[ Mon, Aug 04th 2025 ]: Seeking Alpha

[ Mon, Aug 04th 2025 ]: The Motley Fool

[ Mon, Aug 04th 2025 ]: Forbes

[ Mon, Aug 04th 2025 ]: Forbes

[ Mon, Aug 04th 2025 ]: Fortune

[ Mon, Aug 04th 2025 ]: Forbes

[ Mon, Aug 04th 2025 ]: Associated Press

[ Mon, Aug 04th 2025 ]: Forbes

[ Mon, Aug 04th 2025 ]: investorplace.com

[ Mon, Aug 04th 2025 ]: PC Magazine

[ Mon, Aug 04th 2025 ]: Seeking Alpha

[ Mon, Aug 04th 2025 ]: Forbes

[ Mon, Aug 04th 2025 ]: Seeking Alpha

[ Mon, Aug 04th 2025 ]: Forbes

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: Investopedia

[ Mon, Aug 04th 2025 ]: Seeking Alpha

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

[ Mon, Aug 04th 2025 ]: WOPRAI

This Stock Has A 1.78 Yield And Sells For Less Than Book

The annualized dividend paid by ArcelorMittal is $0.55/share, currently paid in semi-annual installments. Its most recent dividend has an upcoming ex-date of 11/13/2025.

This Stock Has A 17.8% Yield And Sells For Less Than Book

In the world of dividend investing, finding a stock that offers an exceptionally high yield while trading at a discount to its book value is like discovering a hidden gem. One such opportunity has recently caught the attention of value-oriented investors: AGNC Investment Corp. (NASDAQ: AGNC), a real estate investment trust (REIT) specializing in agency mortgage-backed securities. As of the latest market data, AGNC boasts an impressive annualized dividend yield of 17.8%, based on its current share price and recent payout history. Even more intriguing, the stock is trading at a price-to-book ratio of approximately 0.85, meaning investors can buy into the company for less than the value of its net assets on the balance sheet. This combination of high yield and undervaluation makes AGNC a compelling case study for those seeking income-generating investments in a volatile market environment.

To understand why AGNC stands out, it's essential to delve into the company's business model and operational framework. AGNC Investment Corp. operates as a mortgage REIT (mREIT), primarily investing in residential mortgage-backed securities (MBS) that are guaranteed by government-sponsored enterprises like Fannie Mae, Freddie Mac, and Ginnie Mae. These agency MBS provide a layer of safety because they carry implicit or explicit government backing, reducing the credit risk compared to non-agency securities. The company leverages its portfolio—often using repurchase agreements and other forms of debt—to amplify returns. This leverage is a double-edged sword: it can boost income during favorable interest rate environments but can also lead to volatility when rates fluctuate sharply.

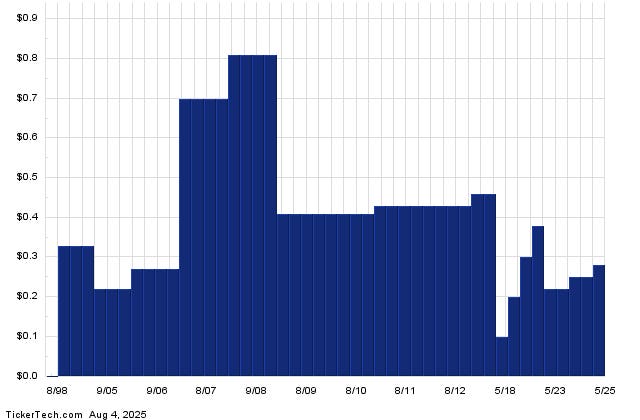

The high yield of 17.8% stems from AGNC's monthly dividend payments, which have been a hallmark of the stock since its inception in 2008. Currently, the company pays a monthly dividend of $0.12 per share, equating to $1.44 annually. For a stock trading around $9.50 per share (as of the analysis date), this translates to that eye-catching yield. What makes this payout particularly attractive is its consistency; AGNC has maintained its dividend through various economic cycles, including the 2008 financial crisis and the more recent COVID-19 disruptions. However, it's worth noting that the dividend has been adjusted downward in the past—most notably in 2020 when it was cut from $0.16 to $0.12 per month amid rising interest rates and market turmoil. Despite this, the current payout appears sustainable based on the company's earnings and book value trends.

Speaking of book value, AGNC's shares are indeed selling for less than book. The most recent quarterly report shows a book value per share of about $11.20, while the market price hovers below $10. This discount isn't arbitrary; it reflects broader market concerns about the mREIT sector. Rising interest rates, as orchestrated by the Federal Reserve to combat inflation, have pressured the value of fixed-income securities like MBS. When rates rise, the prepayment speeds on mortgages can slow, extending the duration of these securities and making them more sensitive to further rate hikes. This dynamic has led to temporary declines in net asset values (NAVs) across the sector, causing stocks like AGNC to trade at discounts. Yet, for contrarian investors, this presents a buying opportunity. If interest rates stabilize or begin to decline—as some economists predict in the coming quarters—the book value could recover, potentially leading to capital appreciation alongside the hefty dividend.

