CYTR, FGP, AGEN, OIIM, KV.A. Top Gainers With Lowest Price Friction In Morning Trade Today

June 17, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, announced today its proprietary Market Maker Friction Factor Report for June 17, 2009. Since late October market makers are now required to be on the bid as much as they are on the offer and for like amounts of stock. This fair market making requirement is designed to prevent market makers from manipulating stock prices. Here is a list of the top companies with the largest gains this morning and lowest price friction (bullish). This means that there was more buying than selling in the stocks and their stock prices rose faster with less Friction. CytRx (NASDAQ: CYTR), Ferrellgas Partners (NYSE: FGP), Antigenics (NASDAQ: AGEN), O2Micro International (NASDAQ: OIIM) and KV Pharma (NYSE: KV.A). To access Friction Factor, Naked Short Data and SqueezeTrigger Prices on all stocks please visit http://www.buyins.net .

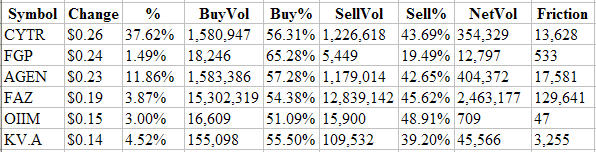

Market Maker Friction Factor is shown in the chart below:

Symbol Change % BuyVol Buy% SellVol Sell% NetVol Friction

CYTR $0.26 37.62% 1,580,947 56.31% 1,226,618 43.69% 354,329 13,628

FGP $0.24 1.49% 18,246 65.28% 5,449 19.49% 12,797 533

AGEN $0.23 11.86% 1,583,386 57.28% 1,179,014 42.65% 404,372 17,581

OIIM $0.15 3.00% 16,609 51.09% 15,900 48.91% 709 47

KV.A $0.14 4.52% 155,098 55.50% 109,532 39.20% 45,566 3,255

Click here to view chart:

Analysis of the Friction Factor chart above shows that each of the six stocks mentioned above have high net dollar gains (Change) and very low price friction in their stocks. The Friction Factor displays how many more shares of buying than selling are required to move a stock higher by one cent or how many more shares of selling than buying moves a stock lower by 1 cent.

For example, the chart above shows CYTR with a dollar gain today of +$0.26 and a Friction Factor of 13,628 shares. That means that it only takes 13,628 more shares of buying than selling to move CYTR higher by one penny. The Market Makers are currently allowing the stock to rise quickly (low friction). The combination of low friction and positive market direction can drive prices higher much faster than normal.

CytRx Corporation (NASDAQ: CYTR), a biopharmaceutical research and development company, engages in the development of human therapeutics. Its product pipeline includes Tamibarotene, a synthetic retinoid in Phase II clinical development to treat acute promyelocytic leukemia; INNO-2006, a pro-drug for doxorubicin in Phase II clinical development for the treatment of cancer; Bafetinib, a drug in Phase I clinical development to treat chronic myeloid leukemia; Arimoclomol, an orally-administered small-molecule product candidate in Phase IIb clinical development for the treatment of amyotrophic lateral sclerosis; and Iroxanadine, an orally-administered small-molecule product candidate in Phase I clinical development to treat diabetic ulcers. The company also engages in developing treatments for neurodegenerative and other disorders based on its small-molecule molecular chaperone amplification technology; and new-drug discovery research utilizing its master chaperone regulator assay technology. The company was founded in 1985 and is headquartered in Los Angeles, California.

