CVH, HIG, SEH, MPEL, PIR, GAB. Top Gainers With Lowest Price Friction In Morning Trade Today

June 18, 2009 / M2 PRESSWIRE / BUYINS.NET, www.buyins.net, announced today its proprietary Market Maker Friction Factor Report for June 18, 2009. Since late October market makers are now required to be on the bid as much as they are on the offer and for like amounts of stock. This fair market making requirement is designed to prevent market makers from manipulating stock prices. Here is a list of the top companies with the largest gains this morning and lowest price friction (bullish). This means that there was more buying than selling in the stocks and their stock prices rose faster with less Friction. Coventry Health (NYSE: CVH), Hartford Financial Services (NYSE: HIG), Spartech (NYSE: SEH), Melco Crown Entertainment (NASDAQ: MPEL), Pier 1 Imports (NYSE: PIR) and Gabelli Equity Trust (NYSE: GAB). To access Friction Factor, Naked Short Data and SqueezeTrigger Prices on all stocks please visit http://www.buyins.net .

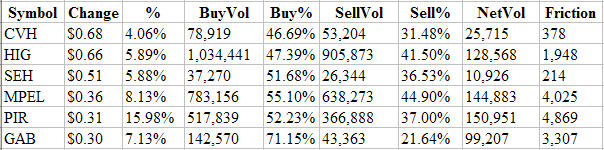

Market Maker Friction Factor is shown in the chart below:

Symbol Change % BuyVol Buy% SellVol Sell% NetVol Friction

CVH $0.68 4.06% 78,919 46.69% 53,204 31.48% 25,715 378

HIG $0.66 5.89% 1,034,441 47.39% 905,873 41.50% 128,568 1,948

SEH $0.51 5.88% 37,270 51.68% 26,344 36.53% 10,926 214

MPEL $0.36 8.13% 783,156 55.10% 638,273 44.90% 144,883 4,025

PIR $0.31 15.98% 517,839 52.23% 366,888 37.00% 150,951 4,869

GAB $0.30 7.13% 142,570 71.15% 43,363 21.64% 99,207 3,307

Click here to view chart:

Analysis of the Friction Factor chart above shows that each of the six stocks mentioned above have high net dollar gains (Change) and very low price friction in their stocks. The Friction Factor displays how many more shares of buying than selling are required to move a stock higher by one cent or how many more shares of selling than buying moves a stock lower by 1 cent.

For example, the chart above shows CVH with a dollar gain today of +$0.68 and a Friction Factor of 378 shares. That means that it only takes 378 more shares of buying than selling to move CVH higher by one penny. The Market Makers are currently allowing the stock to rise quickly (low friction). The combination of low friction and positive market direction can drive prices higher much faster than normal.

Coventry Health Care, Inc. (NYSE: CVH) operates as a managed healthcare company in the United States. The company operates health plans, insurance companies, and network rental and workers� compensation services companies. Its Commercial Business division provides various products, including health maintenance organization (HMO), preferred provider organizations (PPO), and point of service products. This division also offers commercial management services products; and consumer-directed benefit options, including health reimbursement accounts and health savings accounts. The company�s Individual Consumer and Government division offers health benefits to members participating in the Medicare Advantage HMO, Medicare Advantage PPO, Medicare Advantage Private-Fee-For-Service, Medicare Prescription Drug, and Medicaid programs. This division also provides fully-insured managed care services, as well as other products and services, such as pharmacy benefit management, clinical management, and fiscal intermediary services. Its Specialty Business division offers various products, including access to provider network, pharmacy benefits management, field case management, telephonic case management, independent medical exam, and bill review capabilities; and network rental services and other managed care products through a PPO network to national, regional, and local third party administrators and insurance carriers. This division also includes mental-behavioral health benefits business and dental benefits business. The company markets its products and services to individuals, employer and government-funded groups, government agencies, insurance carriers, and administrators through direct sales staff and a network of independent brokers. Coventry Health Care, Inc. was founded in 1986 and is based in Bethesda, Maryland.