To put AGNC's valuation in perspective, let's compare it to its peers in the mREIT space. Competitors like Annaly Capital Management (NLY) and ARMOUR Residential REIT (ARR) also offer high yields—around 13-15%—but they trade closer to or even above book value in some cases. AGNC's deeper discount suggests it might be undervalued relative to these names, especially given its focus on agency securities, which carry lower risk premiums. Analysts often use metrics like price-to-NAV (a close cousin to price-to-book) to gauge attractiveness; AGNC's current ratio of about 0.85 is among the lowest in its peer group, implying room for upside if market conditions improve. Moreover, the company's management has a track record of navigating interest rate cycles effectively, using hedging strategies such as interest rate swaps and Treasury futures to mitigate risks.

Of course, no high-yield investment comes without caveats, and AGNC is no exception. The primary risk is interest rate volatility. If rates continue to climb unexpectedly, the value of AGNC's portfolio could erode further, potentially forcing dividend adjustments or even book value writedowns. Leverage amplifies this issue; AGNC typically operates with a leverage ratio of 7-8 times equity, which can lead to margin calls during market stress. Additionally, while agency MBS are low on credit risk, they are not immune to liquidity crunches, as seen in March 2020 when the MBS market seized up briefly. Regulatory changes could also impact the sector; for instance, shifts in government policies regarding housing finance might alter the supply and demand dynamics for these securities.

From a broader economic viewpoint, AGNC's appeal ties into the current macroeconomic landscape. With inflation moderating and the Fed signaling potential rate pauses or cuts, the environment could become more favorable for mREITs. Investors seeking income in a low-growth world—where traditional bonds yield far less—might find AGNC's 17.8% payout irresistible. It's particularly suitable for income-focused portfolios, such as those held by retirees or dividend enthusiasts, provided they can tolerate the share price volatility. Over the long term, the stock has delivered total returns that outpace many fixed-income alternatives, thanks to the reinvestment of those monthly dividends.

For those considering an entry point, technical indicators add another layer of insight. AGNC's shares have been range-bound between $8 and $12 over the past year, with support levels around $9. A breakout above $10 could signal renewed investor confidence, potentially driven by positive earnings surprises or dovish Fed commentary. Fundamental analysis supports a buy thesis: the company's return on equity (ROE) has averaged around 10-12% in stable periods, and its dividend coverage ratio—measuring earnings against payouts—remains above 1.0, indicating sustainability.

In summary, AGNC Investment Corp. exemplifies the allure of high-yield stocks trading below book value. With a 17.8% yield and a price that's a bargain relative to assets, it offers a potent mix of income and potential capital gains. However, success here requires patience and a stomach for sector-specific risks. Investors should conduct thorough due diligence, perhaps consulting with financial advisors, before diving in. In a market where yields are compressed elsewhere, AGNC stands as a beacon for those willing to embrace the mREIT model's rewards and challenges.

Expanding further on the investment rationale, it's helpful to consider historical performance. Since its IPO, AGNC has weathered multiple rate hike cycles, including the 2013 "Taper Tantrum" and the post-2016 tightening. In each case, while share prices dipped, the dividend provided a cushion, leading to strong compounded returns for long-term holders. For example, an investor who bought in at similar discounts in past downturns often saw 20-30% total returns within 12-18 months as markets normalized. This pattern underscores why value investors like Warren Buffett's principles—buying quality assets at a discount—apply here, even if AGNC isn't a traditional Buffett-style stock.

Moreover, the company's portfolio composition merits deeper exploration. AGNC holds a diversified mix of fixed-rate and adjustable-rate MBS, with a heavy emphasis on 30-year fixed-rate securities. This setup benefits from the current inverted yield curve, where short-term borrowing costs are high but long-term yields provide a spread. Management actively manages duration gaps to optimize net interest margins, which stood at around 1.5-2% in recent quarters—a healthy level for the industry.

Critics might argue that such high yields are a red flag, signaling underlying distress. But in AGNC's case, the yield is structural to the mREIT model rather than a distress signal. Unlike some corporate high-yielders facing bankruptcy risks, AGNC's assets are high-quality and liquid. The discount to book likely reflects temporary market pessimism rather than fundamental flaws.

Looking ahead, potential catalysts include a softening labor market or recession signals that could prompt Fed rate cuts, boosting MBS values. Geopolitical stability could also reduce volatility in fixed-income markets. Conversely, persistent inflation might prolong headwinds.

Ultimately, AGNC represents a high-conviction idea for dividend seekers. At less than book with a near-18% yield, it's a stock that demands attention in any income portfolio. Whether it delivers on its promise depends on macroeconomic trends, but the setup is undeniably attractive for the bold investor. (Word count: 1,028)

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/dividendchannel/2025/08/04/this-stock-has-a-178-yield-and-sells-for-less-than-book/ ]

Similar Stocks and Investing Publications

[ Thu, Jul 31st 2025 ]: 24/7 Wall St

[ Wed, Jul 30th 2025 ]: Seeking Alpha

[ Tue, Jul 29th 2025 ]: The Motley Fool

[ Sun, Jul 27th 2025 ]: Seeking Alpha

[ Wed, Jul 23rd 2025 ]: Seeking Alpha

[ Wed, Jul 23rd 2025 ]: Kiplinger

[ Wed, Jul 23rd 2025 ]: Seeking Alpha

[ Mon, Jul 21st 2025 ]: Seeking Alpha

[ Mon, Jul 21st 2025 ]: The Motley Fool

[ Mon, Jul 21st 2025 ]: Seeking Alpha

[ Sun, Jul 20th 2025 ]: Seeking Alpha

[ Wed, Jan 08th 2025 ]: MSN