Investor Sentiment Remains Cautious: A Deep Dive into the AAII Survey

The American Association of Individual Investors (AAII) recently released its weekly sentiment survey, continuing a trend of cautious pessimism amongst retail investors. While not signaling outright panic, the data paints a picture of an investor base hesitant to embrace significant risk, preferring to hold cash and awaiting clearer signals before committing capital. This article will unpack the key findings from the latest AAII survey and explore what they suggest about the current market landscape, drawing on insights from previous reports and related analyses.

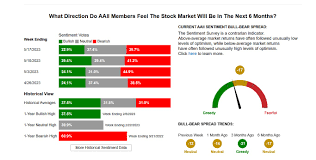

The headline figure is that bearish sentiment remains elevated. Currently sitting at 42.3%, this marks a significant increase from the previous week’s 38.5% and sits well above the historical average of around 30%. This indicates a substantial portion of individual investors believe stock prices are likely to decline in the near future. While not an extreme level historically, its persistence is noteworthy. It's important to remember that bearish sentiment often precedes market rallies; contrarian investors frequently view high bearishness as a buying opportunity, assuming it represents oversold conditions.

Conversely, bullish sentiment has continued its downward spiral. Dropping to 21.5%, this is the lowest reading since March 2023 and significantly below the historical average of around 38%. This decline reflects a lack of confidence in near-term market gains, suggesting investors are hesitant to chase potential upside. The disconnect between bearishness and bullishness – the difference being the “bull-bear spread” - is currently quite wide, further reinforcing the prevailing cautious sentiment.

The most striking element of the current AAII survey is the surge in neutral sentiment. At 36.2%, this represents the highest level since April 2020. This "wait and see" approach reflects a desire to avoid making hasty decisions while assessing market conditions. Investors are essentially on the sidelines, observing developments rather than actively participating. This neutrality can be interpreted as a lack of conviction in either direction – neither strongly bullish nor bearish. It suggests investors are waiting for more clarity before committing capital.

The AAII survey’s historical data reveals that periods of high bearishness often coincide with market bottoms or significant corrections. However, it's crucial to avoid drawing simplistic conclusions. The current environment is complicated by factors such as persistent inflation concerns, the ongoing war in Ukraine, and anxieties surrounding potential interest rate hikes from the Federal Reserve. These macroeconomic uncertainties contribute to investor uncertainty and fuel the cautious sentiment reflected in the survey.

The survey also provides insights into specific sectors. While not explicitly detailed in the latest report (as it focuses primarily on overall sentiment), previous AAII analyses have highlighted shifts in sector preferences during periods of market volatility. Historically, defensive sectors like utilities and consumer staples tend to outperform during times of uncertainty as investors seek safer havens for their capital. Conversely, cyclical sectors – those heavily reliant on economic growth – often underperform.

Furthermore, the survey’s findings are consistent with broader trends observed in investor behavior. Data from brokerage firms show increased cash holdings among retail investors, indicating a reluctance to invest aggressively. This aligns with the AAII's neutral sentiment reading, suggesting that many individuals are prioritizing capital preservation over potential gains. The recent market volatility, driven by inflation data and Federal Reserve policy announcements, has only reinforced this cautious approach.

Looking ahead, several factors will likely influence investor sentiment. Upcoming economic data releases, particularly those related to inflation and employment, will be closely scrutinized. Any signs that inflation is proving more persistent than anticipated could further dampen bullish sentiment and exacerbate bearishness. Conversely, positive surprises in the economy could provide a boost to market confidence. The Federal Reserve’s monetary policy decisions will also play a crucial role; signals of a potential pause or pivot in interest rate hikes could be viewed favorably by investors.

In conclusion, the latest AAII Sentiment Survey underscores the prevailing cautious sentiment among individual investors. Elevated bearishness, declining bullishness, and surging neutral sentiment all point to a market environment characterized by uncertainty and hesitancy. While high bearishness can historically signal buying opportunities, the current landscape demands careful consideration of macroeconomic factors and potential risks. Investors are advised to remain vigilant, monitor economic developments closely, and avoid making impulsive decisions based solely on sentiment indicators. The “wait-and-see” approach currently favored by many individual investors may prove prudent in navigating this period of market volatility.