The Hartford Financial Services Group, Inc. (NYSE: HIG), through its subsidiaries, provides insurance and financial services in the United States and internationally. It engages in life, and property and casualty insurance businesses. The life insurance business comprises six segments: Retail Products Group (Retail), Retirement Plans, International and Institutional Solutions Group (Institutional), Individual Life, Group Benefits, and International. Retail segment offers variable and fixed market value adjusted annuities, retail mutual funds, 529 college savings plans, and Canadian and offshore investment products. Retirement Plans segment provides products and services to corporations and municipalities. Institutional segment offers institutional liability products and variable private placement life insurance, as well as mutual funds to institutional investors. Individual Life segment sells variable universal, whole, and term life products. Group Benefits segment offers group life, accident, and disability coverage. International segment provides investments, retirement savings, and other insurance and savings products in Japan, Brazil, Ireland, and the United Kingdom. The property and casualty insurance business includes five segments: Personal Lines, Small Commercial, Middle Market, Specialty Commercial, and Other Operations. Personal Lines segment offers automobile, homeowners�, and home-based business coverage. Small Commercial segment provides standard commercial insurance coverage to small commercial businesses. Other Operations segment comprises certain property and casualty insurance operations, including the company�s asbestos and environmental exposures. The company was formerly known as ITT-Hartford Group, Inc. and changed its name in 1972. The Hartford Financial Services Group, Inc. was founded in 1810 and is headquartered in Hartford, Connecticut.

Spartech Corporation (NYSE: SEH), together with its subsidiaries, operates as an intermediary processor of engineered thermoplastics in North America and Europe. The company�s Custom Sheet and Rollstock segment manufactures plastic sheets, custom rollstocks, laminates, and cell cast acrylic for use in various applications, including packaging, transportation, building and construction, recreation and leisure, electronics and appliances, signs/advertising, and aerospace markets. Its Packaging Technologies segment manufactures plastic packages and rollstocks primarily used in the food and consumer product markets. The company�s Color and Specialty Compounds segment manufactures custom-designed plastic alloys, compounds, color concentrates, and calendered film for utilization by various manufacturing customers servicing the automotive, building and construction, food/medical packaging, lawn and garden, and electronics and appliances sectors. Spartech Corporation also manufactures various products, including thermoplastic tires and wheels for the medical, lawn and garden, refuse container, and toy markets; profile window frames and fencing for the building and construction market; and doors, hatches, cabinets, and windscreens for boat manufacturers. The company sells its products primarily to original equipment manufacturers through its sales force, as well as through independent sales representatives and wholesale distributors. Spartech was founded in 1947 and is headquartered in Clayton, Missouri.

Melco Crown Entertainment Limited (NASDAQ: MPEL), through its subsidiaries, engages in the development, ownership, and operation of casino gaming and entertainment resort facilities in Macau. The company owns and operates Crown Macau resort that features a casino area of approximately 183,000 square feet with approximately 255 gaming tables and 95 gaming machines, as well as hotel rooms, fine dining and casual restaurants, recreation and leisure facilities, and meeting facilities; Mocha Clubs, which provide single player machines with various games, including progressive jackpots; and multi-player games where players on linked machines play against each other in electronic roulette, baccarat, and sicbo. As of March 9, 2009, the company operated 8 Mocha Clubs in Macau with a total of approximately 1,345 gaming machines. In addition, it owns and operates Taipa Square Casino with approximately 18,300 sq. ft. of gaming space and features approximately 31 gaming tables servicing rolling chip and mass market patrons. Further, Melco Crown Entertainment is developing City of Dreams project, an integrated urban entertainment resort, combining casino with hotel offerings, entertainment venues, a performance theatre, retail, and food and beverage outlets. The company was formerly known as Melco PBL Entertainment (Macau) Limited and changed its name to Melco Crown Entertainment Limited in May 2008. Melco Crown Entertainment Limited was incorporated in 2004 and is based in Central, Hong Kong.

Pier 1 Imports, Inc. (NYSE: PIR), together with its subsidiaries, operates as a specialty retailer of imported decorative home furnishings, gifts, and related items. Its stores offer furniture, decorative home furnishings, dining and kitchen goods, epicurean products, bath and bedding accessories, candles, and other specialty items for the home. The company�s decorative accessories include wood accessories, lamps, vases, dried and artificial flowers, baskets, ceramics, dinnerware, bath and fragrance products, bedding, and seasonal and gift items. Its furniture products comprise furniture and furniture cushions to be used on patios, and in living, dining, kitchen, bedroom, and sunrooms, as well as wall decorations and mirrors. As of March 1, 2008, the company operated 1,011 stores in the United States and 81 stores in Canada under Pier 1 Imports name. Pier 1 Imports, Inc. also operates in Mexico and Puerto Rico. The company was founded in 1970 and is headquartered in Fort Worth, Texas.

