The Market Is Scaling The Wall Of Worry

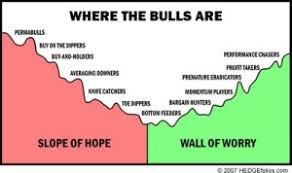

Wall of Worry: Why the Market’s Scaling Has Hit a Critical Threshold

In a thoughtful piece that blends macro‑economic analysis with market‑technical insight, the author charts the dramatic acceleration of equity valuations and the corresponding rise in investor anxiety—a phenomenon they call the “Wall of Worry.” Drawing on data from the S&P 500, Fed policy, corporate earnings, and a suite of risk‑indicators, the article lays out a clear narrative: markets have expanded to a point where the usual rules of scaling are no longer a guarantee of stability, and a subtle but unmistakable shift toward heightened risk is underway.

1. The Growth‑Valuation Feedback Loop

The article opens with a review of the past decade’s growth trajectory. Following the 2008 crisis, the S&P 500’s price‑earnings (P/E) ratio has climbed from a post‑recovery average of roughly 20 to well above 25 in the last two years. While earnings growth has kept pace for a while, the pace has been increasingly reliant on high inflation, fiscal stimulus, and the carry‑over effects of ultra‑low rates. The author argues that the traditional “rules of thumb” for valuation—such as a 15–20× P/E for a healthy market—are no longer applicable when underlying growth has begun to decelerate.

This feedback loop, where higher valuations fuel higher expectations and vice‑versa, has amplified the “market scaling” effect: as the market expands, the distance between reality and expectation grows. The “Wall of Worry” emerges when the market’s expansion pushes valuation ratios into a zone that no longer matches historical patterns of earnings growth, creating a structural mismatch that can only be corrected by a market shock.

2. The Fed’s Rate‑Hike Path and Its Consequences

A central pillar of the article’s argument is the Federal Reserve’s tightening cycle. After a near‑zero policy rate that had propelled equities for years, the Fed began a series of rate hikes in 2022, and by 2024 it had increased the federal funds rate to levels that would have been considered restrictive in the 1990s.

The author ties the Fed’s actions to two key consequences:

- Higher Cost of Capital – Rising rates inflate discount rates used in valuation models, which in turn erodes the present value of future earnings.

- Inflationary Erosion – Even with a cooling rate, the persistence of supply‑chain bottlenecks and geopolitical tensions has kept inflation above target. Elevated inflation compresses corporate margins, especially for companies with fixed‑price contracts or limited pricing power.

The combination of a tighter monetary stance and ongoing inflation pressures has tightened the squeeze on earnings, a key driver of the “Wall of Worry.” When rates climb, bond yields rise, making bonds increasingly attractive relative to equities. The article cites data that, as of July 2024, the yield on the 10‑year Treasury has surpassed the average return of the S&P 500 over the last decade, underscoring the growing threat to equity returns.

3. Corporate Earnings: The New Reality Check

Beyond macro policy, the article zeroes in on corporate earnings, the lifeblood of equity valuations. The author reviews the recent earnings season, noting that many of the top‑tier tech giants—Apple, Microsoft, Amazon—report revenue growth that is slower than the double‑digit percentages of the past three years. Meanwhile, companies in the energy and commodities space are contending with volatile input costs that have eroded profit margins.

By aligning these earnings results with P/E ratios, the author demonstrates a growing “earnings‑valuation gap.” For instance, if a company reports a 5% earnings growth but trades at a 30× P/E, the implied growth requirement to justify that valuation is 8–10% per year—exceeding the company’s actual performance. The Wall of Worry is therefore a statistical reality, not just a philosophical construct.

4. Market‑Risk Indicators: VIX, Credit Spreads, and Beyond

The article also pulls in a range of market‑risk metrics to show how investors are reacting to the looming threat:

- VIX – The volatility index has trended upward steadily, with spikes coinciding with quarterly earnings releases and Fed announcements. The author notes that a VIX above 20 is historically associated with significant market stress.

- Credit Spreads – The spread between the 10‑year Treasury and the 10‑year US Treasury Inflation‑Protected Securities (TIPS) has widened, indicating increasing uncertainty about real returns.

- Corporate Bond Yields – Credit spreads for corporate bonds have expanded, reflecting a growing fear that firms could struggle to refinance debt.

These indicators collectively reinforce the narrative that the market has reached a critical juncture. While the market has shown resilience in the past, the cumulative weight of elevated rates, persistent inflation, and deteriorating earnings has begun to erode confidence.

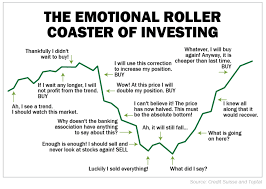

5. Investor Take‑aways: Strategy and Sentiment

The piece concludes with practical guidance for investors navigating the Wall of Worry. The author stresses the importance of rebalancing risk exposure, especially for those with long‑term equity mandates. Some recommended actions include:

- Diversification Across Asset Classes – Increasing allocation to inflation‑protected bonds or real assets (like commodities or real estate) to hedge against rising rates and inflation.

- Defensive Sectors – Prioritizing companies with pricing power and stable cash flows (utilities, consumer staples) that can withstand higher costs.

- Valuation‑Based Positioning – Using relative valuation multiples to identify undervalued sectors and avoid overexposed positions in high‑growth tech.

- Liquidity Management – Keeping a portion of the portfolio in liquid assets to capitalize on potential mean‑reversion opportunities when markets correct.

The article does not advocate for a complete market exit, but rather a cautious stance that recognizes the structural changes in the market environment.

6. Final Thoughts

By weaving together macro‑policy analysis, earnings data, and risk‑indicator metrics, the “Wall of Worry” narrative paints a picture of a market that is outpacing its fundamentals. The author urges investors to recognize that the scaling laws that once governed market growth are now being challenged by a confluence of tightening monetary policy, persistent inflation, and corporate earnings that are struggling to keep pace.

While uncertainty is always part of investing, the Wall of Worry reminds us that when valuation gaps widen and risk‑indicators flare, the market is primed for a correction—an event that, if it occurs, could reshape the investment landscape for years to come. The article’s thorough data‑driven approach offers a framework for evaluating these risks and adjusting portfolios accordingly, providing a timely cautionary note for anyone holding equity positions in an environment that is far from the calm seas of the past decade.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4822511-market-scaling-wall-of-worry ]