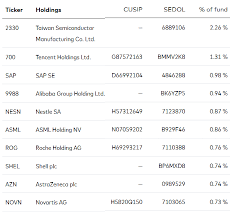

VEU is a pass‑through ETF that tracks the FTSE All‑World ex US Index. The index contains roughly 3,800 large‑cap, mid‑cap and small‑cap companies outside the United States, providing exposure to developed and emerging markets in Europe, Asia, Latin America and the Middle East. The fund’s portfolio is weighted by free‑float market capitalization, with the largest sectors being financials, consumer discretionary, information technology and health care. Vanguard’s low‑cost structure is reflected in VEU’s 0.07% expense ratio, which is competitive with other broad‑global ex‑US funds.

The ETF’s assets under management (AUM) were reported at $25.4 billion on the last reporting date, making it one of the largest ex‑US ETFs in the Vanguard family. The fund’s distribution history shows a steady rise in the dividend yield over the last decade, with an average quarterly payout of around $0.035 per share, translating to an annualized yield of roughly 0.14%—typical for a globally diversified equity ETF.

Why the Distribution Matters

For investors, the quarterly distribution offers a regular source of income. Even though the yield is modest, it can be especially attractive to income‑focused investors who prefer a diversified, low‑cost global exposure without having to pick individual stocks. Importantly, the distribution is paid in US dollars, which simplifies tax reporting for U.S. investors.

According to Vanguard’s distribution policy, the fund’s dividends are tax‑pre‑withheld at the 30% U.S. withholding tax rate for foreign investors. Domestic U.S. investors receive the full distribution amount. The distribution will be subject to ordinary income tax in the U.S., unless the investor is eligible for a reduced rate under a tax treaty.

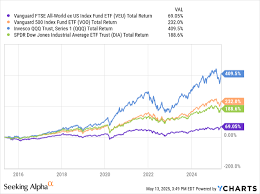

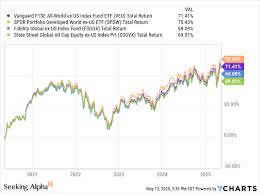

Performance Snapshot

The past year has been a mixed bag for VEU. The fund returned +6.2% through September 2024, outperforming the S&P 500’s 5.4% performance over the same period. The fund’s largest gains came from the technology sector in China and Asia, while the European consumer staples sector contributed solid dividends that helped smooth the portfolio’s performance during the European political turbulence.

Vanguard reported that the fund’s average daily turnover is 2.5%, indicating a relatively low‑turnover strategy that helps keep transaction costs low and aligns closely with the underlying index.

Where the Money Comes From

The $0.03532 distribution per share is derived from the dividends paid by the companies that make up the FTSE All‑World ex US Index. Vanguard’s research shows that the fund’s top five holdings as of the latest quarter include major global players such as ASML Holding, Tencent Holdings, Nestlé, SAP SE and Toyota Motor Corp. These companies alone generate more than 15% of the fund’s total dividend income.

Vanguard’s distribution policy is to pay out at least 90% of the fund’s net dividend income each quarter. The remaining 10% is retained in the fund to support any necessary capital gains distributions or to provide a cushion for the fund’s operating expenses.

Practical Implications for Investors

Regular Income – The quarterly payout of $0.03532 per share equates to $1.41 per $40,000 invested (assuming 1,000 shares), which can help supplement other income streams.

Diversification – VEU’s broad global coverage reduces reliance on any single country or sector, potentially lowering portfolio volatility.

Tax Considerations – U.S. investors will owe ordinary income tax on the distribution, whereas foreign investors will face a 30% withholding tax unless treaty benefits apply.

Re‑investment – Many brokerage platforms allow automatic reinvestment of dividends, which can accelerate compounding over the long term.

Looking Ahead

Vanguard has not announced any significant changes to the ETF’s structure, expense ratio, or underlying index composition. The fund is expected to continue its quarterly distribution pattern, subject to the performance of the underlying holdings and the prevailing global dividend environment. Analysts suggest that if the global equity markets maintain their current momentum, VEU could maintain a dividend yield in the 0.12–0.15% range over the next 12–18 months.

Investors who have already allocated capital to VEU should keep an eye on the fund’s quarterly statements, available on Vanguard’s official website (link: https://investor.vanguard.com/etf/profile/VEU) and on Seeking Alpha’s distribution page. For those still considering a global equity allocation, the ETF’s low expense ratio and consistent dividend payout make it a compelling candidate for a diversified, income‑oriented portfolio.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4496031-vanguard-ftse-all-world-ex-us-etf-declares-quarterly-distribution-of-03532 ]