The Gabelli Equity Trust, Inc. (NYSE: GAB) operates as a closed-end, nondiversified management investment company. It principally invests in equity securities, as well as in preferred stock. The fund�s investment portfolio primarily includes investments in companies operating in consumer discretionary, consumer staples, financials, healthcare, information technology, industrials, materials, telecom services, and utilities sectors. Gabelli Funds, LLC serves as the investment advisor of the fund. The fund was founded in 1986 and is based in Rye, New York.

About BUYINS.NET

WWW.BUYINS.NET is a service designed to help bonafide shareholders of publicly traded US companies fight naked short selling. Naked short selling is the illegal act of short selling a stock when no affirmative determination has been made to locate shares of the stock to hypothecate in connection with the short sale. Buyins.net has built a proprietary database that uses Threshold list feeds from NASDAQ, AMEX and NYSE to generate detailed and useful information to combat the naked short selling problem. For the first time, actual trade by trade data is available to the public that shows the attempted size, actual size, price and average value of short sales in stocks that have been shorted and naked shorted. This information is valuable in determining the precise point at which short sellers go out-of-the-money and start losing on their short and naked short trades.

BUYINS.NET has built a massive database that collects, analyzes and publishes a proprietary SqueezeTrigger for each stock that has been shorted. The SqueezeTrigger database of nearly 2,550,000,000 short sale transactions goes back to January 1, 2005 and calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like Buyins.net to access the data.

The SqueezeTrigger database collects individual short trade data on over 7,000 NYSE, AMEX and NASDAQ stocks and general short trade data on nearly 8,000 OTCBB and PINKSHEET stocks. Each month the database grows by approximately 50,000,000 short sale transactions and provides investors with the knowledge necessary to time when to buy and sell stocks with outstanding short positions. By tracking the size and price of each month�s short transactions, BUYINS.NET provides institutions, traders, analysts, journalists and individual investors the exact price point where short sellers start losing money and a short squeeze can begin.

All material herein was prepared by BUYINS.NET, based upon information believed to be reliable. The information contained herein is not guaranteed by BUYINS.NET to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. None of the companies in this report have paid to be included in this report. From time to time we will mention a company that may have previously paid $995 per month for market data purchased from BUYINS.NET. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. BUYINS.NET is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. BUYINS.NET will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

BUYINS.NET, FRICTION FACTOR and SQUEEZETRIGGER are intended for use by stock market professionals. As a member, visitor, or user of any kind, you accept full responsibilities for your investment and trading actions. The contents of BUYINS.NET, including but not limited to all implied or expressed views, opinions, teachings, data, graphs, opinions, or otherwise are not predictions, warranty, or endorsements of any kind. Please seek stock market advice from the proper securities professional, or investment advisor.

By visiting BUYINS.NET or using any data or services, you agree to assume full responsibility for the decisions or actions that you undertake. BUYINS.NET, LLC, its owner(s), operators, employees, partners, affiliates, advertisers, information providers and any other associated person or entity, shall under no circumstances be held liable to the user and/or any third party for loss or damages of any kind, including but not limited to trading losses, lost trading opportunity, direct, indirect, consequential, special, incidental, or punitive damages. As a user, you agree that any damages collected shall not exceed the amount paid to BUYINS.NET and/or its owners. As a website user, you agree that any and all legal matters of any kind are to be reviewed and handled in their entirety within the State of California only. By using the services of this website, you are consenting to the terms as outlined, and forfeit all legal jurisdictions in any other State.

Past performance is not a guarantee of future outcomes. Any and all examples are hypothetical and should not be considered a guarantee or endorsement of such trading activity. BUYINS.NET does not take responsibility for problems of any kind, including but not limited to issues with operations, data accuracy or completeness, contacting issues, technical issues, and timeliness. BUYINS.NET places great integrity on the data collected and distributed. This information is deemed reliable, but not guaranteed. All information and data is provided "as is" without warranty or guarantee of any kind.

Please seek investment and/or trading advice, council, information or services from a securities professional. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and BUYINS.NET undertakes no obligation to update such statements.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the SEC.

Contact: Thomas Ronk, CEO www.BUYINS.net +1-800-715-9999 Tom@buyins.net