Ferrellgas Partners, L.P. (NYSE: FGP), through its subsidiary, Ferrellgas, L.P., distributes propane and related equipment and supplies primarily in the United States. It transports propane purchased from third parties to propane distribution locations and then to tanks on customers� premises, or to portable propane tanks delivered to nationwide and local retailers. It conducts its portable tank exchange operations through a network of independent and partnership-owned distribution outlets. The company�s propane is used for various applications, including space heating, water heating, and cooking in the residential and industrial/commercial markets; for outdoor cooking using gas grills in the portable tank exchange market; and for crop drying, space heating, irrigation, and weed control in the agricultural market. Ferrellgas Partners also engages in providing common carrier services; wholesale propane marketing and distribution; wholesale marketing of propane appliances; and the sale of carbon dioxide and refined fuels. The company serves approximately residential, industrial/commercial, portable tank exchange, agricultural, and other customers in 50 states, the District of Columbia, and Puerto Rico. As of July 31, 2008, it had 871 propane distribution locations. Ferrellgas, Inc. serves as the general partner of the company. Ferrellgas Partners was founded in 1939 and is headquartered in Overland Park, Kansas.

Antigenics Inc. (NASDAQ: AGEN), a biotechnology company, engages in developing and commercializing technologies to treat cancers and infectious diseases, primarily based on immunological approaches. Its products include Oncophage (vitespen), a patient-specific therapeutic cancer vaccine registered for use in the Russia Federation, as well as under review by the European Medicines Agency for the treatment of kidney cancer patients with earlier-stage disease. The company tested Oncophage in phase 3 clinical trials for the treatment of renal cell carcinoma and metastatic melanoma; and phase 1 and phase 2 clinical trials for various indications, as well as in phase 2 clinical trial for the treatment of recurrent glioma, a type of brain cancer. Its product candidate portfolio also includes QS-21 Stimulon adjuvant, which is used in various vaccines under development in trials for diseases, such as hepatitis, human immunodeficiency virus, influenza, cancer, Alzheimer�s disease, malaria, and tuberculosis; AG-707, a therapeutic vaccine program for the treatment of genital herpes; and Aroplatin, a liposomal chemotherapeutic for the treatment of solid malignancies and B-cell lymphomas. The company was formerly known as Antigenics L.L.C. and changed its name to Antigenics, Inc. in February 2000. Antigenics was founded in 1994 and is headquartered in Lexington, Massachusetts.

O2Micro International Limited (NASDAQ: OIIM), a fabless semiconductor company, designs, develops, and markets semiconductor components for power management and security applications. It offers mixed signal integrated circuits (ICs) that provide battery management for mobile applications, such as notebook PCs, power tools, electric bikes, electric vehicles, hybrid electric vehicles, and uninterruptible power supply systems, as well as supplies battery charge controllers. The company�s products also comprise security-based ICs, which include SmartCardBus, E-Guardian, MemoryCardBus, and Pre-Boot Security that protect against undesired product use and enable PKI-based secure e-commerce supported by Power Switch ICs. In addition, it provides intelligent lighting backlight CCFL, EEFL, FFL, and LED controllers for various sizes of LCD display applications, comprising desktop monitors, televisions, notebooks, global positioning system, and other mobile applications. Additionally, the company develops intelligent security software solutions, and silicon products and other engineered multi-layered structures for integrated circuits, as well as provides semiconductor assembly and testing services. Further, O2Micro International licenses its intellectual property to third parties. It serves the electronics manufacturers of communications, computer, consumer, industrial, and automotive products. The company sells its products through direct sales offices; sales representatives in China, Hong Kong, Singapore, Taiwan, and the United States; and distributors in Japan and China. O2Micro International was founded in 1995 and is headquartered in George Town, the Cayman Islands.

KV Pharmaceutical Company (NYSE: KV.A) is a fully integrated specialty pharmaceutical company that develops, manufactures, markets, and acquires technology-distinguished branded and generic/non-branded prescription pharmaceutical products. The Company markets its technology distinguished products through ETHEX Corporation, a subsidiary that competes with branded products, and Ther-Rx Corporation, the company's branded drug subsidiary.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,550,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each month�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. None of the companies in this report have paid to be included in this report. From time to time we will mention a company that may have previously paid $995 per month for market data purchased from BUYINS.NET. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET, FRICTION FACTOR and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor.

By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State.

Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net